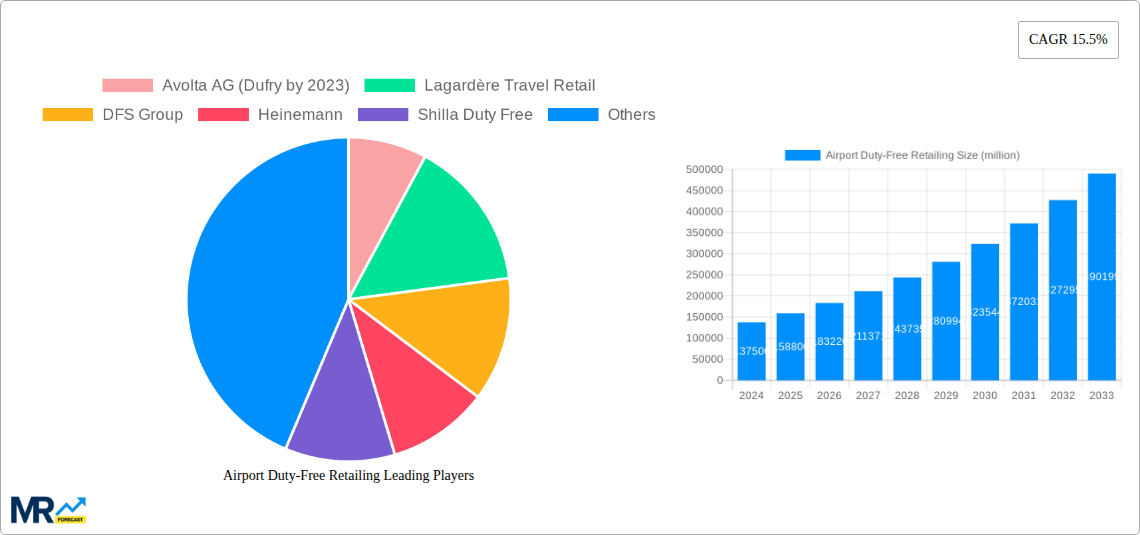

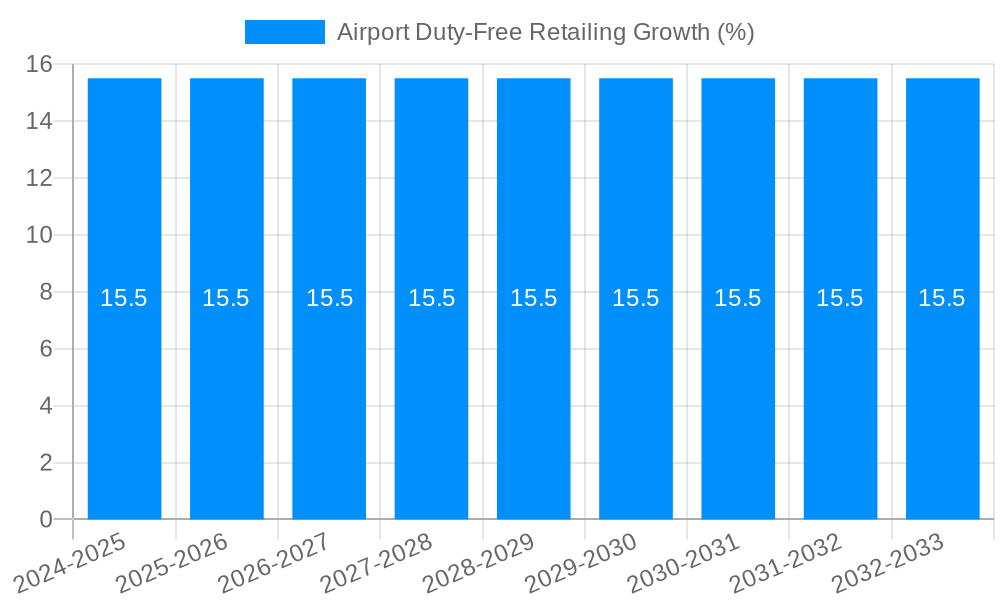

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airport Duty-Free Retailing?

The projected CAGR is approximately 15.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Airport Duty-Free Retailing

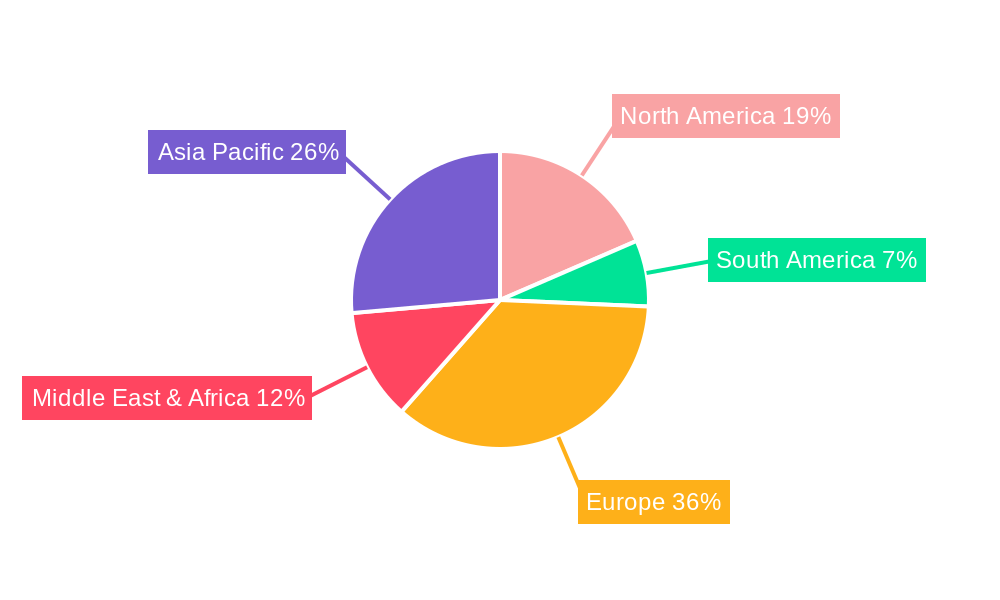

Airport Duty-Free RetailingAirport Duty-Free Retailing by Type (Cosmetics & Personal Care Products, Alcohol, Wine and Spirits, Tobacco & Cigarettes, Fashion & Luxury Goods, Confectionery & Food Stuff, Others), by Application (Online Duty-free Shops, Offline Duty-free Retailing), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Airport Duty-Free Retailing market is poised for substantial growth, projected to reach an impressive market size of approximately $158.8 billion by 2025. This growth is propelled by a robust Compound Annual Growth Rate (CAGR) of 15.5%, indicating a dynamic and expanding industry. The primary drivers for this surge include the increasing volume of international air travel, a burgeoning middle class with higher disposable incomes, and the continuous innovation in retail offerings by major players like Avolta AG (formerly Dufry), Lagardère Travel Retail, and DFS Group. These companies are actively enhancing the customer experience through sophisticated store designs, personalized services, and the integration of digital technologies, further stimulating consumer spending within these captive environments. The market's expansion is also fueled by favorable government policies in various regions that support duty-free operations, aiming to boost tourism and local economies.

The diverse product segments within Airport Duty-Free Retailing are all contributing to its overall dynamism. Cosmetics & Personal Care Products remain a dominant category, consistently attracting travelers seeking premium brands and travel exclusives. Simultaneously, the Alcohol, Wine and Spirits segment continues to perform strongly, driven by evolving consumer preferences and promotional activities. The Fashion & Luxury Goods segment is also witnessing significant traction, as travelers increasingly leverage duty-free opportunities for high-value purchases. Emerging markets, particularly in Asia Pacific, are expected to play a pivotal role in the market's future trajectory, driven by a rapidly growing travel infrastructure and an increasing number of international airports. The strategic expansion of both online duty-free platforms and offline retail networks by key players like China Duty Free Group and Dubai Duty Free is crucial for capturing a larger market share and catering to the evolving needs of global travelers.

This comprehensive report delves into the dynamic world of Airport Duty-Free Retailing, providing an in-depth analysis of market trends, growth drivers, challenges, and future projections. Spanning a crucial Study Period of 2019-2033, with a Base Year of 2025 and a Forecast Period from 2025-2033, this research meticulously examines the Historical Period of 2019-2024 to establish a robust foundation. The report offers valuable insights for stakeholders seeking to understand and capitalize on the opportunities within this multi-billion dollar industry.

XXX The global Airport Duty-Free Retailing market is undergoing a significant transformation, driven by evolving passenger demographics, shifting consumer preferences, and the increasing adoption of digital technologies. Pre-pandemic, the sector experienced consistent growth, fueled by a surge in international travel and the allure of tax-free shopping. The Cosmetics & Personal Care Products segment has consistently been a powerhouse, contributing an estimated $35,000 million in 2025, driven by brand loyalties and impulse purchases. Similarly, Alcohol, Wine and Spirits remain a cornerstone, projected to generate $28,000 million in the same year, owing to premiumization trends and gifting occasions. However, the industry faced unprecedented disruption during the COVID-19 pandemic, leading to a sharp decline in passenger traffic and, consequently, sales. The recovery trajectory is now marked by a renewed focus on the traveler experience, with a growing emphasis on personalized offers and seamless shopping journeys. The rise of Online Duty-free Shops is a pivotal trend, projected to capture a substantial share of the market, offering convenience and wider product selections beyond the physical airport space. This shift is challenging traditional Offline Duty-free Retailing models, forcing operators to innovate and integrate digital channels. Furthermore, sustainability and ethical sourcing are gaining traction, influencing purchasing decisions for a growing segment of environmentally conscious travelers. The demand for unique, locally sourced products and artisanal brands is also on the rise, offering opportunities for diversification beyond mainstream luxury offerings. The report forecasts a strong rebound, with an anticipated market size exceeding $150,000 million by 2033, underscoring the resilience and adaptive nature of this retail sector.

Several key factors are propelling the growth and evolution of the Airport Duty-Free Retailing market. The fundamental driver remains the resumption and projected growth of international air travel. As borders reopen and travel confidence returns, passenger volumes are expected to climb, directly translating to increased footfall in airports and, subsequently, higher potential for duty-free sales. The increasing disposable income of a growing global middle class, particularly in emerging economies, is also a significant contributor. This demographic possesses a greater propensity to spend on discretionary items, including luxury goods and premium beverages, which are staples of duty-free offerings. Furthermore, airport infrastructure development and expansion projects worldwide are creating more attractive and accessible retail spaces, enhancing the overall shopping environment. The strategic partnerships between airport authorities and leading duty-free retailers, such as the collaborations between Avolta AG and various airport operators, ensure prime locations and optimized store layouts. The ever-present allure of tax-free savings continues to be a powerful incentive for travelers, making duty-free purchases a compelling proposition compared to domestic retail prices. This price differential, coupled with targeted promotions and loyalty programs, incentivizes impulse buys and planned purchases alike. The increasing sophistication of travel retail marketing, utilizing data analytics to understand passenger behavior and personalize offers, is also playing a crucial role in driving sales.

Despite the promising outlook, the Airport Duty-Free Retailing sector is not without its significant challenges and restraints. The volatility of global travel patterns, influenced by geopolitical events, economic downturns, and public health crises (as witnessed with the COVID-19 pandemic), poses a constant threat to sales projections. This unpredictability makes long-term strategic planning difficult for retailers. Stringent regulatory frameworks and varying customs regulations across different countries can complicate the cross-border operations of duty-free retailers and limit the product categories that can be offered. The increasing prevalence of e-commerce and online retail in general poses a direct challenge, as consumers now have access to a vast array of products at competitive prices from the comfort of their homes, potentially reducing the need for in-airport purchases. The rise of domestic travel retail channels and the liberalization of tax-free allowances in certain countries can also erode the unique advantage of airport duty-free shopping. Furthermore, rising operational costs for retailers, including high rental fees at prime airport locations and increasing labor costs, can squeeze profit margins. Changing consumer preferences and the growing demand for ethical and sustainable products require significant investment in sourcing and marketing to meet evolving expectations. The increasing competition from non-duty-free retail outlets within airports that offer convenience and unique local products also presents a challenge.

The Asia Pacific region, particularly China, is poised to dominate the Airport Duty-Free Retailing market in the coming years, driven by a confluence of factors related to its burgeoning middle class, increasing outbound tourism, and a sophisticated retail landscape. This dominance will be most pronounced in the Cosmetics & Personal Care Products and Fashion & Luxury Goods segments. China's immense population and rapidly expanding disposable income translate into a massive consumer base eager for premium and branded products. Travelers from China are renowned for their significant spending power in duty-free channels, often prioritizing high-value items.

Asia Pacific Dominance:

Dominant Segments:

The integration of Online Duty-free Shops is also a critical factor that will amplify the dominance of these segments and regions. Retailers are increasingly investing in digital platforms that allow consumers to pre-order items, enhancing convenience and potentially capturing sales from travelers who might otherwise forgo in-person shopping. The synergy between online and offline channels will be crucial for maximizing market share.

Several key factors are acting as growth catalysts for the Airport Duty-Free Retailing industry. The resumption and projected growth of global air passenger traffic is the most fundamental catalyst, directly translating to increased footfall and purchasing opportunities. The rising disposable income in emerging economies, particularly in Asia, is fueling a demand for premium and luxury goods, which are core to duty-free offerings. The increasing number of airports investing in retail modernization and expansion, creating more appealing and accessible shopping environments, also acts as a significant catalyst. Furthermore, the strategic adoption of digital technologies, including e-commerce platforms and personalized marketing strategies, is enhancing customer engagement and driving sales by offering convenience and tailored experiences.

This report offers a holistic understanding of the Airport Duty-Free Retailing landscape. It meticulously analyzes market size, growth rates, and key trends across various segments, including Cosmetics & Personal Care Products, Alcohol, Wine and Spirits, Tobacco & Cigarettes, Fashion & Luxury Goods, Confectionery & Food Stuff, and Others. The report also examines the interplay between Online Duty-free Shops and Offline Duty-free Retailing, highlighting the evolving consumer journey. Through detailed examination of industry developments and competitive strategies employed by leading players, this report equips stakeholders with the knowledge to navigate the complexities and capitalize on the future opportunities within this dynamic global market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15.5%.

Key companies in the market include Avolta AG (Dufry by 2023), Lagardère Travel Retail, DFS Group, Heinemann, Shilla Duty Free, King Power International, Lotte Duty Free, China Duty Free Group (CDFG), Dubai Duty Free (DDF), ARI (DAA), Duty Free Americas (DFA).

The market segments include Type, Application.

The market size is estimated to be USD 158800 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Airport Duty-Free Retailing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Airport Duty-Free Retailing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.