1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti-Static Solid Tyre?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Anti-Static Solid Tyre

Anti-Static Solid TyreAnti-Static Solid Tyre by Type (Stick Tire, Non-stick Tires, World Anti-Static Solid Tyre Production ), by Application (Engineering Vehicles, Construction Machinery, Military Vehicles, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

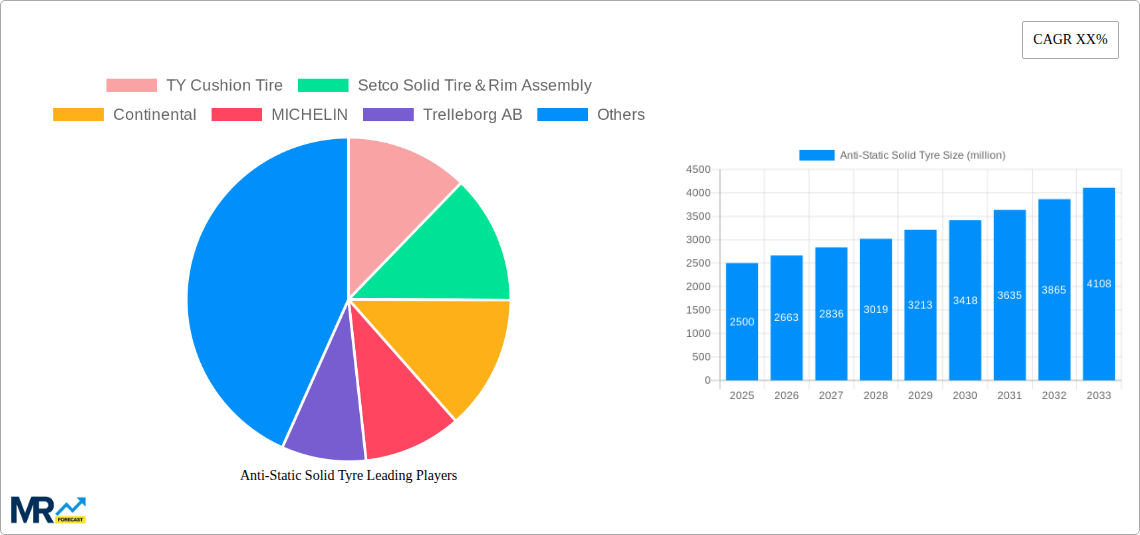

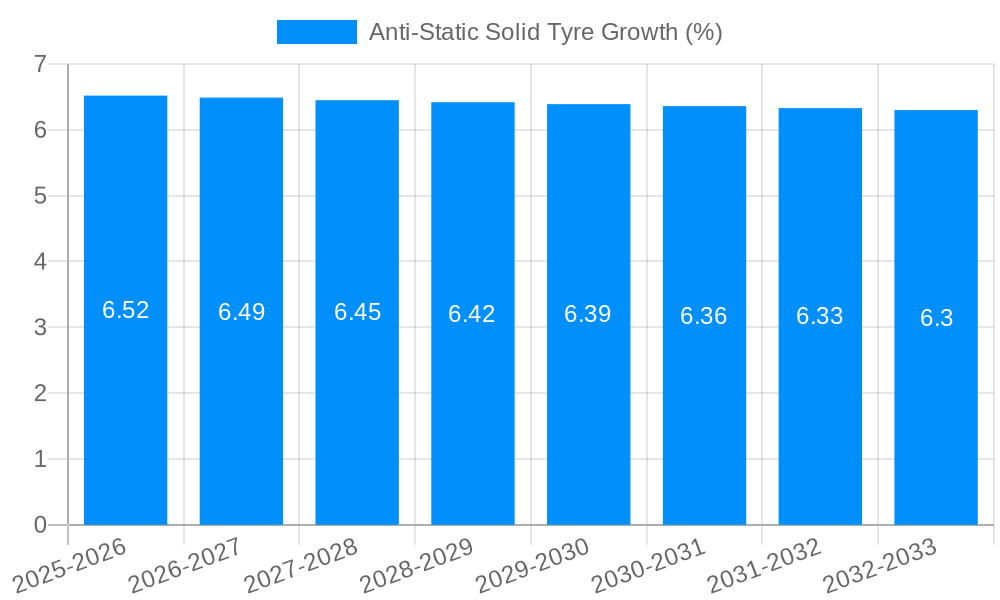

The global anti-static solid tyre market is poised for significant expansion, driven by the increasing adoption of specialized tyres across various industrial and commercial applications. With an estimated market size projected to reach \$2,500 million by 2025, the sector is expected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% through 2033. This sustained growth is largely fueled by the escalating demand for enhanced safety and operational efficiency in environments where static electricity poses a risk. Key sectors such as engineering vehicles, construction machinery, and military vehicles are increasingly relying on anti-static solid tyres to prevent equipment damage, protect sensitive electronics, and ensure worker safety. The inherent durability, low maintenance requirements, and superior load-bearing capacity of solid tyres, coupled with their anti-static properties, make them an indispensable component in these demanding fields. Emerging applications in material handling, warehousing, and specialized industrial settings further contribute to the market's upward trajectory, indicating a broadening scope of utility for these advanced tyre solutions.

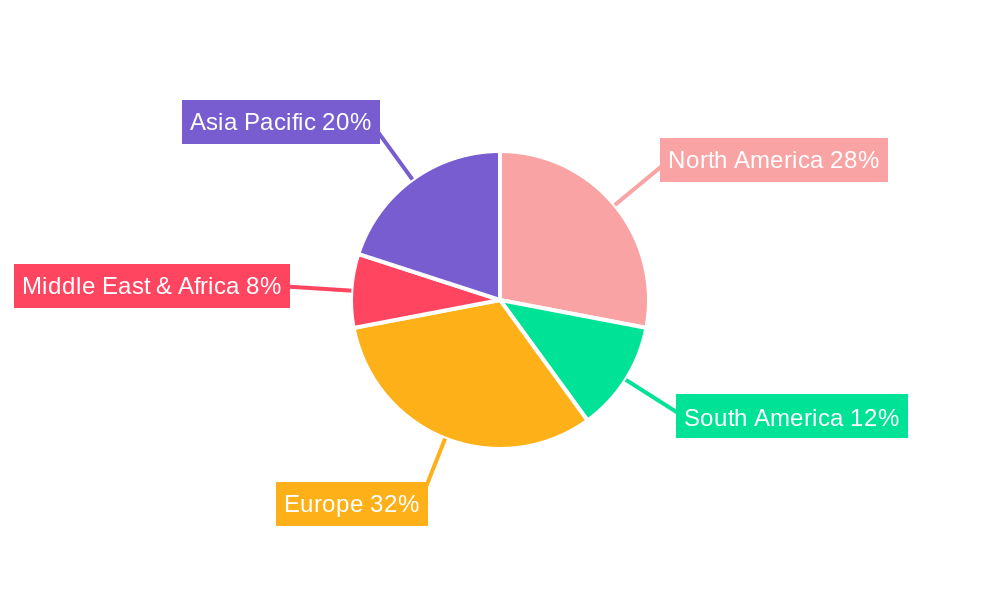

Further analysis of the market reveals a dynamic landscape influenced by technological advancements and evolving industry standards. The market segmentation into stick tires and non-stick tires, alongside a focus on global anti-static solid tyre production, highlights the specialized nature of this segment. While the inherent advantages of solid tyres mitigate some traditional market restraints like the need for frequent replacement, challenges related to initial cost and the availability of specialized manufacturing capabilities persist. However, the growing awareness of the long-term economic benefits derived from reduced downtime and enhanced safety is steadily overcoming these hurdles. Regions like Asia Pacific, particularly China and India, are emerging as significant growth engines due to rapid industrialization and substantial investments in infrastructure and manufacturing. Similarly, North America and Europe continue to be mature yet vital markets, driven by stringent safety regulations and the presence of leading manufacturers and end-users in sectors requiring advanced material handling and heavy-duty equipment. The collaborative efforts between tyre manufacturers and equipmentOriginal Equipment Manufacturers (OEMs) are expected to drive innovation and tailor-made solutions, further cementing the market's positive outlook.

This report provides an in-depth analysis of the global Anti-Static Solid Tyre market, offering a comprehensive overview of its current landscape, future projections, and influencing factors. Spanning a Study Period from 2019-2033, with a Base Year of 2025 and an Estimated Year also of 2025, the report meticulously examines the Historical Period of 2019-2024 to forecast trends and dynamics for the Forecast Period of 2025-2033. Leveraging quantitative data, including production volumes in the millions, this report delves into critical market insights, growth drivers, challenges, regional dominance, leading players, and significant industry developments. The analysis covers various segments such as Type (Stick Tire, Non-stick Tires, World Anti-Static Solid Tyre Production) and Application (Engineering Vehicles, Construction Machinery, Military Vehicles, Other), providing a holistic understanding of the market's intricate ecosystem.

The global Anti-Static Solid Tyre market is experiencing a significant surge, driven by an increasing demand for enhanced safety and operational efficiency across various industrial sectors. This upward trajectory is intrinsically linked to the growing adoption of advanced materials and manufacturing processes that prioritize the mitigation of electrostatic discharge (ESD) risks. The World Anti-Static Solid Tyre Production is projected to witness robust growth, with output expected to reach tens of millions of units annually by the end of the forecast period. Key market insights reveal a discernible shift towards specialized solid tires designed for environments with a high risk of static electricity accumulation. Industries such as manufacturing, warehousing, and material handling, where flammable materials or sensitive electronic components are prevalent, are becoming primary consumers. The adoption of Non-stick Tires with enhanced anti-static properties is gaining traction due to their superior performance in preventing debris adherence and ensuring consistent traction, further contributing to operational uptime and safety. Furthermore, the market is observing a rising trend in the integration of advanced conductive polymers and carbon black formulations within the rubber matrix to achieve superior static dissipation capabilities. This innovation not only addresses safety concerns but also contributes to the longevity and durability of the tires, thereby reducing total cost of ownership for end-users. The evolving regulatory landscape, which increasingly emphasizes workplace safety standards, is also playing a pivotal role in propelling the demand for anti-static solutions. As a result, manufacturers are investing heavily in research and development to introduce next-generation anti-static solid tires that offer improved performance characteristics, including higher load-bearing capacity, enhanced abrasion resistance, and superior heat dissipation. The market is poised for sustained expansion, fueled by technological advancements and a growing awareness of the critical importance of static control in industrial operations.

The accelerating demand for anti-static solid tires is primarily propelled by an unwavering commitment to safety and operational excellence across a diverse range of industries. The inherent risks associated with electrostatic discharge (ESD) in environments handling volatile materials or sensitive electronic equipment necessitate the adoption of specialized tire solutions. Manufacturing facilities, petrochemical plants, and electronic assembly lines, for instance, are increasingly mandating the use of anti-static tires to prevent catastrophic accidents, such as ignitions or damage to delicate components. This safety imperative is further amplified by stringent governmental regulations and industry-specific safety standards that mandate the control of static electricity. The growing emphasis on maximizing operational uptime and minimizing downtime is another significant driver. Traditional pneumatic tires can be prone to punctures and damage, leading to costly interruptions. Solid tires, by their very nature, offer superior durability and resilience, and when combined with anti-static properties, they provide a comprehensive solution for demanding applications. The ability of anti-static solid tires to prevent debris accumulation and maintain consistent traction further contributes to improved material handling efficiency and reduced wear and tear on equipment. Moreover, the increasing mechanization and automation within industries like construction and logistics are leading to a higher utilization of heavy-duty vehicles and machinery, where robust and reliable tire solutions are paramount. The inherent advantages of solid tires in terms of load-bearing capacity and puncture resistance, coupled with the critical safety feature of static dissipation, position them as an indispensable component for these operations.

Despite the robust growth prospects, the anti-static solid tyre market faces several challenges and restraints that can impede its full potential. One of the primary hurdles is the initial cost of production. While the long-term benefits of anti-static solid tires are significant, their upfront price point can be considerably higher than conventional tires. This can be a deterrent for smaller businesses or those operating with tight budgets, particularly in price-sensitive markets. The complexity of material science and manufacturing processes involved in achieving effective anti-static properties also contributes to higher production costs. Developing and incorporating specialized conductive materials and ensuring their uniform dispersion within the rubber matrix requires sophisticated technology and stringent quality control. Furthermore, the lack of widespread awareness and understanding of the specific benefits of anti-static solid tires among all potential end-users can limit adoption. Many industries may not fully comprehend the risks associated with static electricity or the advantages offered by these specialized tires, leading to reliance on standard, less safe alternatives. The availability of substitutes, such as anti-static coatings applied to existing tires or specialized flooring solutions, can also present a competitive challenge. While these may not offer the integrated benefits of an anti-static solid tire, they can be perceived as more economical alternatives in certain scenarios. Lastly, geographic variations in regulations and safety standards can create market fragmentation and necessitate tailored product offerings, adding to the complexity of global market penetration and increasing the World Anti-Static Solid Tyre Production lead time for certain regions.

The global Anti-Static Solid Tyre market is poised for significant growth, with certain regions and segments emerging as dominant forces.

North America: This region is expected to be a major contributor to market expansion, driven by its highly industrialized economy, strict safety regulations, and advanced technological adoption.

Europe: Similar to North America, Europe boasts a mature industrial landscape with a strong emphasis on workplace safety and environmental compliance.

Asia Pacific: This region is emerging as a high-growth market for anti-static solid tires, driven by rapid industrialization, expanding manufacturing capabilities, and increasing awareness of safety protocols.

Dominant Segments:

Application: Construction Machinery: This segment is expected to be a primary driver of the Anti-Static Solid Tyre market.

Type: Non-stick Tires with Anti-Static Properties: While not a separate production category, the demand for "non-stick" characteristics combined with anti-static functionality within solid tires is on the rise.

The growth of the anti-static solid tyre industry is catalyzed by a confluence of factors. Heightened global emphasis on industrial safety and stricter regulatory frameworks mandating ESD control are primary drivers. The increasing adoption of advanced manufacturing and material handling technologies, which often involve sensitive electronics or flammable substances, necessitates reliable anti-static solutions. Furthermore, the inherent durability and reduced maintenance of solid tires, coupled with their anti-static properties, offer a compelling total cost of ownership advantage, driving demand in heavy-duty applications. Continuous innovation in rubber compounding and material science to enhance anti-static performance and overall tire longevity also acts as a significant catalyst.

This report provides a comprehensive overview of the anti-static solid tyre market, delving into intricate details beyond a mere market size estimation. It meticulously analyzes the drivers of growth, dissects the challenges that may hinder market expansion, and identifies the key regions and segments poised for dominance. The report highlights the innovative strides made by leading manufacturers and presents a timeline of significant industry developments, offering valuable insights for strategic decision-making. Furthermore, it emphasizes the underlying technological advancements and evolving regulatory landscapes that shape the market's trajectory, ensuring stakeholders are well-equipped to navigate the complexities and capitalize on the opportunities within this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include TY Cushion Tire, Setco Solid Tire&Rim Assembly, Continental, MICHELIN, Trelleborg AB, NEXEN TIRE AMERICA, Tube&Solid Tire, Superior Tire&Rubber, Global Rubber industries(GRI), CAMSO.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Anti-Static Solid Tyre," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Anti-Static Solid Tyre, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.