1. What is the projected Compound Annual Growth Rate (CAGR) of the Alcoholic and Non-Alcoholic Beverages?

The projected CAGR is approximately 3.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Alcoholic and Non-Alcoholic Beverages

Alcoholic and Non-Alcoholic BeveragesAlcoholic and Non-Alcoholic Beverages by Type (Alcoholic Beverages, Non-Alcoholic Beverages), by Application (Bar, Restaurant, Daily Life, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

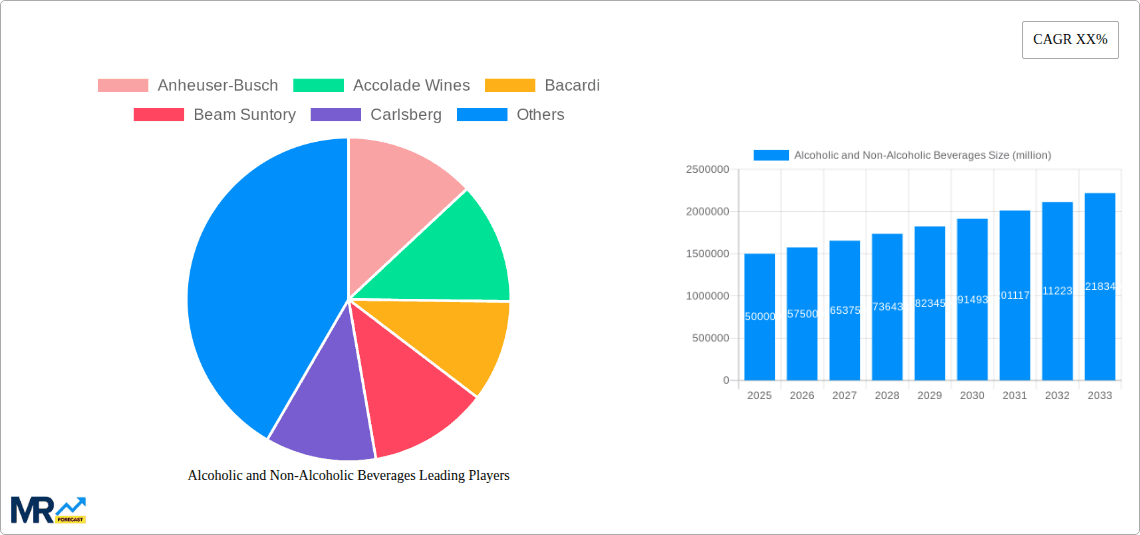

The global alcoholic and non-alcoholic beverage market is poised for robust expansion, driven by evolving consumer preferences, rising disposable incomes, and expanding distribution networks. The market, valued at $385.6 billion in the 2025 base year, is projected to grow at a compound annual growth rate (CAGR) of 3.9%, reaching an estimated $385.6 billion by 2033. Key growth drivers include the increasing demand for health-conscious beverages, such as functional drinks, and premiumization across both alcoholic and non-alcoholic segments. Consumers are actively seeking healthier alternatives with added benefits like enhanced hydration or added vitamins, boosting demand for functional waters, herbal teas, and low-sugar options. Simultaneously, premiumization encourages consumers to invest in high-quality, artisanal beverages, impacting categories from craft beers and premium spirits to specialty non-alcoholic drinks. However, market expansion is tempered by concerns regarding excessive alcohol consumption, evolving regulations, and fluctuating raw material costs. Leading companies are strategically navigating these challenges through product innovation, targeted marketing, and sustainable sourcing practices.

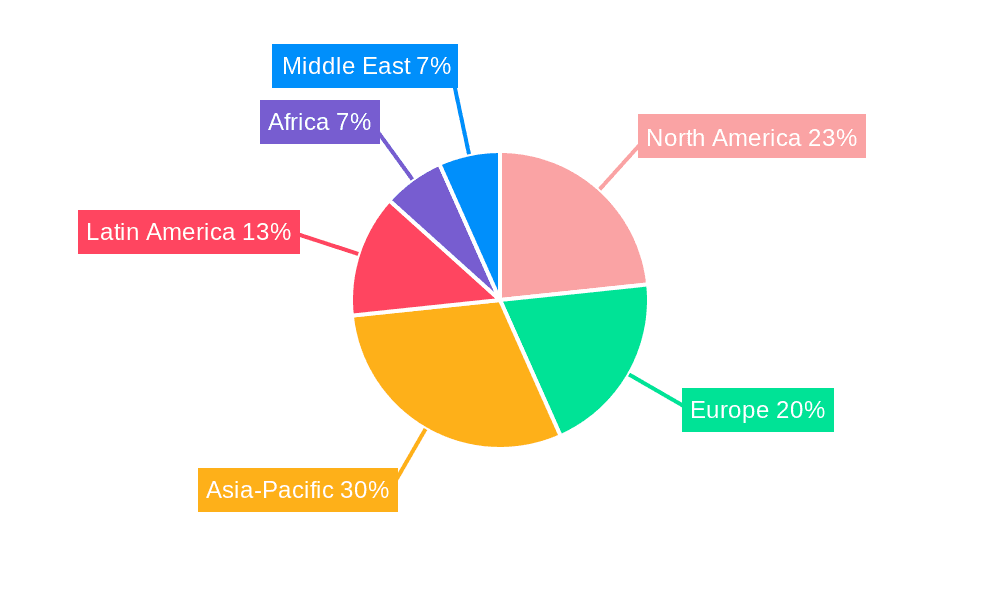

The competitive arena features prominent multinational corporations such as Anheuser-Busch, Diageo, and Coca-Cola, alongside significant regional players and emerging brands. These entities leverage established brand recognition and extensive distribution channels to sustain market dominance. However, the proliferation of direct-to-consumer models and online marketplaces offers emerging niche brands viable avenues for competition. Product segmentation reveals a diverse landscape encompassing beer, wine, spirits, carbonated soft drinks, juices, bottled water, energy drinks, and functional beverages. Regional consumer preferences and regulatory environments significantly influence market dynamics. While North America and Europe remain key markets, developing economies in Asia and Africa exhibit substantial growth potential, propelled by urbanization and expanding middle-class populations. Future market trajectory will be shaped by the industry's adaptability to evolving consumer tastes, embrace of technological advancements, and commitment to sustainability.

The global alcoholic and non-alcoholic beverage market exhibits dynamic trends reflecting evolving consumer preferences and economic conditions. From 2019 to 2024 (historical period), the market witnessed significant fluctuations influenced by factors like global pandemics and shifting consumer spending patterns. The estimated market value for 2025 stands at approximately XXX million units, showcasing a notable recovery and growth trajectory. The forecast period (2025-2033) anticipates continued expansion, driven by several key factors. The rise of health-conscious consumers is fueling the growth of low-alcohol and non-alcoholic options, particularly in developed markets. Simultaneously, premiumization within both alcoholic and non-alcoholic segments is evident, with consumers increasingly willing to spend more on high-quality, unique products. This is reflected in the burgeoning craft beer and artisanal beverage sectors. Furthermore, innovative product development, encompassing functional beverages with added health benefits and exciting flavor profiles, is driving market dynamism. The increasing integration of technology, from e-commerce platforms for direct-to-consumer sales to sophisticated supply chain management, is reshaping the industry landscape. Finally, the evolving regulatory environment, particularly regarding alcohol taxation and marketing restrictions, continues to influence market dynamics across different regions. The overall market picture is one of diversification, premiumization, and a growing emphasis on health and wellness.

Several key factors are propelling the growth of the alcoholic and non-alcoholic beverage market. Firstly, the increasing disposable incomes, particularly in developing economies, are leading to higher spending on beverages, both alcoholic and non-alcoholic. This is especially true for younger demographics, who are increasingly experimenting with diverse beverage choices. Secondly, the growing urbanization and changing lifestyles are contributing to higher demand. People in urban areas tend to consume more beverages outside the home, leading to increased sales in restaurants, bars, and other retail channels. Thirdly, the aggressive marketing strategies employed by leading companies, leveraging digital platforms and targeted campaigns, are instrumental in shaping consumer choices and preferences. Innovative packaging, attractive branding, and influencer marketing play a significant role in market penetration. Fourthly, the rise of e-commerce and online delivery services has expanded access to a wider range of beverages, surpassing geographical limitations and enhancing consumer convenience. Lastly, the continuous innovation in flavors, formulations, and product formats caters to diverse palates and preferences, stimulating market expansion and fostering customer loyalty.

Despite the positive growth trends, the alcoholic and non-alcoholic beverage industry faces several significant challenges. Fluctuations in raw material prices, particularly for agricultural commodities used in beverage production, can impact profitability and pricing strategies. The increasing regulatory scrutiny and stringent regulations regarding alcohol content, labeling, and marketing practices pose hurdles, particularly for alcoholic beverage manufacturers. Health concerns associated with excessive alcohol consumption continue to fuel negative publicity and impact consumer choices, promoting the shift towards low-alcohol and non-alcoholic alternatives. Intense competition among established players and the emergence of new entrants create pressure on pricing and market share. Furthermore, sustainability concerns, related to water usage, packaging waste, and carbon footprint, are pushing companies to adopt eco-friendly practices, adding to operational costs and complexity. Finally, economic downturns and changing consumer spending patterns can significantly affect beverage consumption, particularly within the premium segments.

North America: This region is projected to maintain a leading position due to high per capita consumption, established distribution networks, and strong brand presence. The premiumization trend within both alcoholic and non-alcoholic segments strongly influences this dominance. The US, in particular, shows high demand for craft beers, premium spirits, and functional beverages. Canada also contributes significantly with its diverse consumer base.

Europe: While mature, the European market demonstrates considerable growth potential in specific segments, particularly low-alcohol and non-alcoholic beverages, reflecting evolving health consciousness. Specific countries like Germany, France, and the UK showcase diverse preferences and strong local brands.

Asia-Pacific: Rapid economic growth and increasing urbanization in countries like China and India are driving significant expansion within the alcoholic and non-alcoholic beverage market. However, cultural nuances and regulatory differences require specific market strategies.

Premium Segments: Across all regions, the premium segment experiences accelerated growth, reflecting a willingness among consumers to pay more for high-quality, unique products and experiences. This includes premium spirits, craft beers, artisanal sodas, and functional beverages.

Non-alcoholic segment: This segment is experiencing consistent growth due to growing health awareness, increased participation in fitness activities, and changing lifestyles which encourage mindful consumption. This sector includes functional beverages and premium soft drinks.

The combination of these factors contributes to a dynamic and complex market landscape. Market leaders need to strategically adapt to evolving consumer preferences, regulatory requirements, and competitive pressures to maintain their positions.

The industry is fueled by several key growth catalysts, including rising disposable incomes, increasing urbanization, evolving consumer preferences for premium and functional beverages, the expansion of e-commerce, and continuous innovation in flavors and formats. The health-conscious consumer trend is particularly impactful, boosting the non-alcoholic and low-alcohol segments, while premiumization drives growth within both sectors.

This report provides a detailed analysis of the alcoholic and non-alcoholic beverage market, covering historical data, current trends, and future projections. It offers insights into key market drivers and challenges, examines leading players, and identifies significant growth opportunities within various segments and regions. This comprehensive analysis equips stakeholders with actionable intelligence for strategic decision-making in this dynamic and evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.9%.

Key companies in the market include Anheuser-Busch, Accolade Wines, Bacardi, Beam Suntory, Carlsberg, Constellation Brands, China Resource Enterprise, Diageo, Heineken, E. & J. Gallo Winery, Coca-Cola, PepsiCo, Nestlé, Dr Pepper Snapple Group, Red Bull, Danone, Yakult, Unilever, Kraft Heinz, Apollinaris, .

The market segments include Type, Application.

The market size is estimated to be USD 385.6 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Alcoholic and Non-Alcoholic Beverages," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Alcoholic and Non-Alcoholic Beverages, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.