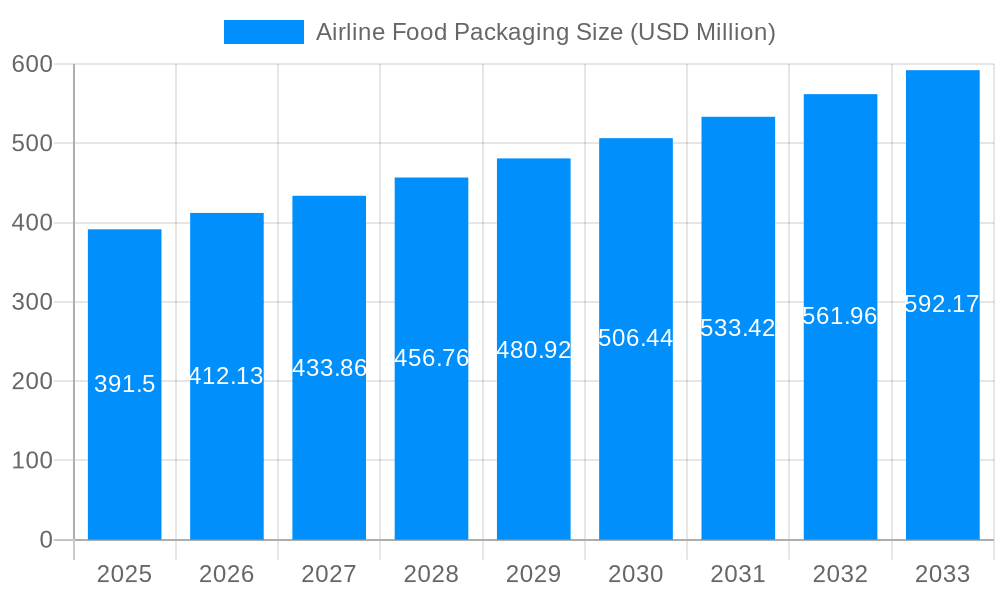

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airline Food Packaging?

The projected CAGR is approximately 5.3%.

Airline Food Packaging

Airline Food PackagingAirline Food Packaging by Type (Plastic Packaging, Paper Packaging, Aluminum Foil Packaging, Others, World Airline Food Packaging Production ), by Application (Food, Beverage, World Airline Food Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The global airline food packaging market is projected to reach approximately USD 391.5 billion by 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of 5.3% from 2019 to 2033. This significant growth trajectory is underpinned by several key drivers. The increasing global air passenger traffic, a direct consequence of expanding economies and a burgeoning middle class, fuels the demand for in-flight meal services, consequently boosting the need for specialized packaging solutions. Furthermore, a growing emphasis on hygiene and food safety, particularly post-pandemic, is compelling airlines and caterers to adopt advanced packaging materials and designs that ensure the integrity of meals throughout their journey from preparation to consumption. Technological advancements in packaging materials, including the development of sustainable and lightweight options, also play a crucial role in driving market expansion. These innovations not only reduce operational costs for airlines through fuel efficiency but also align with increasing environmental consciousness among travelers and regulatory bodies.

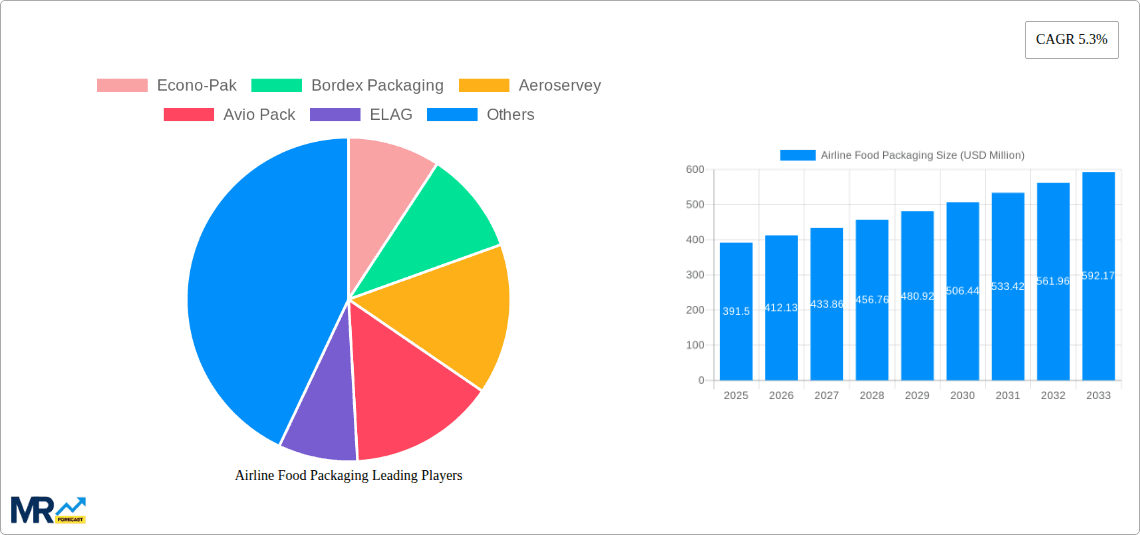

The market is segmented by material type, with Plastic Packaging currently holding a significant share due to its versatility, cost-effectiveness, and barrier properties, essential for preserving food quality. However, a notable trend is the rising demand for Paper Packaging and Aluminum Foil Packaging, driven by sustainability initiatives and a desire to reduce plastic waste. These alternatives are gaining traction as airlines strive to meet environmental targets and cater to eco-conscious passengers. The application segment is dominated by Food and Beverage packaging, reflecting the core need for safe and appealing in-flight catering. Key players like Econo-Pak, Bordex Packaging, and ELAG are actively innovating to offer a diverse range of solutions, from traditional plastic containers to compostable alternatives and advanced aluminum foil designs, catering to the evolving demands across diverse geographical regions. This competitive landscape fosters continuous product development and strategic collaborations, ensuring the market remains dynamic and responsive to industry shifts.

This comprehensive report offers an in-depth analysis of the global airline food packaging market, projecting its trajectory from 2019 to 2033. With a base year of 2025 and an estimated year of 2025, the study provides critical insights for the forecast period of 2025-2033, building upon the historical period of 2019-2024. The market is expected to witness significant expansion, with projections indicating a valuation reaching $12.5 billion by 2033. This report delves into the intricate dynamics shaping this essential industry, from material innovations and evolving consumer preferences to the complex logistical demands of air travel.

The report segmentations encompass a broad spectrum of crucial elements. Under Type, we meticulously analyze Plastic Packaging, Paper Packaging, and Aluminum Foil Packaging, alongside a granular examination of Others. The overarching World Airline Food Packaging Production is quantified and forecasted, providing a crucial benchmark for market size and growth. Furthermore, the report dissects the Application landscape, focusing on the demand generated by Food and Beverage sectors within the airline industry. Finally, a dedicated section on Industry Developments highlights the most pivotal advancements and strategic shifts influencing the market's future.

The airline food packaging market is undergoing a significant transformation, driven by a confluence of sustainability imperatives, evolving passenger expectations, and technological advancements. In the historical period of 2019-2024, the industry witnessed a growing emphasis on lightweight yet durable solutions to minimize fuel consumption and reduce waste. This trend is projected to accelerate, with plastic packaging continuing to hold a substantial market share due to its versatility, cost-effectiveness, and barrier properties. However, a notable shift is emerging towards more eco-friendly alternatives. The demand for paper packaging, including molded pulp and recycled cardboard, is on the rise, as airlines and caterers strive to meet stringent environmental regulations and cater to the increasing consumer consciousness regarding plastic pollution. The estimated year of 2025 is a pivotal point, marking a heightened focus on biodegradability and compostability within plastic alternatives.

Furthermore, the aesthetic appeal and functional design of airline food packaging are gaining prominence. Beyond mere containment, packaging is increasingly viewed as an extension of the brand experience, with airlines investing in premium finishes, innovative opening mechanisms, and personalized branding to enhance passenger satisfaction. The integration of smart technologies, such as QR codes for traceability and ingredient information, is also an emerging trend, offering transparency and a more engaging experience for travelers. The World Airline Food Packaging Production is anticipated to grow steadily, with projections pointing towards a valuation of approximately $10.2 billion in 2025. The forecast period of 2025-2033 is expected to see a substantial CAGR of around 4.5%, pushing the market towards the $12.5 billion mark. This growth will be fueled by an increase in air travel post-pandemic and a sustained demand for convenient and safe meal solutions. The application segment for Food will remain the dominant driver, accounting for an estimated 70% of the market share in 2025, followed by Beverage packaging. The adoption of advanced manufacturing techniques, such as high-speed automated filling and sealing, will further optimize production processes and contribute to market expansion. The growing emphasis on portion control and hygienic packaging solutions, particularly in light of recent global health concerns, will also play a crucial role in shaping future packaging designs.

The ascent of the airline food packaging market is propelled by a multifaceted array of driving forces, intricately woven into the fabric of the aviation and food industries. Primarily, the robust recovery and anticipated growth in global air travel, particularly evident from the historical period of 2019-2024 and projected into the forecast period of 2025-2033, serves as a fundamental catalyst. As passenger numbers rebound and international travel resumes its upward trend, so too does the demand for in-flight catering, and consequently, airline food packaging. This surge in passenger volume directly translates into a greater need for secure, hygienic, and efficient packaging solutions for meals and beverages.

Secondly, the escalating global concern for sustainability and the drive towards a circular economy are profoundly influencing packaging choices. Airlines and food manufacturers are under immense pressure from regulatory bodies, environmental advocacy groups, and increasingly eco-conscious consumers to adopt packaging materials that minimize environmental impact. This has spurred innovation in paper packaging, biodegradable plastics, and reusable container systems, driving market growth in these alternative segments. The push for aluminum foil packaging, renowned for its recyclability and barrier properties, also benefits from this environmental impetus. Furthermore, advancements in material science and packaging technology are enabling the development of lighter, stronger, and more resource-efficient packaging, contributing to both cost savings for airlines through reduced fuel consumption and a more sustainable footprint. The increasing emphasis on food safety and hygiene, amplified by global health events, also necessitates advanced packaging that ensures product integrity and prevents contamination throughout the supply chain.

Despite the promising growth trajectory, the airline food packaging market grapples with several inherent challenges and restraints that can impede its full potential. A significant hurdle is the cost sensitivity associated with airline operations. Airlines are perpetually seeking ways to optimize their expenditures, and the cost of packaging materials, particularly sustainable alternatives, can often be higher than traditional options. This financial pressure can lead to a reluctance to adopt premium or novel packaging solutions, even if they offer environmental or functional benefits. The complexity of the global supply chain for airline food packaging also presents a logistical challenge. Ensuring a consistent and reliable supply of specialized packaging materials to diverse geographical locations, catering to the unique requirements of various airlines and catering companies, demands robust and efficient distribution networks. Disruptions in these networks, whether due to geopolitical events, natural disasters, or economic fluctuations, can significantly impact production and delivery.

Moreover, regulatory fragmentation across different countries and regions can create compliance complexities for packaging manufacturers and airlines. Varying standards for food contact materials, labeling requirements, and waste management policies necessitate extensive research and adaptation, adding to operational costs. The performance requirements for airline food packaging are also exceptionally stringent. Packaging must withstand extreme temperature fluctuations, high altitudes, and the rigors of handling throughout the catering and in-flight service process. Failure to maintain product integrity can lead to spoilage, waste, and reputational damage, making the development of robust and reliable packaging a continuous challenge. Finally, the inherent limitations of certain sustainable materials, such as their barrier properties or durability in specific conditions, can sometimes present functional compromises compared to conventional plastics, requiring careful material selection and innovative design.

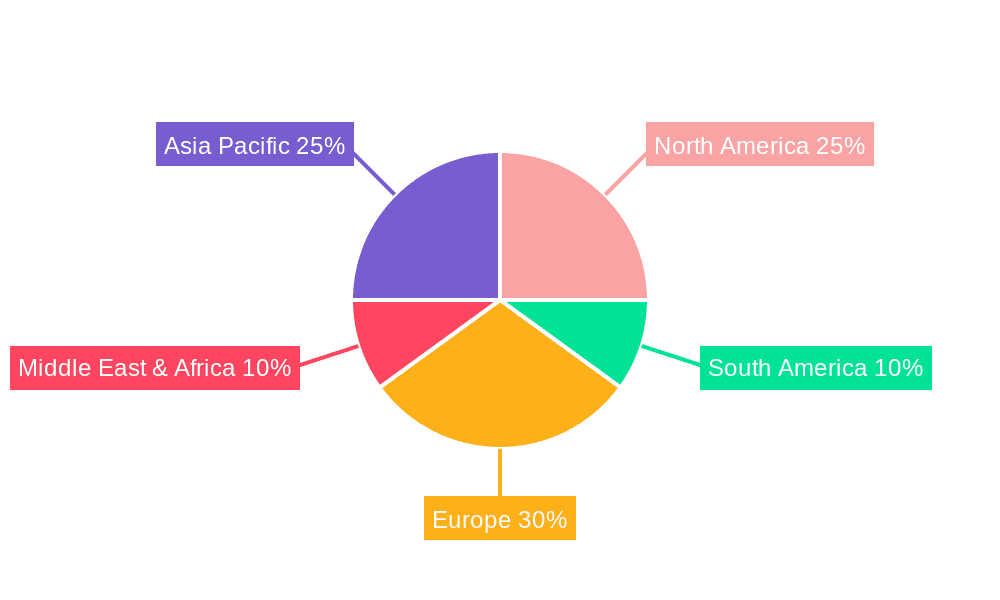

The global airline food packaging market is characterized by distinct regional dynamics and segment dominance.

North America is poised to emerge as a dominant force, driven by a confluence of factors. The region boasts a mature aviation industry with a high volume of passenger traffic, both domestic and international. Major airlines in the United States and Canada are at the forefront of adopting innovative and sustainable packaging solutions, spurred by consumer demand and stringent environmental regulations. The presence of leading packaging manufacturers and a well-established food service infrastructure further solidifies North America's leading position. The robust demand for both Food and Beverage applications within this region significantly contributes to its market share.

Asia Pacific is projected to witness the most rapid growth in the airline food packaging market. The burgeoning middle class, increasing disposable incomes, and expanding airline networks in countries like China, India, and Southeast Asian nations are fueling a substantial increase in air travel. This surge in passengers directly translates into a greater requirement for in-flight catering and, consequently, airline food packaging. The region is also a hub for manufacturing, with a growing number of local and international players focusing on cost-effective solutions, including Plastic Packaging and Paper Packaging. The adoption of advanced packaging technologies is expected to accelerate as airlines in this region aim to enhance passenger experience and meet international standards.

The Plastic Packaging segment is expected to retain its leading position throughout the forecast period. Its versatility, excellent barrier properties, and relatively lower cost make it an indispensable material for many airline food applications. From rigid trays and containers to flexible films and pouches, plastic packaging offers a wide range of solutions for various food and beverage items. However, the environmental concerns associated with single-use plastics are driving innovation within this segment, with a growing focus on recycled content and improved recyclability.

The Paper Packaging segment is anticipated to witness significant growth, driven by the increasing demand for sustainable alternatives. Molded pulp containers, paperboard boxes, and compostable paper-based films are gaining traction as airlines and caterers seek to reduce their environmental footprint. The recyclability and biodegradability of paper make it an attractive option, particularly in regions with strong environmental consciousness. The continuous advancements in paper-based barrier coatings are also enhancing its suitability for a wider range of food applications.

While Aluminum Foil Packaging might represent a smaller share, its unique properties, such as excellent thermal conductivity and barrier against light and moisture, make it crucial for specific applications, particularly for hot meals and sensitive food items. Its high recyclability also aligns with sustainability goals.

The Food application segment will undoubtedly dominate the market, accounting for the largest share in 2025 and throughout the forecast period. This is due to the fundamental purpose of in-flight catering being the provision of meals. The variety of meal types, from snacks and salads to main courses, necessitates a diverse range of packaging solutions. The Beverage segment, while significant, will follow, driven by the demand for drinks, juices, and water.

Several key growth catalysts are poised to propel the airline food packaging industry forward. The anticipated surge in global air travel, coupled with a renewed focus on passenger experience, will directly translate into increased demand for in-flight catering and, by extension, packaging. Furthermore, the accelerating global imperative for sustainability and the growing consumer preference for eco-friendly products are driving significant innovation in biodegradable, compostable, and recyclable packaging materials. Advancements in packaging technology, enabling lighter, more durable, and cost-effective solutions, will also contribute to market expansion.

This comprehensive report provides an exhaustive examination of the global airline food packaging market, spanning from 2019 to 2033. It offers unparalleled insights into the market's evolution, with a base year of 2025 and an estimated year of 2025, projecting a market valuation to reach $12.5 billion by 2033. The report meticulously analyzes market segmentation by Type (Plastic, Paper, Aluminum Foil, Others) and Application (Food, Beverage), alongside a detailed assessment of World Airline Food Packaging Production. Furthermore, it delves into crucial aspects such as market trends, driving forces, challenges, regional dominance, growth catalysts, leading players, and significant industry developments, making it an indispensable resource for stakeholders seeking to navigate this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.3%.

Key companies in the market include Econo-Pak, Bordex Packaging, Aeroservey, Avio Pack, ELAG, Hulamin, Form Plastics, Lovell Industries, KM Packaging, Sowinpak, Monty's Bakehouse, Taixing Group, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Airline Food Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Airline Food Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.