1. What is the projected Compound Annual Growth Rate (CAGR) of the Anodized Aluminum Cookware?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Anodized Aluminum Cookware

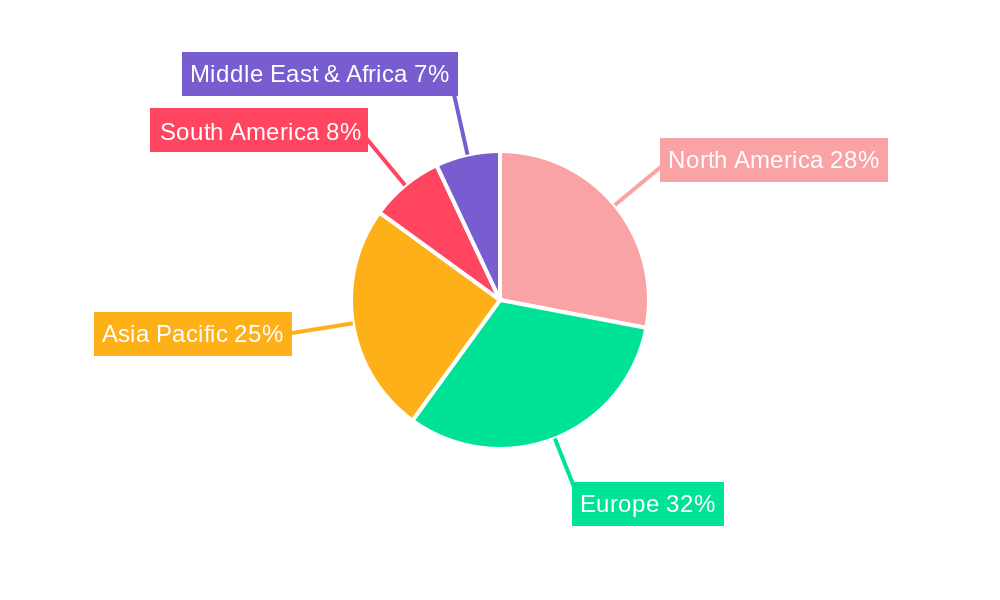

Anodized Aluminum CookwareAnodized Aluminum Cookware by Type (Pot, Pan, Other), by Application (Residential, Commercial, World Anodized Aluminum Cookware Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

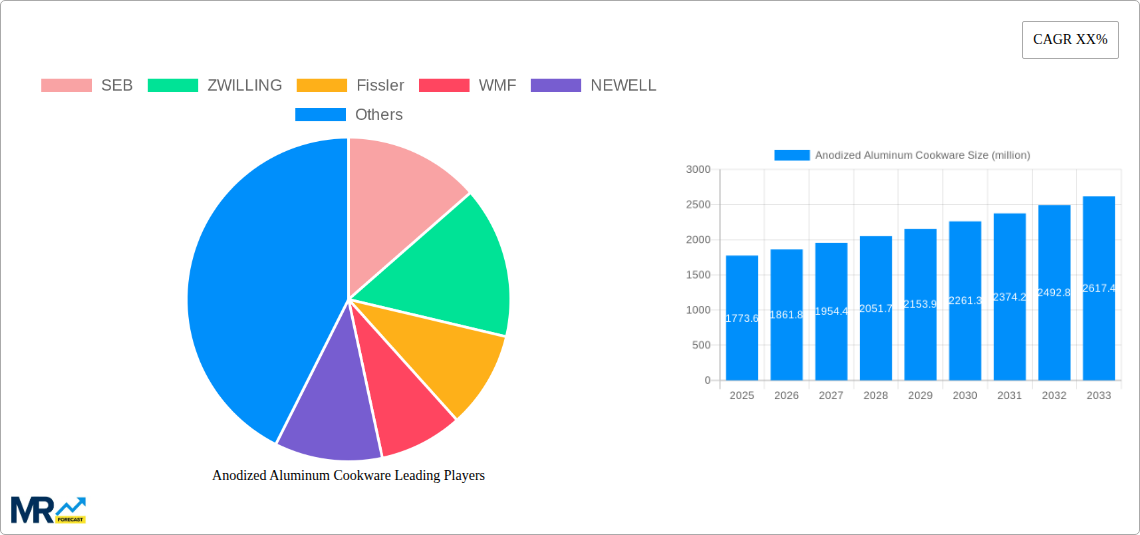

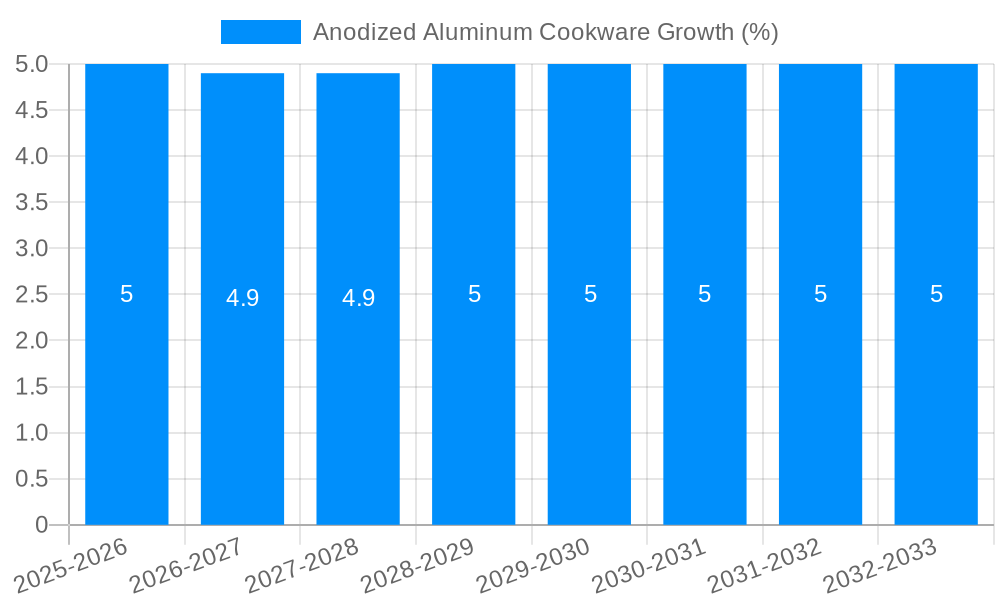

The global anodized aluminum cookware market is poised for significant expansion, projected to reach an estimated $1773.6 million by 2025. This robust growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period of 2025-2033. Several key drivers are fueling this upward trajectory. Consumer demand for durable, scratch-resistant, and non-reactive cookware continues to rise, directly benefiting anodized aluminum products due to their superior performance characteristics compared to conventional aluminum. The growing awareness among consumers about the health benefits of anodized cookware, which minimizes the risk of aluminum leaching into food, is another crucial factor. Furthermore, increasing disposable incomes in emerging economies and a growing trend towards home cooking and gourmet kitchen aesthetics are creating new avenues for market penetration.

Key trends shaping the anodized aluminum cookware landscape include the rising popularity of eco-friendly and sustainable kitchenware, prompting manufacturers to adopt greener production processes and materials. Innovations in surface treatments and designs, such as hard-anodized finishes and ergonomic handles, are also enhancing product appeal and functionality. The market is also experiencing a segmentation shift, with increasing demand for specialized cookware types like pots and pans, catering to diverse culinary needs in both residential and commercial settings. However, the market is not without its restraints. The relatively higher price point of anodized aluminum cookware compared to its non-anodized counterparts can deter price-sensitive consumers. Additionally, competition from alternative materials like stainless steel and cast iron, which also offer durability and performance, presents an ongoing challenge. Supply chain volatilities and fluctuating raw material costs can also impact production and pricing strategies.

The global anodized aluminum cookware market is poised for substantial growth, with an estimated production of 450 million units in the base year of 2025. This burgeoning demand is a direct reflection of evolving consumer preferences and the inherent advantages of anodized aluminum as a cookware material. During the study period of 2019-2033, the market is projected to witness a compound annual growth rate (CAGR) of approximately 7.5%, reaching an impressive production volume of over 600 million units by 2033. This upward trajectory is fueled by several key trends. Firstly, the increasing emphasis on healthy cooking practices has led consumers to seek out non-reactive cookware. Anodized aluminum, particularly hard-anodized aluminum, offers superior resistance to acidic foods, preventing any metallic leaching into the food and preserving the natural flavors and nutritional value. This aligns perfectly with the growing health-conscious demographic. Secondly, the aesthetic appeal of anodized aluminum cookware is a significant driver. Its sleek, modern finish and durability make it a desirable addition to any kitchen, transcending mere functionality to become a style statement. Manufacturers are responding with a wider array of colors and finishes, further appealing to design-conscious consumers. Thirdly, the robust nature of anodized aluminum cookware, characterized by its resistance to scratching, warping, and corrosion, ensures a longer product lifespan. This durability translates into better value for money, a crucial consideration for a market segment that increasingly values sustainability and long-term investment. The historical period (2019-2024) already demonstrated a consistent upward trend, with production growing from approximately 380 million units in 2019 to an estimated 430 million units in 2024, setting a strong foundation for the projected expansion. The estimated year of 2025, with its projected production of 450 million units, serves as a critical benchmark for future growth trajectories. The market is expected to witness a significant shift towards premium offerings, with consumers willing to invest more in high-quality, long-lasting anodized aluminum products that offer superior performance and aesthetic appeal. This premiumization trend is expected to be a dominant force throughout the forecast period of 2025-2033.

Several potent forces are propelling the growth of the global anodized aluminum cookware market. Paramount among these is the escalating consumer demand for healthier and safer cooking options. The anodization process creates a non-reactive surface on the aluminum, which means it doesn't interact with acidic foods like tomatoes or citrus fruits. This prevents the potential leaching of aluminum into food, a concern that has been amplified by increasing consumer awareness of health and wellness. As a result, consumers are actively seeking out cookware that offers superior food safety and preserves the natural taste and nutritional integrity of their meals. Complementing this health-conscious shift is the growing appreciation for durability and longevity in household products. Anodized aluminum cookware stands out for its exceptional resilience. It is significantly harder than raw aluminum, making it highly resistant to scratches, dents, and warping. This robust nature ensures that the cookware maintains its performance and appearance over an extended period, offering consumers a cost-effective and sustainable choice. The reduced need for frequent replacements translates into better long-term value, a factor that resonates strongly with an increasingly discerning consumer base. Furthermore, the aesthetic appeal of anodized aluminum cookware is an undeniable catalyst. Its sleek, modern finish and resistance to tarnishing make it a visually attractive addition to any kitchen, aligning with contemporary interior design trends. Manufacturers are leveraging this by offering a wider spectrum of colors and sophisticated finishes, catering to the desire for both functionality and style in home kitchens.

Despite its promising outlook, the anodized aluminum cookware market faces certain challenges and restraints that could temper its growth. One significant hurdle is the relatively higher price point compared to basic aluminum or non-stick coated cookware. While the enhanced durability and performance justify the cost for many consumers, it can act as a barrier to entry for budget-conscious shoppers, limiting market penetration in certain segments. The manufacturing process for anodized aluminum is also more complex and energy-intensive than that for raw aluminum, contributing to higher production costs. Another restraint stems from the availability of a wide array of alternative cookware materials, each with its own set of advantages. Stainless steel, cast iron, and ceramic cookware offer different cooking properties and price points, creating a competitive landscape where anodized aluminum must continually demonstrate its superiority. Consumer perception regarding the safety of aluminum cookware, even when anodized, can also be a lingering concern. Although the anodization process significantly mitigates the risk of aluminum leaching, some consumers remain apprehensive, influenced by past controversies or a lack of comprehensive understanding of the anodization process. This necessitates ongoing educational efforts by manufacturers to build trust and confidence. Additionally, the reliance on specific raw material inputs, such as sulfuric acid and electricity for the anodization process, can expose the market to price volatility and supply chain disruptions. Fluctuations in the cost of these essential components can impact profit margins and ultimately influence the retail pricing of the finished products.

The global anodized aluminum cookware market is characterized by regional dominance and segment preferences, with the Pan segment and Residential application within the North America and Europe regions projected to be key drivers of market expansion.

Dominant Segment: Pan

Dominant Application: Residential

Key Dominant Regions: North America and Europe

The anodized aluminum cookware industry is experiencing significant growth catalysts that are propelling its expansion. The increasing global awareness regarding healthy eating habits and the desire for cookware that doesn't leach harmful chemicals are primary drivers. Anodized aluminum's non-reactive surface ensures food safety and preserves nutritional value, aligning perfectly with this trend. Furthermore, the enhanced durability and longevity of anodized aluminum cookware, offering superior resistance to scratches, warping, and corrosion, provides excellent long-term value for consumers, reducing the need for frequent replacements. This economic and sustainable advantage is increasingly appealing. The aesthetic appeal of anodized aluminum, with its sleek, modern finishes, also plays a crucial role, catering to the growing demand for stylish kitchenware that complements contemporary home decor.

This comprehensive report delves deep into the global anodized aluminum cookware market, providing an in-depth analysis of its intricate dynamics from 2019 to 2033. The study leverages key insights derived from an estimated production of 450 million units in the base year of 2025 and projects substantial growth, anticipating over 600 million units by 2033, driven by a healthy CAGR of approximately 7.5%. The report meticulously examines the driving forces, including the surge in health-conscious consumers seeking non-reactive cookware and the increasing appreciation for product durability and aesthetic appeal. It also addresses the inherent challenges and restraints, such as price sensitivity and competition from alternative materials, providing a balanced perspective. Furthermore, the report identifies key regions and segments poised for dominance, with a particular focus on the "Pan" segment and "Residential" application, primarily in North America and Europe, detailing their market share and growth projections. The growth catalysts that are shaping the industry's future are thoroughly explored, alongside a comprehensive list of leading players. Finally, significant developments and trends observed throughout the study period are highlighted, offering a forward-looking view of the anodized aluminum cookware landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include SEB, ZWILLING, Fissler, WMF, NEWELL, Cuisinart, Vinod, Meyer Corporation, China ASD, Linkfair, Guanhua, Anotech, Homichef, De Buyer, Gers Equipement, Giza, Saften Metal San, OMS, Le Creuset, KUHN RIKON, Nuova H.S.S.C., Scanpan, BERNDES, Maspion, Neoflam, TTK Prestige, Hawkins Cookers, Nanlong, Sanhe Kitchenware, Cooker King, .

The market segments include Type, Application.

The market size is estimated to be USD 1773.6 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Anodized Aluminum Cookware," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Anodized Aluminum Cookware, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.