1. What is the projected Compound Annual Growth Rate (CAGR) of the Animal & Pet Food Flavors?

The projected CAGR is approximately 6.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Animal & Pet Food Flavors

Animal & Pet Food FlavorsAnimal & Pet Food Flavors by Type (Natural, Artificial), by Application (Animal Feed, Pet Food), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

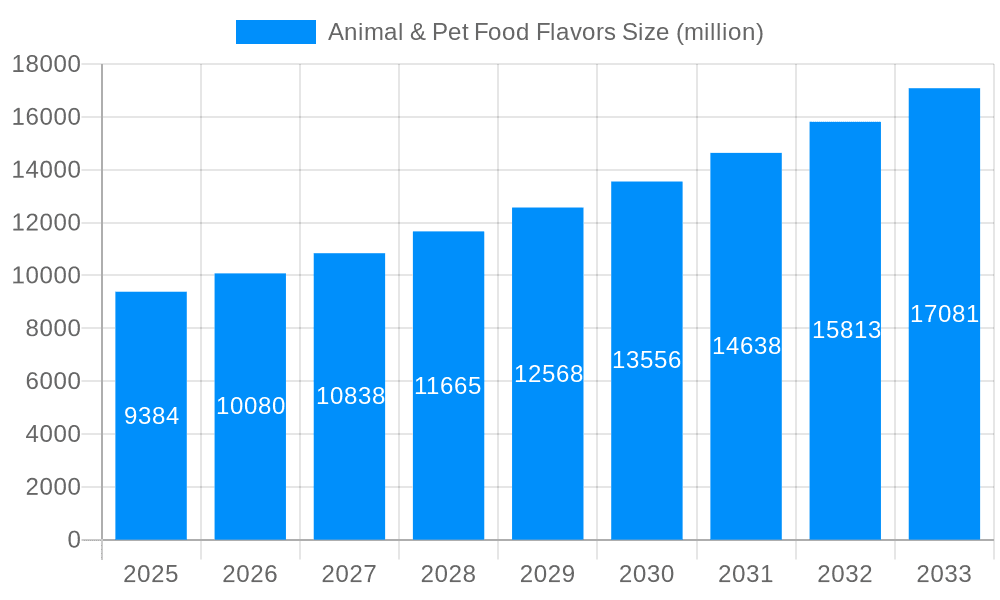

The global animal and pet food flavors market, valued at $9,384 million in 2025, is projected to experience robust growth, driven by increasing pet ownership globally, rising consumer demand for premium pet food with enhanced palatability, and the growing adoption of natural and functional ingredients in animal feed. The market's Compound Annual Growth Rate (CAGR) of 7.5% from 2025 to 2033 indicates significant expansion opportunities. Key drivers include the increasing humanization of pets, leading to higher spending on premium pet food, and the expanding market for functional pet foods addressing specific health needs. The preference for natural flavors is also fueling market growth, while challenges remain in ensuring flavor stability and cost-effectiveness, particularly concerning natural ingredient sourcing. The market is segmented by flavor type (natural and artificial) and application (animal feed and pet food), with natural flavors gaining significant traction due to growing consumer awareness regarding ingredient health and safety. The competitive landscape is highly fragmented, with major players like Firmenich, Givaudan, and International Flavors & Fragrances dominating the market through extensive product portfolios, robust R&D capabilities, and strategic partnerships. Regional analysis reveals significant growth potential in Asia-Pacific, driven by rising disposable incomes and increasing pet ownership in developing economies. North America and Europe, however, are expected to maintain significant market shares due to established pet food industries and high per capita pet ownership. Future growth is expected to be influenced by innovations in flavor technology, catering to specific dietary requirements and pet preferences, alongside evolving regulatory landscapes concerning food safety and ingredient labeling.

The substantial growth in the animal and pet food flavors market is further shaped by several key trends. The increasing demand for customized pet food solutions tailored to specific breeds, ages, and health conditions necessitates diverse flavor profiles. Furthermore, technological advancements are enabling the creation of innovative flavor compounds offering enhanced palatability, improved nutrient absorption, and cost optimization. However, potential restraints include fluctuating raw material costs, particularly for natural ingredients, and stringent regulations regarding the use of certain flavoring agents. Successful players will need to prioritize sustainable sourcing practices, invest in research and development of novel flavor technologies, and adapt to evolving consumer preferences and regulatory requirements to maintain a competitive edge. The focus on transparency and clean labels will also be a key factor in future market success.

The global animal and pet food flavors market is experiencing robust growth, driven by escalating pet ownership, increasing humanization of pets, and a rising demand for palatable and nutritious pet food. The market, valued at XXX million units in 2025, is projected to reach XXX million units by 2033, exhibiting a significant Compound Annual Growth Rate (CAGR). This expansion is fueled by several key trends. Firstly, consumers are increasingly seeking premium pet food options, mirroring their own food choices. This translates into a higher demand for natural and functional flavors that enhance palatability and provide perceived health benefits. Secondly, the growing awareness of animal welfare and sustainability is influencing the market, leading to a preference for ethically sourced ingredients and environmentally friendly flavoring solutions. The increasing prevalence of allergies and sensitivities in both pets and humans is also impacting flavor selection, with manufacturers increasingly focusing on hypoallergenic and novel protein sources, requiring specialized flavor profiles. Furthermore, innovation in flavor technology is constantly evolving, with the development of more sophisticated and targeted flavor systems to address specific palatability needs across different animal species and life stages. The market is also witnessing a shift towards customized and personalized pet food solutions, contributing to the increased use of specialized flavors tailored to individual pet preferences. Finally, the growing adoption of online pet food retail channels and the rise of direct-to-consumer brands are opening new avenues for product innovation and flavor differentiation, accelerating market growth. The historical period (2019-2024) showed steady growth, setting the stage for the significant expansion anticipated during the forecast period (2025-2033).

Several factors are driving the expansion of the animal and pet food flavors market. The increasing humanization of pets is a primary driver. Owners are treating their pets like family members, leading to a greater emphasis on high-quality, palatable food. This translates into a demand for richer, more appealing flavors that go beyond basic nutritional requirements. The growing pet food market itself is a major contributor; as the pet food industry expands, so too does the demand for flavors to enhance product appeal. Technological advancements in flavor creation, allowing for more complex and nuanced flavor profiles, are also fueling market growth. These advancements lead to the development of flavors that better mask undesirable tastes in pet food, increasing overall acceptance among animals. Furthermore, changing consumer preferences towards natural and organic ingredients are impacting the demand for natural flavors and flavoring agents in pet food production. This growing awareness of health and wellness is influencing consumer purchasing decisions, pushing manufacturers to adopt cleaner label ingredients and natural flavors. The rising disposable incomes, especially in emerging economies, are further bolstering the market, as pet owners are willing to invest more in premium pet food products. Finally, stringent regulations regarding food safety and quality are pushing manufacturers to adopt high-quality and safe flavoring solutions, fostering market expansion.

Despite the positive growth trajectory, several challenges constrain the animal and pet food flavors market. Fluctuations in raw material prices, particularly for natural ingredients, represent a significant risk. Price volatility can affect profitability and make it difficult for manufacturers to maintain consistent pricing. Stringent regulatory frameworks related to food safety and labeling, varying across different regions, pose challenges for global companies seeking to maintain a uniform product range. These regulations necessitate significant investment in compliance and can impact product development cycles. The development and introduction of new and innovative flavors requires significant research and development investment, which can be a considerable hurdle for smaller companies. Consumer perception and acceptance of artificial flavors remain a concern. Many pet owners are increasingly wary of artificial ingredients, leading to a demand for natural alternatives, even at a higher cost. Competition among flavor manufacturers is fierce, with established players competing for market share and smaller businesses striving for differentiation. Maintaining a strong and differentiated product offering is crucial for success. Finally, maintaining a consistent flavor profile across different batches and throughout the shelf life of the product is a technical challenge that requires careful quality control.

Segments Dominating the Market:

Pet Food Application: This segment is expected to dominate the market due to the significantly higher volume of pet food produced compared to animal feed. The humanization of pets and the increasing demand for premium pet food are key factors driving this segment's growth.

Natural Flavors: Driven by consumer preferences for healthier and more natural pet food options, the demand for natural flavors in pet food is substantially increasing. While often more expensive than artificial counterparts, the perception of health benefits and the positive impact on brand image make this segment highly attractive.

Regions/Countries Dominating the Market:

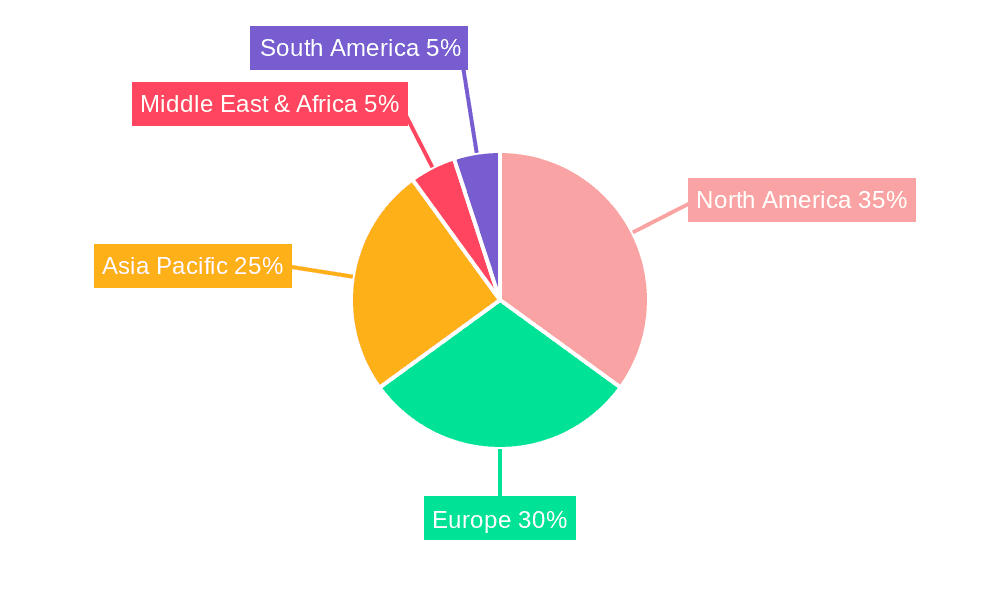

North America: This region is a significant market driver due to high pet ownership rates, high disposable incomes, and a growing demand for premium pet food. The strong regulatory framework and consumer awareness of pet food ingredients also contribute to the market's prominence.

Europe: Similar to North America, Europe displays high pet ownership and a growing awareness of pet health and nutrition, fueling the demand for high-quality and palatable pet food, including those with natural flavors.

Asia-Pacific: This region is showing rapid growth due to increasing pet ownership, particularly in developing economies like China and India. While still catching up to North America and Europe in terms of per capita pet food consumption, the sheer volume of the pet population promises tremendous market potential.

The combination of the pet food application segment and the natural flavors type creates the largest and fastest-growing sub-segment within the overall animal and pet food flavors market. The North American and European regions, followed by the rapidly developing Asia-Pacific region, represent the key geographical locations driving this significant growth.

The animal and pet food flavors industry is experiencing growth spurred by several key factors: increased pet ownership globally, the humanization of pets leading to premiumization of pet food, the growing demand for natural and functional ingredients, and continuous innovation in flavor technology, enabling development of novel and appealing flavor profiles for pets. Government regulations promoting food safety and transparency also positively influence market growth by driving quality improvement across the supply chain.

This report offers a detailed analysis of the animal and pet food flavors market, providing in-depth insights into market trends, driving forces, challenges, and key players. The comprehensive coverage encompasses historical data (2019-2024), current market estimates (2025), and future projections (2025-2033), enabling stakeholders to make informed strategic decisions. The report includes a segment-wise analysis (natural vs. artificial, animal feed vs. pet food) and a regional breakdown, providing granular information for targeted market understanding. Key players are profiled to provide insights into their market positioning, competitive strategies, and recent developments. The report concludes by offering valuable insights into growth opportunities and potential future market scenarios.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.2%.

Key companies in the market include Firmenich, Frutarom Industries, Givaudan, Huabao International, International Flavors & Fragrances, Kerry, V. Mane Fils, Robertet, Sensient, Symrise, Takasago, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Animal & Pet Food Flavors," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Animal & Pet Food Flavors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.