1. What is the projected Compound Annual Growth Rate (CAGR) of the Antiseptics & Disinfectants?

The projected CAGR is approximately 2.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Antiseptics & Disinfectants

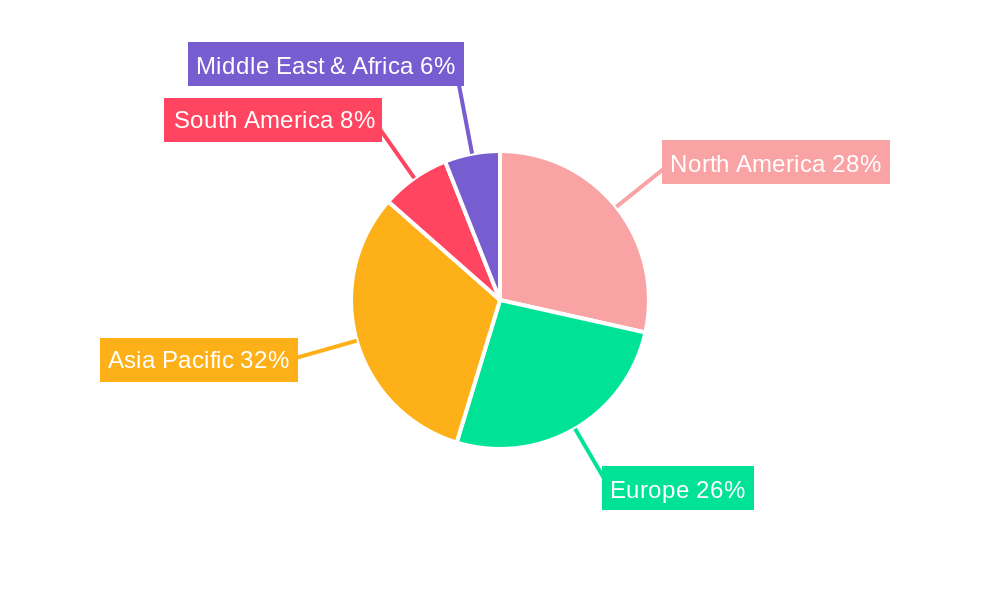

Antiseptics & DisinfectantsAntiseptics & Disinfectants by Application (Chemical Industry, Metal Processing, Ship Industry, Food Industry, Daily Necessities, Others), by Type (Antiseptics, Disinfectants), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

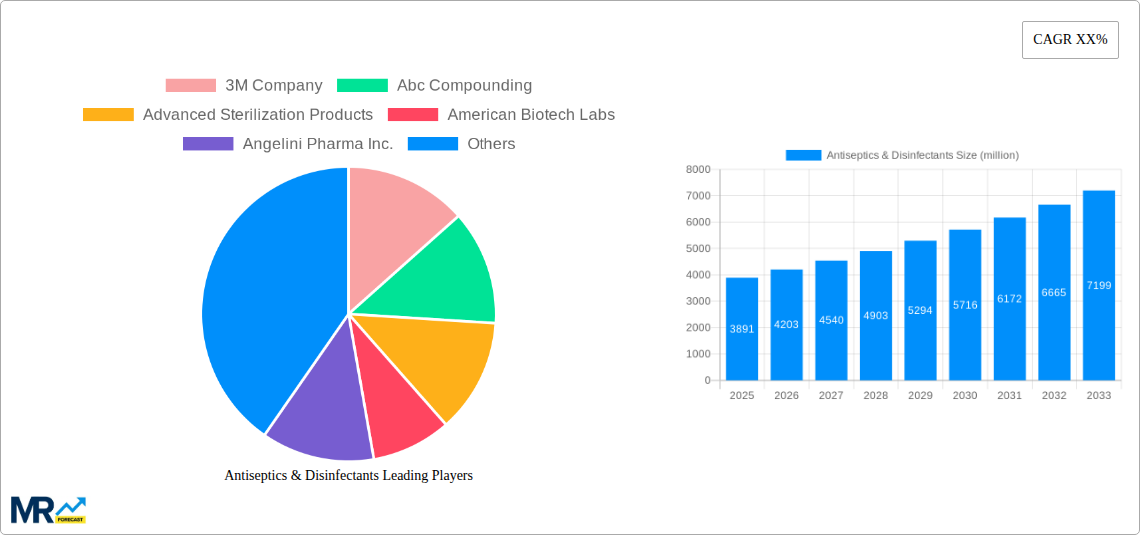

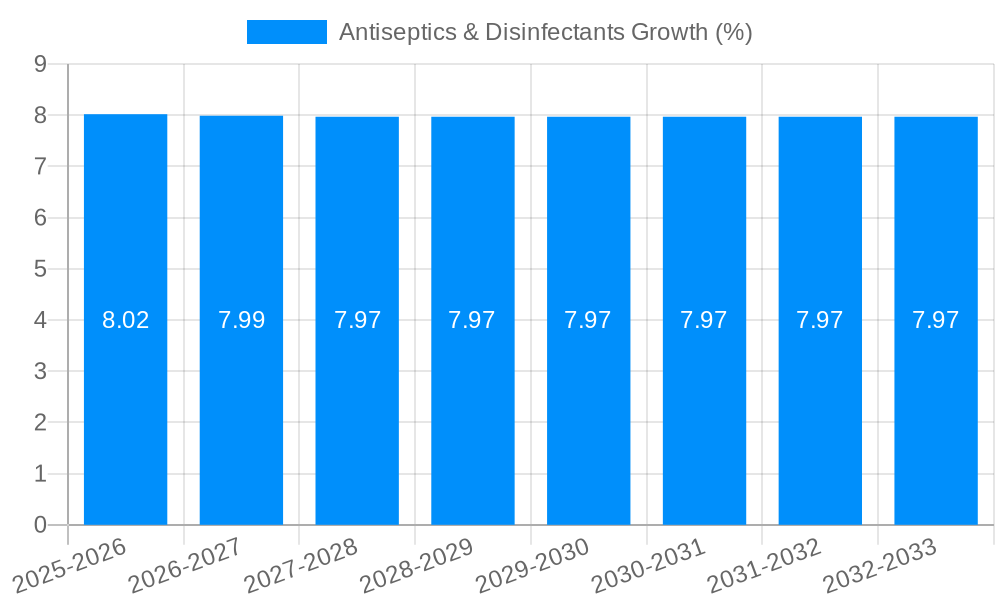

The global antiseptics and disinfectants market, valued at $3191.6 million in 2025, is projected to experience steady growth, driven by several key factors. The increasing prevalence of healthcare-associated infections (HAIs) is a major catalyst, fueling demand for effective sterilization and disinfection solutions in hospitals and other healthcare settings. Furthermore, rising consumer awareness of hygiene and sanitation, particularly amplified by recent global health concerns, is boosting the adoption of antiseptics and disinfectants in household settings. Growth is also supported by the expanding applications of these products across various industries, including food processing, pharmaceuticals, and water treatment, where maintaining stringent hygiene standards is crucial. While regulatory hurdles and concerns regarding the potential development of antimicrobial resistance pose challenges, the market is expected to overcome these constraints due to continuous innovation in product formulations and delivery systems. The market is segmented by product type (alcohols, halogens, quaternary ammonium compounds, etc.), application (healthcare, household, industrial), and geography. The consistent CAGR of 2.9% indicates a stable, albeit not explosive, growth trajectory over the forecast period (2025-2033), suggesting a long-term market opportunity for established players and new entrants alike.

The competitive landscape is characterized by the presence of both large multinational corporations and smaller specialized firms. Major players are focusing on strategic acquisitions, product diversification, and geographical expansion to consolidate their market share. Research and development efforts are concentrated on developing novel, environmentally friendly, and more effective formulations with broader antimicrobial activity. The focus on sustainable solutions reflects a growing industry trend toward reducing the environmental impact of chemical disinfectants. Despite the presence of established players, opportunities exist for innovative companies to penetrate the market with differentiated products catering to specific niche applications or addressing unmet needs, such as the demand for eco-friendly and biodegradable options. The market's relatively steady growth and consistent demand for effective infection control solutions indicate a stable future with potential for further expansion driven by evolving consumer needs and technological advancements.

The global antiseptics and disinfectants market exhibited robust growth during the historical period (2019-2024), exceeding $XX billion in 2024. This expansion is projected to continue throughout the forecast period (2025-2033), with the market expected to reach a value exceeding $YY billion by 2033, representing a Compound Annual Growth Rate (CAGR) of Z%. Several key factors contribute to this positive trajectory. The rising prevalence of hospital-acquired infections (HAIs) and the increasing awareness of hygiene and sanitation practices, particularly in healthcare settings, fuel the demand for effective antiseptics and disinfectants. Furthermore, stringent government regulations concerning infection control and the growing adoption of advanced sterilization techniques in various industries, including healthcare, food processing, and pharmaceuticals, are driving market expansion. The emergence of novel antimicrobial agents with enhanced efficacy and reduced toxicity also plays a significant role. The market is witnessing a shift towards environmentally friendly and sustainable formulations, responding to growing consumer and regulatory concerns about the environmental impact of traditional chemicals. The increasing demand for ready-to-use products and convenient packaging formats further contributes to market growth. The COVID-19 pandemic significantly impacted the market in the recent past, creating heightened demand for disinfectants and hand sanitizers which is shaping the post-pandemic market dynamics. Market segmentation by product type (e.g., disinfectants, antiseptics, sterilizing solutions), application (e.g., healthcare, household, industrial), and end-user (e.g., hospitals, clinics, homes, industries) reveals unique growth patterns within each sector. The healthcare segment currently holds a dominant market share, driven by stringent infection control protocols and the increasing number of healthcare facilities. However, the household and industrial segments are also experiencing substantial growth, fueled by increased consumer awareness and industrial hygiene requirements. The market is characterized by both established multinational companies and smaller niche players, showcasing a diverse and competitive landscape.

Several powerful forces are propelling the growth of the antiseptics and disinfectants market. The surging incidence of infectious diseases, both globally and regionally, is a primary driver. This includes the rise of antibiotic-resistant bacteria, necessitating the development and adoption of novel antimicrobial agents and improved infection control practices. The healthcare sector, in particular, is experiencing a significant increase in demand for effective disinfectants and antiseptics to prevent hospital-acquired infections (HAIs), which pose a substantial threat to patient safety and healthcare system resources. Growing awareness among consumers about hygiene and sanitation, driven by public health campaigns and educational initiatives, is fostering a broader adoption of antiseptics and disinfectants in households and public spaces. Stringent regulatory frameworks imposed by governments worldwide, requiring mandatory adherence to hygiene and sanitation protocols in various industries, further stimulate market growth. The expanding industrial sector, especially in food processing, pharmaceuticals, and manufacturing, is generating heightened demand for industrial-grade disinfectants and sterilizing agents to ensure product safety and maintain hygienic production environments. The shift towards advanced sterilization technologies and the adoption of innovative product formulations, incorporating improved efficacy, safety, and environmental friendliness, contribute to this market's robust growth trajectory.

Despite the promising growth prospects, the antiseptics and disinfectants market faces several challenges and restraints. The development of antimicrobial resistance (AMR) poses a significant threat, rendering existing antimicrobial agents less effective over time, requiring continuous innovation in the development of new, potent, and broad-spectrum solutions. Stringent regulatory approvals and the lengthy process associated with introducing new products into the market can delay the commercialization of innovative formulations, creating a bottleneck in market expansion. The potential for adverse health effects associated with the use of certain antimicrobial chemicals necessitates rigorous safety testing and the development of safer, less toxic alternatives. Fluctuating raw material prices and supply chain disruptions can impact production costs and product availability, potentially affecting market stability. The rising cost of healthcare and increasing pressure to reduce healthcare expenditures can lead to cost-containment measures that may affect the adoption of expensive, advanced antiseptics and disinfectants. Furthermore, consumer concerns regarding the environmental impact of some antimicrobial agents are driving demand for eco-friendly and sustainable alternatives, demanding substantial research and development efforts.

Segments:

The substantial growth in the healthcare segment coupled with the geographically diverse expansion particularly in Asia Pacific signifies the dynamic nature of this market.

Several factors catalyze the growth of the antiseptics and disinfectants industry. These include the persistent rise in infectious diseases, the development of antibiotic resistance, and growing consumer awareness of hygiene. Stringent government regulations mandating better infection control practices and the advancement of novel antimicrobial agents with enhanced efficacy and safety profiles also stimulate growth. Finally, the increasing demand for convenient, ready-to-use products and environmentally friendly formulations fuels this market’s expansion.

This report provides a comprehensive analysis of the antiseptics and disinfectants market, covering market size, growth trends, key drivers and restraints, regional and segmental analysis, and competitive landscape. It offers valuable insights for industry players, investors, and other stakeholders seeking to understand and capitalize on the market's growth potential. The report combines historical data (2019-2024), estimated data (2025), and forecasts (2025-2033) to provide a comprehensive view of the market's trajectory. The study includes detailed profiles of leading market players, highlighting their strategies, product portfolios, and market positions. Ultimately, it aims to equip readers with the necessary information to make informed decisions and effectively navigate the dynamic antiseptics and disinfectants market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.9%.

Key companies in the market include 3M Company, Abc Compounding, Advanced Sterilization Products, American Biotech Labs, Angelini Pharma Inc., Becton, Dickinson And Company, Bio-Cide International Inc., Cardinal Health, Carefusion Corp., Clorox Company, The, Novartis Ag, Nyco Products Co., Palmero Health Care, Procter & Gamble Company, Professional Disposables International Inc.(Pdi), Pure Bioscience, Reckitt Benckiser Group Plc, Safetec Of America Inc., Sciessent Llc, Sealed Air Corp., Stepan Company, Sterilex Corp., Steris Corp., Thermo Fisher Scientific Inc., Vanc Pharmaceuticals Inc., Veridien Corp., Virox Technologies Inc., Wellspring Pharmaceutical Corp., Xttrium Laboratories, Zep Inc., .

The market segments include Application, Type.

The market size is estimated to be USD 3191.6 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Antiseptics & Disinfectants," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Antiseptics & Disinfectants, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.