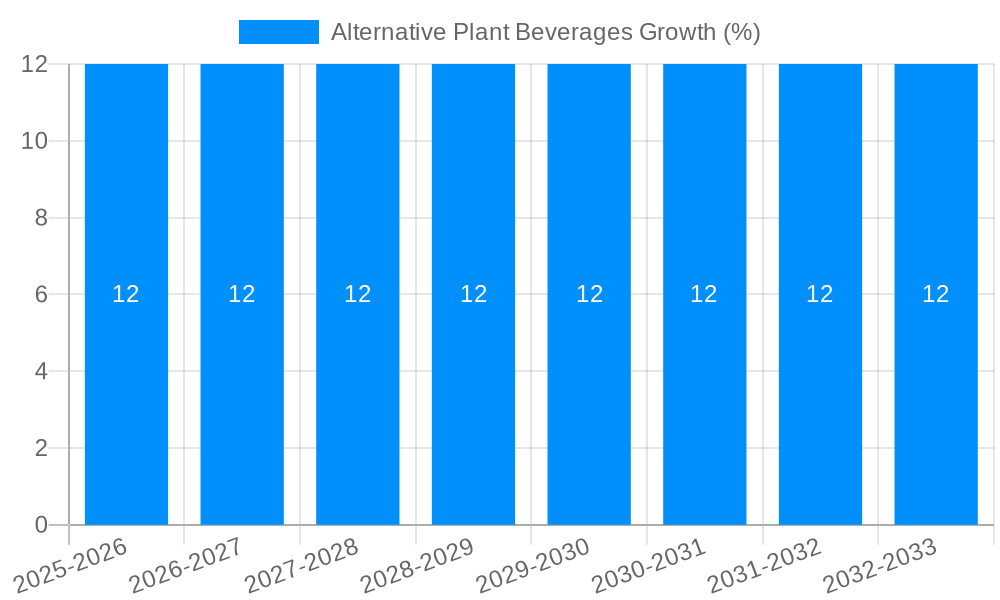

1. What is the projected Compound Annual Growth Rate (CAGR) of the Alternative Plant Beverages?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Alternative Plant Beverages

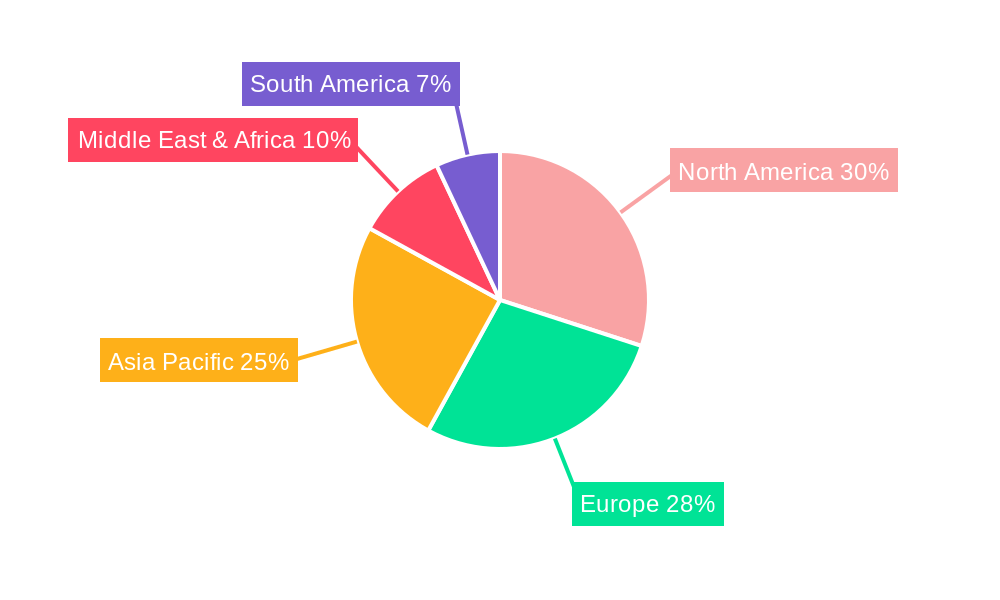

Alternative Plant BeveragesAlternative Plant Beverages by Type (Almond, Soy, Coconut, Rice, Oats, Others), by Application (Direct Drink, Confectionery, Bakery, Ice Cream, Cheese, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

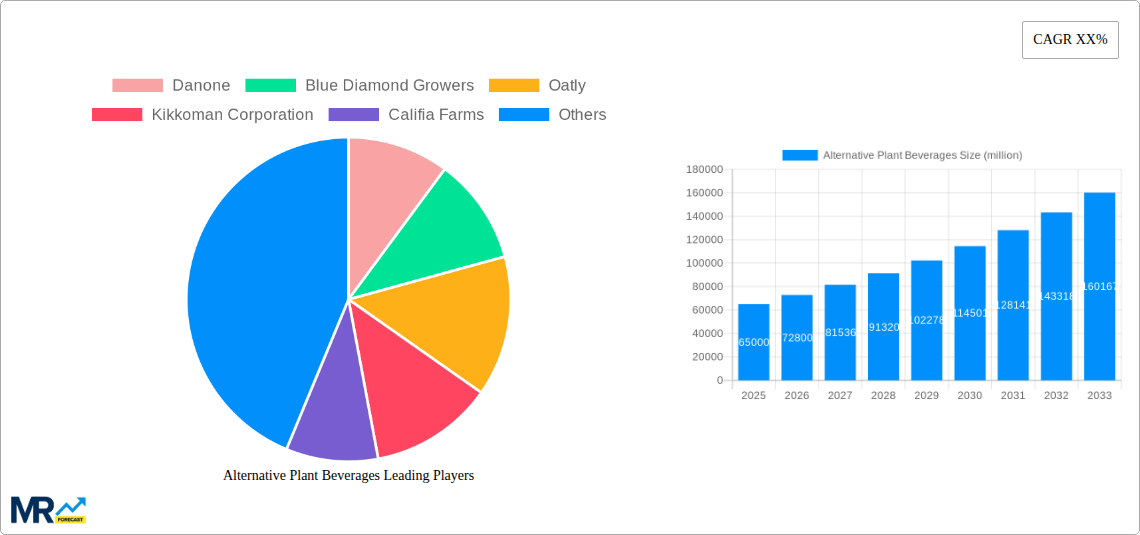

The global Alternative Plant Beverages market is experiencing robust expansion, projected to reach approximately USD 65,000 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 12% from 2019-2033. This significant market size is fueled by a confluence of evolving consumer preferences, heightened awareness of health and environmental sustainability, and a growing demand for dairy-free alternatives. Consumers are increasingly seeking beverages that align with their dietary needs, including lactose intolerance, veganism, and a desire for perceived healthier options. The market's growth is further propelled by innovations in product development, leading to a wider variety of plant-based milk alternatives with improved taste, texture, and nutritional profiles. Key drivers include the rising popularity of plant-based diets, ethical considerations surrounding animal welfare, and the significant environmental footprint associated with traditional dairy farming. The demand for these beverages is not limited to direct consumption but is also expanding across diverse applications like confectionery, bakery, and ice cream, indicating a broadening market penetration.

The competitive landscape is characterized by the presence of both established dairy giants and agile, innovative plant-based brands. Leading companies such as Danone, Blue Diamond Growers, Oatly, and Califia Farms are actively investing in research and development, expanding their product portfolios, and strengthening their global distribution networks. The market is segmented by type, with almond, soy, and oat-based beverages dominating the current market share, while coconut and rice milk also hold significant positions. Emerging plant sources are also gaining traction, contributing to the market's dynamism. Geographically, North America and Europe currently represent the largest markets, driven by strong consumer adoption of plant-based lifestyles. However, the Asia Pacific region is poised for substantial growth due to increasing disposable incomes, urbanization, and a growing awareness of health benefits. Restraints include potential price volatility of raw materials and consumer perception challenges related to taste and texture compared to dairy milk, although continuous product development is actively addressing these concerns.

Here's a comprehensive report description on Alternative Plant Beverages, incorporating your specified details and structure:

This in-depth report offers a panoramic view of the global Alternative Plant Beverages market, meticulously analyzing its trajectory from the historical period of 2019-2024 through the estimated base year of 2025 and projecting its growth through the forecast period of 2025-2033. With an estimated market valuation of USD 110,500 million in 2025, this sector is experiencing dynamic shifts driven by evolving consumer preferences, technological advancements, and an increasing awareness of health and environmental sustainability. The report leverages a robust methodology, incorporating extensive primary and secondary research, to provide actionable insights for stakeholders.

The global Alternative Plant Beverages market is experiencing a significant metamorphosis, driven by a confluence of factors that are reshaping consumer habits and industry landscapes. XXX The burgeoning demand for dairy-free alternatives, fueled by increasing lactose intolerance, dairy allergies, and a growing vegan and flexitarian population, is a primary trend. Consumers are actively seeking healthier and more sustainable options, leading to a discernible shift away from traditional dairy products. This trend is further amplified by the widespread availability and improved taste profiles of plant-based beverages. The market is witnessing rapid innovation in product formulation, with companies venturing beyond traditional soy and almond bases to explore novel ingredients like oats, coconuts, rice, and even more niche options such as hemp and flax. This diversification caters to a broader spectrum of palates and nutritional requirements. Furthermore, the "clean label" movement is gaining traction, with consumers scrutinizing ingredient lists and favoring products with fewer artificial additives and preservatives. Transparency in sourcing and processing is becoming a critical differentiator. The rise of premium and functional plant-based beverages, enriched with added vitamins, minerals, and probiotics, is another key trend. These products are positioned not just as dairy replacements but as health-boosting formulations. The increasing adoption of plant-based beverages in culinary applications, including baking, confectionery, and ice cream manufacturing, is also a noteworthy trend, expanding the market's reach beyond direct consumption. The market's projected growth from an estimated USD 110,500 million in 2025 to a substantial USD 250,000 million by 2033 underscores the enduring power of these evolving trends. The strategic focus on sustainability, encompassing ethical sourcing, reduced environmental impact, and recyclable packaging, is becoming paramount for market players, influencing both product development and consumer loyalty.

The remarkable ascent of the Alternative Plant Beverages market is propelled by a powerful synergy of evolving consumer consciousness, technological advancements, and compelling economic factors. A fundamental driver is the growing global awareness regarding the health implications of dairy consumption, including lactose intolerance, allergies, and potential links to chronic diseases. This has spurred a significant migration of consumers towards plant-based alternatives perceived as healthier and easier to digest. Concurrently, the escalating environmental concerns associated with traditional dairy farming, such as greenhouse gas emissions, land usage, and water consumption, are influencing purchasing decisions. Consumers are increasingly opting for beverages with a lower ecological footprint. The expansion of the vegan and flexitarian consumer base, driven by ethical considerations and a desire for a more sustainable lifestyle, represents a substantial market segment. This demographic actively seeks out and champions plant-based products. Technological innovations in processing and formulation have played a crucial role in improving the taste, texture, and nutritional profiles of plant-based beverages, making them more appealing and competitive with dairy counterparts. Product development has moved beyond mere imitation to create unique and enjoyable beverage experiences. The increasing availability and distribution of these products across various retail channels, from supermarkets to online platforms, have made them more accessible to a wider audience. This enhanced accessibility is a critical enabler of market growth.

Despite its robust growth trajectory, the Alternative Plant Beverages market is not without its inherent challenges and restraints that require strategic navigation. One significant hurdle is the perception and reality of price premiums associated with many plant-based alternatives compared to conventional dairy milk. While economies of scale are improving, the initial cost of production and specialized ingredients can still be a deterrent for price-sensitive consumers, particularly in emerging economies. The taste and texture variability across different plant-based beverage types and brands can also present a challenge. While innovation has significantly improved this aspect, some consumers still find certain alternatives unappealing or distinctly different from dairy milk, hindering widespread adoption. Furthermore, the nutritional completeness of some plant-based beverages, particularly regarding protein content and essential vitamins like B12 and D, can be a concern for consumers relying on them as primary sources of nutrition. Fortification efforts are ongoing, but ensuring parity with dairy can be complex. Regulatory complexities and varying labeling standards across different regions can also create obstacles for global market expansion. Ensuring compliance with diverse food safety and nutritional claims requires significant investment and effort. Finally, established brand loyalty and ingrained consumer habits associated with dairy products pose a persistent challenge. Shifting deeply entrenched preferences requires sustained marketing efforts and compelling product differentiation.

The global Alternative Plant Beverages market is poised for significant expansion, with certain regions and product segments emerging as dominant forces, shaping the industry's future landscape.

Dominant Regions/Countries:

Dominant Segments:

The interplay between these dominant regions and segments will be crucial in shaping the overall market dynamics and investment strategies within the Alternative Plant Beverages industry for the foreseeable future.

The Alternative Plant Beverages industry is propelled by several key growth catalysts that are fundamentally altering its market dynamics. The escalating consumer demand for healthier lifestyle choices, driven by increased awareness of the benefits of plant-based diets and concerns about dairy consumption, is a primary catalyst. This is intrinsically linked to the growing consciousness around environmental sustainability, as plant-based beverages generally possess a lower carbon footprint compared to their dairy counterparts. Furthermore, continuous product innovation, leading to improved taste, texture, and nutritional profiles, is attracting a broader consumer base. The expansion of distribution channels, both online and offline, has significantly enhanced accessibility, making these beverages readily available to a wider demographic.

The global Alternative Plant Beverages market is characterized by the presence of several key players, driving innovation and market expansion.

This comprehensive report provides an exhaustive analysis of the Alternative Plant Beverages market, offering a holistic understanding of its present landscape and future potential. It delves deep into market segmentation by type (Almond, Soy, Coconut, Rice, Oats, Others), application (Direct Drink, Confectionery, Bakery, Ice Cream, Cheese, Others), and geographical regions. The report meticulously examines the historical data from 2019-2024, establishes a robust base year of 2025 with an estimated market valuation of USD 110,500 million, and projects future growth trends through the forecast period of 2025-2033. Beyond quantitative data, it offers qualitative insights into key market trends, driving forces, challenges, and significant industry developments. The report is an indispensable resource for stakeholders seeking to navigate and capitalize on the dynamic opportunities within the burgeoning Alternative Plant Beverages sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Danone, Blue Diamond Growers, Oatly, Kikkoman Corporation, Califia Farms, Earth's Own Food Company, Ezaki Glico, Ripple Foods, Marusan-Ai Co. Ltd, Campbell Soup Company, SunOpta, Nutrisoya Foods, Elmhurst Milked Direct, Panos Brands, Jindilli Beverages (milkadamia), Hebei Yangyuan Zhihui, He Bei Cheng De Lolo, Coconut Palm Group, V V Food and Beverage, Vitasoy International Holdings, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Alternative Plant Beverages," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Alternative Plant Beverages, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.