1. What is the projected Compound Annual Growth Rate (CAGR) of the Animal and Plant In Vivo Imaging Systems?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Animal and Plant In Vivo Imaging Systems

Animal and Plant In Vivo Imaging SystemsAnimal and Plant In Vivo Imaging Systems by Type (Optical Imaging, Ultrasound Imaging, PET/SPECT Imaging, Magnetic Resonance Imaging, Computed Tomography Imaging, Others), by Application (Laboratories, Vet Hospitals and Clinics), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

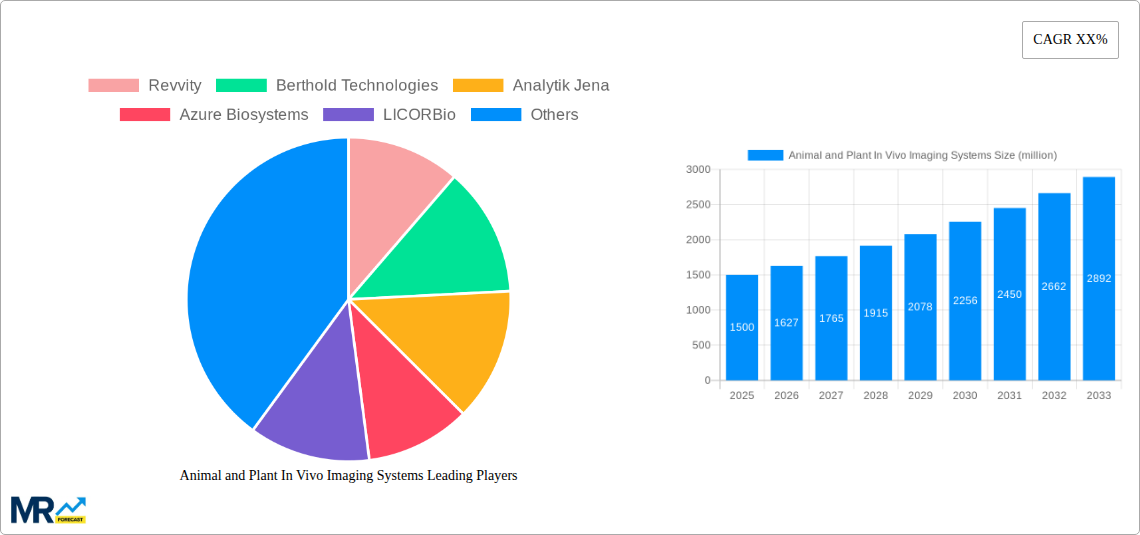

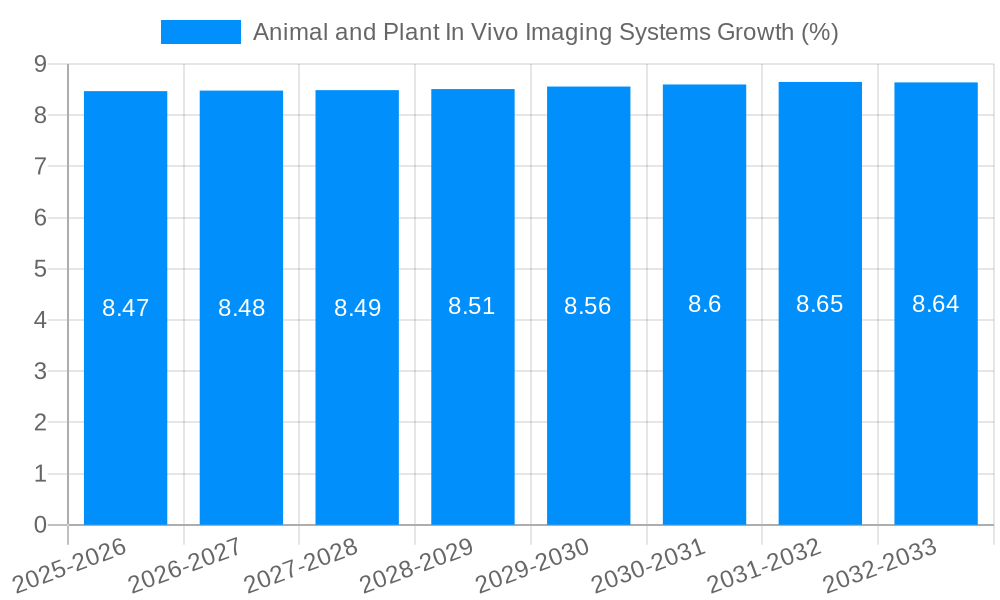

The global Animal and Plant In Vivo Imaging Systems market is poised for significant expansion, driven by increasing investments in preclinical research, drug discovery, and the growing need for advanced diagnostics in veterinary medicine. With an estimated market size of approximately $1.5 billion in 2025, the sector is projected to grow at a Compound Annual Growth Rate (CAGR) of around 8.5% through 2033. This robust growth is fueled by technological advancements in imaging modalities such as optical imaging, ultrasound, PET/SPECT, MRI, and CT, which offer unparalleled resolution and sensitivity for studying biological processes in living organisms. The expanding applications in academic research, pharmaceutical development, and the burgeoning fields of plant science research and agricultural biotechnology are further augmenting market demand. Moreover, the rising pet population and increased expenditure on animal healthcare globally are creating substantial opportunities for veterinary imaging solutions, contributing to the overall market trajectory.

Key trends shaping this dynamic market include the integration of artificial intelligence (AI) and machine learning (ML) for enhanced image analysis and interpretation, leading to more accurate and efficient research outcomes. Miniaturization of imaging devices and the development of multi-modal imaging systems that combine the strengths of different technologies are also gaining traction. However, the market faces certain restraints, including the high cost of advanced imaging equipment and the need for specialized technical expertise for operation and maintenance. Stringent regulatory frameworks for animal research and the limited availability of skilled professionals in certain regions can also pose challenges. Despite these hurdles, the continuous innovation in imaging technologies, coupled with the growing recognition of the importance of in vivo imaging in understanding complex biological systems and improving healthcare outcomes for both animals and plants, ensures a promising future for the market.

Here's a report description on Animal and Plant In Vivo Imaging Systems, incorporating your specified values, companies, segments, and structure.

The global Animal and Plant In Vivo Imaging Systems market is poised for substantial expansion, projected to reach approximately \$3.8 billion by 2033, with a remarkable compound annual growth rate (CAGR) of over 12% during the forecast period of 2025-2033. The base year of 2025 sets the stage for this dynamic growth, building upon the foundational advancements observed during the historical period of 2019-2024. A key trend underpinning this upward trajectory is the increasing demand for non-invasive research methodologies across both the pharmaceutical and biotechnology sectors. Researchers are actively seeking advanced imaging techniques that allow for longitudinal studies of disease progression, drug efficacy, and physiological responses without the need for animal sacrifice. This has driven significant investment in sophisticated optical imaging systems, which offer unparalleled resolution and sensitivity for visualizing cellular and molecular processes. Furthermore, the burgeoning field of plant science is increasingly leveraging in vivo imaging to understand plant growth, stress responses, and the impact of environmental factors, opening up new avenues for crop improvement and sustainable agriculture. The integration of artificial intelligence (AI) and machine learning (ML) algorithms into imaging analysis is another critical trend, enabling faster and more accurate data interpretation, thereby accelerating the pace of discovery. The development of multimodal imaging platforms, combining the strengths of different technologies like PET/SPECT and MRI, is also gaining traction, offering researchers a more comprehensive understanding of biological systems. The growing adoption of these advanced systems in veterinary hospitals and clinics, driven by the desire for improved diagnostic capabilities and personalized treatment plans for animals, further fuels market growth. The industrial segment, particularly in areas like food safety and quality control, is also witnessing a rise in the application of these imaging technologies. The market is characterized by a continuous influx of innovative products and technological enhancements, ensuring its sustained and robust expansion throughout the study period of 2019-2033.

The ascent of the Animal and Plant In Vivo Imaging Systems market is fundamentally propelled by a confluence of critical drivers that are reshaping the landscape of biological research and diagnostics. Paramount among these is the escalating R&D expenditure by pharmaceutical and biotechnology companies, particularly in the discovery and development of novel therapeutics. The need for precise, quantitative, and non-invasive methods to assess drug pharmacokinetics, pharmacodynamics, and toxicity is paramount, and in vivo imaging systems provide an indispensable solution. This demand is further amplified by the increasing complexity of biological targets and the move towards personalized medicine, necessitating sophisticated tools to track treatment responses at the molecular and cellular levels. The growing emphasis on ethical animal research and the drive to reduce, refine, and replace animal testing (the 3Rs) also plays a significant role, as in vivo imaging allows for more studies with fewer animals. In the realm of plant science, the urgent need to enhance crop yields and resilience in the face of climate change and growing global populations is a powerful impetus. In vivo imaging enables detailed analysis of plant physiology, stress responses, and the efficacy of agricultural interventions, contributing to food security initiatives. Moreover, advancements in detector technologies, image processing software, and the miniaturization of imaging devices are making these systems more accessible, affordable, and user-friendly, thereby broadening their adoption across a wider spectrum of research institutions and veterinary practices. The synergistic integration of these technological advancements with the evolving needs of the scientific community creates a fertile ground for sustained market expansion.

Despite the robust growth trajectory, the Animal and Plant In Vivo Imaging Systems market is not without its hurdles. A primary challenge lies in the substantial capital investment required to acquire and maintain these advanced imaging systems. The high cost of sophisticated equipment, coupled with ongoing expenses for maintenance, software updates, and specialized personnel, can be a significant barrier, particularly for smaller research institutions, academic laboratories, and emerging veterinary clinics. Furthermore, the steep learning curve associated with operating complex imaging technologies and interpreting the resulting data necessitates specialized training and expertise. This can limit the widespread adoption of certain advanced modalities. Regulatory hurdles and the need for stringent ethical approvals, especially for studies involving live animals, can also contribute to longer development cycles and increased operational complexities. The integration of disparate imaging data from multiple modalities can also present challenges in terms of standardization, quantification, and cross-validation, demanding robust bioinformatic tools and protocols. The rapid pace of technological evolution also poses a challenge, as early adopters may face obsolescence issues if newer, more advanced systems become available shortly after their investment. Ensuring data security and privacy, particularly with the increasing digitization of research information, is another critical concern that requires significant attention. Addressing these challenges through innovative financing models, comprehensive training programs, and standardized data management practices will be crucial for unlocking the full potential of the in vivo imaging market.

Dominant Segments:

Dominant Region:

The global Animal and Plant In Vivo Imaging Systems market is anticipated to witness the significant dominance of Optical Imaging as a segment, primarily driven by its versatility, high resolution, and relatively lower cost of entry compared to some other modalities. Optical imaging techniques, including fluorescence imaging, bioluminescence imaging, and near-infrared (NIR) imaging, offer unparalleled capabilities for visualizing cellular and molecular processes in real-time within living organisms. The ability to track gene expression, protein localization, disease progression, and drug distribution at the cellular level makes optical imaging indispensable for preclinical research in drug discovery and development. The continuous innovation in fluorescent probes, bioluminescent reporters, and sensitive detection systems further enhances its appeal. Companies like LICORBio, Revvity, and Azure Biosystems are at the forefront of developing advanced optical imaging solutions. The development of portable and benchtop optical imaging systems has also made this technology more accessible to a broader range of research settings, including smaller academic labs and specialized research groups.

In terms of application, Laboratories are poised to be the leading segment, acting as the primary hub for cutting-edge biological research and development. Pharmaceutical companies, biotechnology firms, contract research organizations (CROs), and academic institutions all rely heavily on in vivo imaging systems to conduct fundamental research, preclinical studies, and drug efficacy testing. The stringent requirements for understanding disease mechanisms, evaluating therapeutic targets, and assessing the safety and efficacy of new drug candidates drive a continuous demand for sophisticated imaging technologies within laboratory environments. These labs are at the forefront of adopting new imaging modalities and integrating them into their research workflows, contributing significantly to market growth.

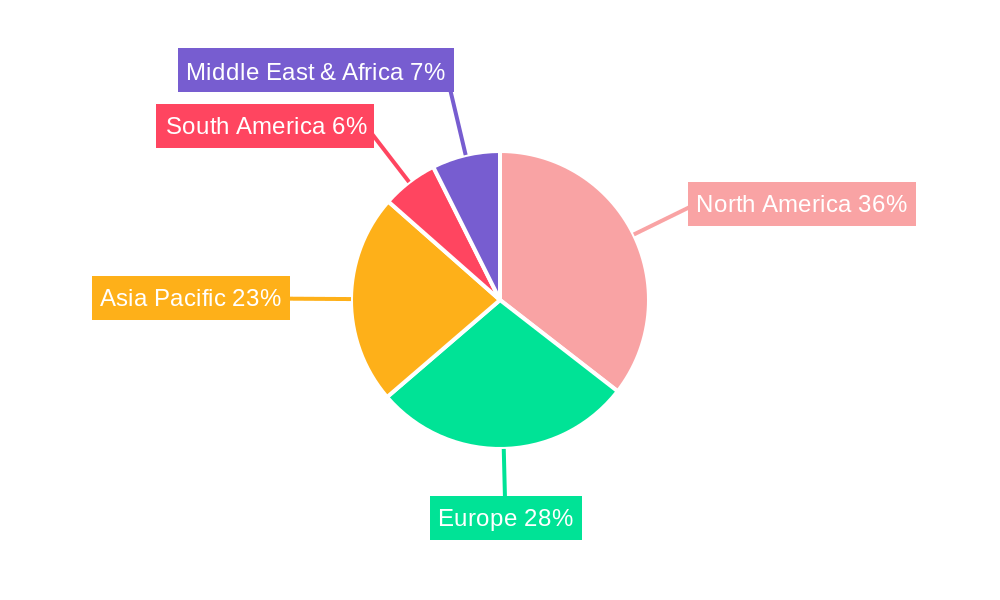

Regionally, North America is projected to maintain its leadership position in the Animal and Plant In Vivo Imaging Systems market. This dominance is attributed to several factors, including the presence of a highly developed pharmaceutical and biotechnology industry with substantial R&D investments, a robust network of leading research institutions and universities, and a strong emphasis on technological innovation. The region boasts a high concentration of companies investing in preclinical research, a supportive regulatory environment for medical device development, and a skilled workforce proficient in operating and interpreting data from advanced imaging systems. Furthermore, government initiatives and funding for life sciences research in countries like the United States contribute to the sustained growth of the in vivo imaging market. The proactive adoption of new technologies and the continuous pursuit of novel drug discoveries by North American entities ensure its continued leadership in this dynamic sector.

The Animal and Plant In Vivo Imaging Systems industry is experiencing robust growth fueled by several key catalysts. The escalating demand for non-invasive research methodologies in drug discovery and development, coupled with increasing R&D investments by pharmaceutical and biotech firms, is a primary driver. Advancements in imaging technology, such as enhanced sensitivity, higher resolution, and multimodal capabilities, are enabling more precise and comprehensive biological insights. Furthermore, the growing application of in vivo imaging in plant science for crop improvement and stress analysis, alongside the increasing adoption in veterinary medicine for enhanced diagnostics, are opening new market avenues. The rising focus on ethical research practices and the reduction of animal usage also propels the adoption of non-invasive imaging solutions.

This comprehensive report offers an in-depth analysis of the Animal and Plant In Vivo Imaging Systems market from 2019 to 2033, with a base year of 2025 and a detailed forecast period of 2025-2033. It meticulously examines market trends, driving forces, challenges, and restraints, providing valuable insights for stakeholders. The report highlights dominant market segments, including Optical Imaging and applications in Laboratories, and identifies North America as the leading region. It also profiles key players and their contributions, alongside significant recent developments in the sector. The report aims to equip industry professionals with the critical information needed to navigate this rapidly evolving market and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Revvity, Berthold Technologies, Analytik Jena, Azure Biosystems, LICORBio, Scintica Instrumentation, Vieworks, Thermo Fisher Scientific, Ningbo Icoe Commodity, Canon Medical Systems, Bruker, Hallmarq Veterinary Imaging, Huan Tong Nuclear Magnetic, Sunny Optical Technology, Photon, MILABS, iThera Medical, Aspect Imaging, TOMOWAVE, Trifoil Imaging, Clinx, Raylight Technology, Beijing NOVEL MEDICAL Equipmen, Tanon, Guangzhou Biolight Biotechnology, PINGSENG Healthcare, Fujifilm Visualsonics.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Animal and Plant In Vivo Imaging Systems," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Animal and Plant In Vivo Imaging Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.