1. What is the projected Compound Annual Growth Rate (CAGR) of the Antistatic Additives for Safety Footwear?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Antistatic Additives for Safety Footwear

Antistatic Additives for Safety FootwearAntistatic Additives for Safety Footwear by Application (High-Top Safety Footwear, Low-Cut Safety Footwear), by Type (Rubber Antistatic Additives, TPU Antistatic Additives, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

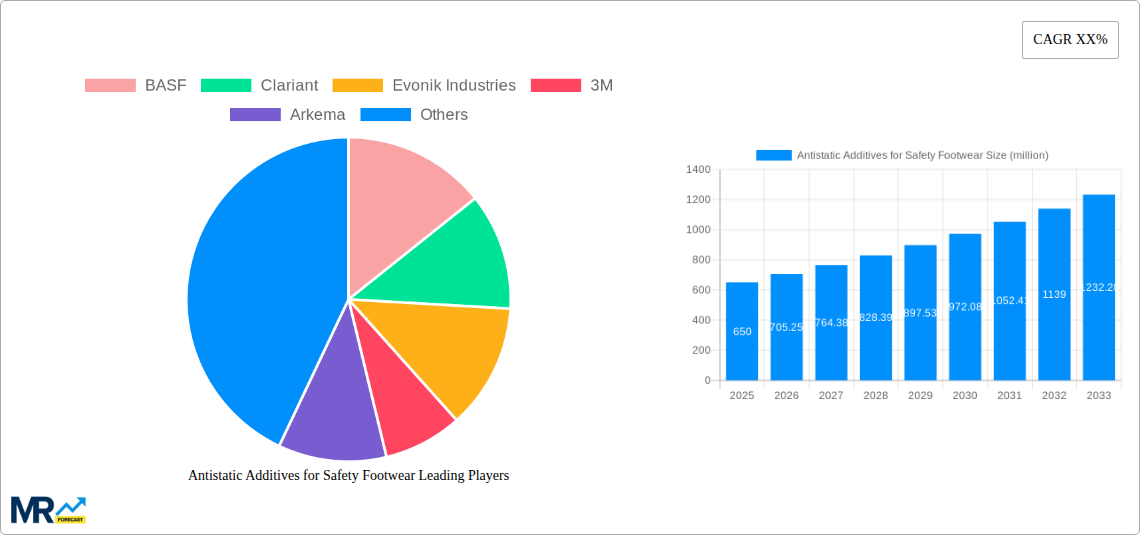

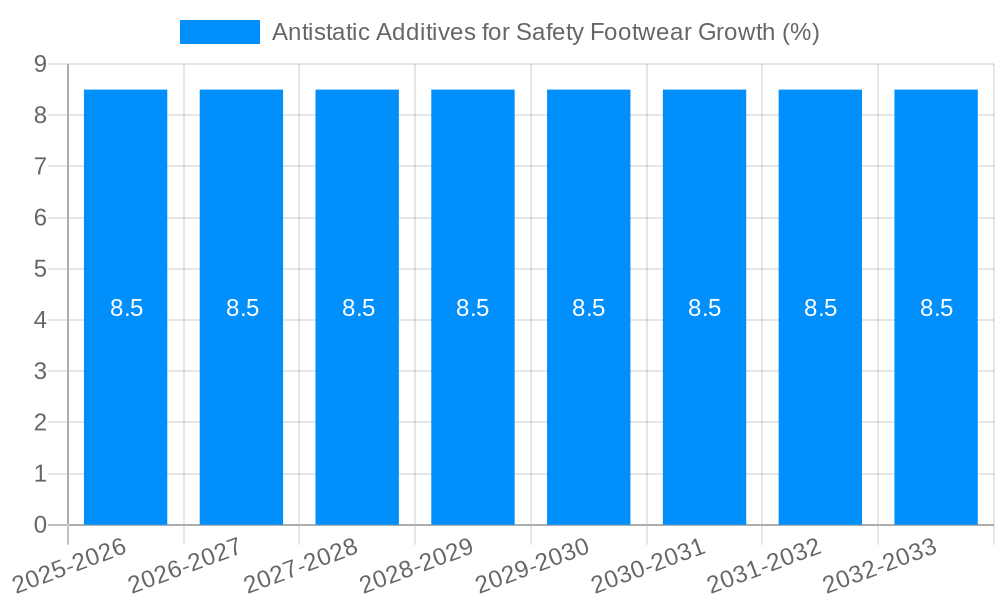

The global market for antistatic additives in safety footwear is poised for significant expansion, driven by a confluence of escalating workplace safety regulations and the inherent need to protect against electrostatic discharge (ESD) in various hazardous environments. With an estimated market size of USD 650 million in 2025, this sector is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 8.5% through 2033, reaching an impressive value of USD 1,350 million. This growth is largely fueled by the increasing adoption of safety footwear in industries like electronics manufacturing, oil and gas, automotive, and pharmaceuticals, where the risk of ignition from static electricity is a critical concern. The demand for high-top safety footwear, offering enhanced ankle support and protection, is a key application segment, alongside the established low-cut variants. Furthermore, advancements in material science are contributing to the development of more effective and durable antistatic additives, with rubber-based and TPU-based formulations leading the charge. Key players are investing in research and development to create innovative solutions that offer superior ESD protection, comfort, and longevity, thereby responding to the evolving demands of end-users and regulatory bodies.

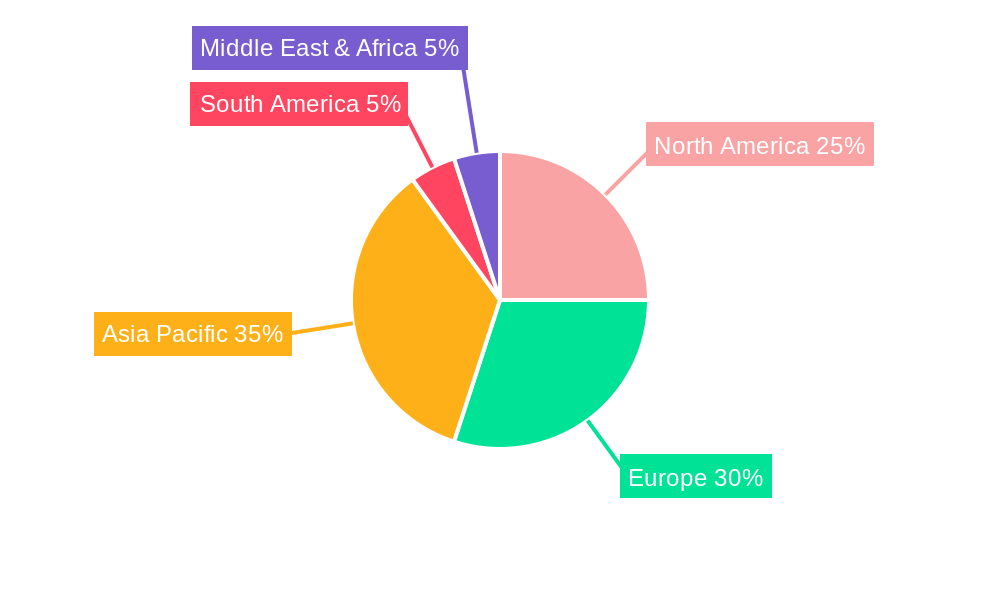

The market's trajectory is further bolstered by a growing awareness among employers about the financial and human costs associated with ESD-related accidents. This has translated into stricter implementation of safety protocols and an increased procurement of certified antistatic safety footwear. While the market exhibits strong growth potential, certain restraints, such as the cost of implementing advanced antistatic technologies and the availability of raw materials, could pose challenges. However, the overarching trend towards enhanced worker safety and the continuous innovation by leading chemical manufacturers like BASF, Clariant, Evonik Industries, and DuPont are expected to outweigh these limitations. Asia Pacific, particularly China and India, is emerging as a pivotal growth region due to rapid industrialization and a burgeoning manufacturing sector. Simultaneously, established markets in North America and Europe will continue to drive demand for premium and specialized antistatic footwear solutions, reflecting their mature industrial landscapes and stringent safety standards.

Here is a unique report description on Antistatic Additives for Safety Footwear, incorporating the requested information and structure:

The global antistatic additives market for safety footwear is poised for substantial growth, driven by a confluence of increasing industrial safety regulations, rising adoption of protective gear across diverse sectors, and advancements in additive technologies. The study period, spanning from 2019 to 2033, with a base year of 2025, highlights a consistent upward trajectory. In the base year of 2025, the market is projected to reach a significant valuation, with further expansion anticipated throughout the forecast period of 2025-2033. This growth is underpinned by a heightened awareness among employers and employees regarding the critical need to mitigate electrostatic discharge (ESD) in environments prone to ignitable atmospheres and sensitive electronic components. Historically, the period from 2019 to 2024 laid the groundwork for this expansion, characterized by early adoption in niche industries and gradual regulatory implementation. Looking ahead, the market is expected to witness a compound annual growth rate (CAGR) that reflects its increasing importance. The demand for advanced antistatic solutions is escalating, moving beyond basic dissipation to offer enhanced durability, improved comfort, and greater versatility in various footwear materials. The shift towards more sophisticated additive formulations that do not compromise the mechanical properties or aesthetic appeal of safety footwear is a key trend. Furthermore, the growing emphasis on sustainable and eco-friendly additives is also shaping the market landscape. As industries continue to evolve and prioritize worker safety, the role of antistatic additives in safety footwear will become even more integral, driving innovation and market expansion. The market's ability to adapt to evolving material science and regulatory frameworks will be crucial for sustained success, with a notable increase in market value expected to be in the hundreds of million dollars by the end of the forecast period. This upward trend indicates a robust and dynamic market, with significant opportunities for stakeholders to capitalize on.

The antistatic additives for safety footwear market is experiencing robust growth due to several compelling driving forces. Foremost among these is the escalating stringency of industrial safety regulations worldwide. Governing bodies and industry associations are increasingly mandating the use of antistatic footwear in hazardous environments, such as chemical plants, oil and gas refineries, electronics manufacturing facilities, and pharmaceutical laboratories, to prevent catastrophic fires and explosions caused by electrostatic discharge. This regulatory push directly translates into higher demand for effective antistatic additives. Concurrently, there's a discernible and continuous rise in the overall adoption of safety footwear across a widening spectrum of industries. As companies prioritize the well-being of their workforce, the investment in personal protective equipment (PPE), including specialized safety footwear, is on an upward curve. This broader adoption inherently fuels the need for antistatic properties to ensure comprehensive protection. Furthermore, significant advancements in material science and additive technology are playing a pivotal role. Manufacturers are developing more efficient, durable, and user-friendly antistatic additives that can be seamlessly integrated into various footwear materials like rubber and TPU. These innovations not only enhance the antistatic performance but also contribute to the overall comfort and longevity of the footwear, making them more attractive to end-users. The growing awareness among end-users about the specific risks associated with static electricity in their work environments is also a crucial factor, prompting them to actively seek out safety footwear with certified antistatic properties.

Despite the promising growth trajectory, the antistatic additives for safety footwear market is not without its challenges and restraints. A primary concern revolves around the cost-effectiveness and scalability of certain advanced antistatic additive formulations. While innovative solutions offer superior performance, their higher production costs can sometimes deter price-sensitive manufacturers, particularly in emerging economies where cost is a significant factor. This can lead to a slower adoption rate compared to less expensive, but potentially less effective, alternatives. Another significant challenge lies in the potential degradation of antistatic properties over time due to wear and tear, exposure to harsh chemicals, or environmental factors. Ensuring the long-term efficacy of antistatic additives within the footwear material is crucial for maintaining safety standards. Manufacturers face the task of developing additives that offer persistent protection throughout the lifespan of the footwear, which can be technically demanding. Furthermore, the compatibility of antistatic additives with a wide array of existing footwear materials and manufacturing processes can also pose a hurdle. Not all additives are universally compatible, and extensive testing and formulation adjustments may be required, adding to R&D costs and production lead times. The complex regulatory landscape, while a driver, can also be a restraint if there is a lack of clear, standardized testing and certification protocols across different regions. This ambiguity can create confusion and increase compliance burdens for manufacturers. Finally, the availability of skilled labor and specialized manufacturing equipment necessary for incorporating some advanced antistatic additives can also present a bottleneck in certain markets, slowing down the overall market penetration.

The antistatic additives for safety footwear market exhibits significant regional and segmental dominance, with Europe emerging as a key region poised to lead the market. This dominance is intricately linked to the region's stringent industrial safety regulations, which have historically been at the forefront of mandating protective measures in high-risk environments. Countries like Germany, the United Kingdom, and France, with their robust manufacturing sectors and advanced industrial infrastructure, are major consumers of safety footwear. The presence of numerous industries such as automotive, chemical, and pharmaceuticals, all of which require specialized antistatic protection, further bolsters demand. Furthermore, European consumers and businesses demonstrate a high degree of safety consciousness and a willingness to invest in premium protective gear that meets rigorous international standards. The established supply chains and the presence of leading chemical and footwear manufacturers within Europe also contribute to its market leadership.

Within the segmental analysis, the Rubber Antistatic Additives segment is expected to hold a substantial market share and exhibit strong growth. Rubber is a widely used material in the manufacturing of safety footwear due to its durability, flexibility, and resistance to chemicals and abrasion, making it ideal for demanding industrial applications. Antistatic additives incorporated into rubber compounds effectively dissipate static electricity, preventing the accumulation of hazardous charges. This makes rubber antistatic footwear indispensable in industries where flammable materials or sensitive electronics are present, such as the oil and gas sector, mining, and electronics assembly. The inherent properties of rubber lend themselves well to effective incorporation of antistatic additives, ensuring consistent and reliable performance. The continued demand for robust and reliable safety footwear in these critical sectors directly fuels the growth of the rubber antistatic additives segment. Moreover, ongoing advancements in rubber compounding and additive technology are leading to more effective and longer-lasting antistatic solutions for rubber-based safety footwear, further solidifying its dominant position in the market.

Several key growth catalysts are propelling the antistatic additives for safety footwear industry forward. The ever-increasing global emphasis on occupational health and safety, driven by both regulatory mandates and corporate responsibility initiatives, is a primary catalyst. As industries recognize the severe risks associated with electrostatic discharge, the demand for safety footwear equipped with antistatic properties escalates. Furthermore, the expansion of key end-user industries like electronics manufacturing, petrochemicals, and pharmaceuticals, particularly in developing economies, creates new markets and amplifies the need for specialized protective gear. Technological advancements in additive chemistry, leading to more efficient, durable, and cost-effective antistatic solutions, also act as significant growth catalysts, making these additives more accessible and appealing to a wider range of manufacturers.

This comprehensive report offers an in-depth analysis of the antistatic additives market for safety footwear, providing invaluable insights for stakeholders. The report meticulously examines market dynamics, including current trends, historical data from 2019-2024, and future projections up to 2033, with 2025 serving as the base and estimated year. It details the key driving forces, such as stringent regulations and growing industry adoption, and identifies critical challenges like cost-effectiveness and additive longevity. The report pinpoints dominant regions and segments, offering a granular view of market leadership and growth opportunities. It also elaborates on the catalysts fueling industry expansion and profiles the leading global players. Through a detailed breakdown of significant developments and a thorough examination of market segmentation, this report provides a holistic understanding of the antistatic additives for safety footwear landscape, enabling informed strategic decision-making for manufacturers, suppliers, and end-users alike. The report's extensive coverage is designed to equip businesses with the knowledge needed to navigate this dynamic and evolving market effectively.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BASF, Clariant, Evonik Industries, 3M, Arkema, Solvay, DuPont, ADEKA, Piedmont Chemical Industries, Mitsubishi Chemical, Avanzare, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Antistatic Additives for Safety Footwear," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Antistatic Additives for Safety Footwear, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.