1. What is the projected Compound Annual Growth Rate (CAGR) of the Agriculture Autonomous Robot?

The projected CAGR is approximately 15%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Agriculture Autonomous Robot

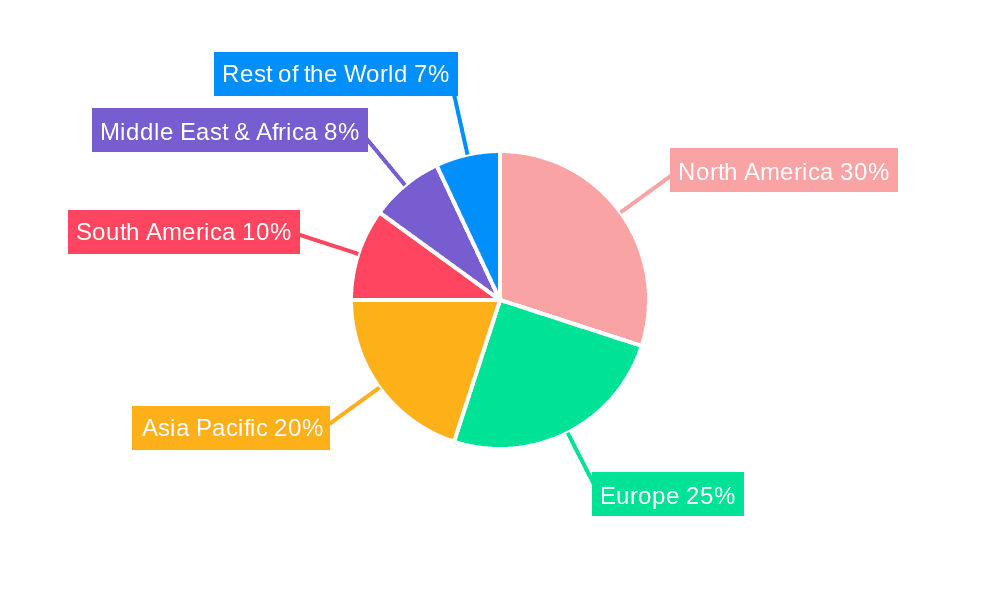

Agriculture Autonomous RobotAgriculture Autonomous Robot by Type (Crop Harvesting Robots, Crop Monitoring Robots, Others), by Application (Crop Monitoring, Harvesting and Picking, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

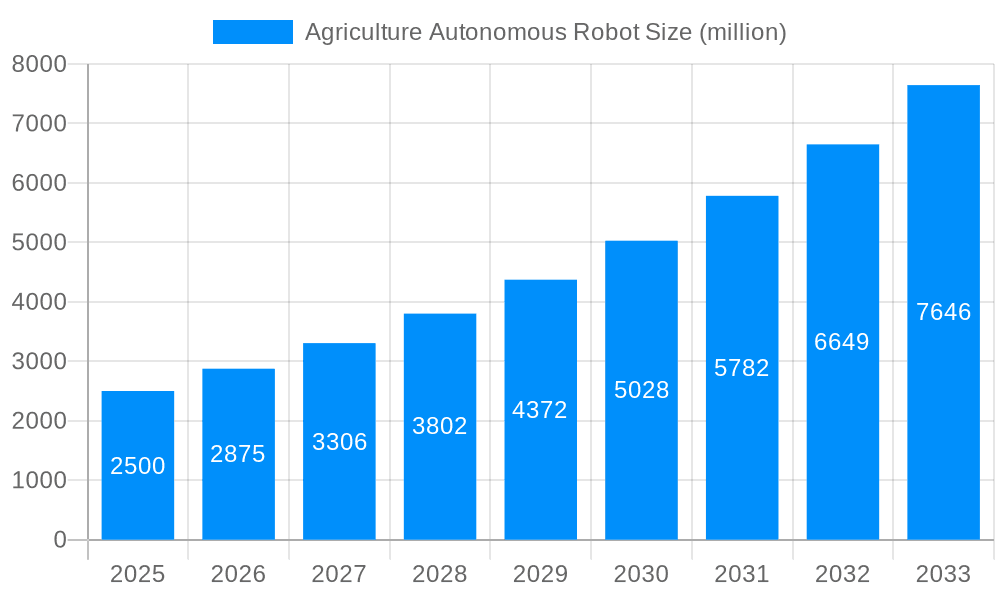

The global agriculture autonomous robot market is experiencing robust expansion, currently valued at an estimated $2.5 billion. This dynamic sector is projected to witness substantial growth, driven by a compelling Compound Annual Growth Rate (CAGR) of 15% over the forecast period. This remarkable surge is fueled by the increasing need for enhanced agricultural efficiency, reduced labor dependency, and the adoption of precision farming techniques. Autonomous robots are revolutionizing crop monitoring, enabling real-time data collection on plant health, soil conditions, and pest infestations, thereby facilitating proactive interventions. Furthermore, their application in harvesting and picking operations promises to address labor shortages and improve the speed and quality of produce collection. The market's trajectory is also influenced by advancements in artificial intelligence, machine learning, and sensor technologies, which are continuously improving the capabilities and affordability of these agricultural machines.

The market's expansion is further supported by a growing awareness of sustainable agriculture practices and the imperative to maximize yields while minimizing environmental impact. Farmers are increasingly recognizing the long-term economic and operational benefits of integrating autonomous robots into their workflows. Key drivers include the rising global population, necessitating higher food production, and the shrinking agricultural workforce in many developed and developing nations. While the adoption of sophisticated technology presents an initial investment, the long-term gains in productivity, cost savings on labor and resources, and improved crop quality are proving to be a significant incentive. The market is characterized by intense innovation, with companies like AGCO Corporation, Deere and Company, and KUBOTA Corporation leading the charge in developing and deploying a diverse range of autonomous solutions for various agricultural needs.

The agriculture autonomous robot market is poised for an unprecedented surge in growth, projected to witness a compound annual growth rate (CAGR) of 25.3% from 2025 to 2033. This robust expansion signifies a fundamental shift in agricultural practices, driven by the imperative to enhance productivity, optimize resource utilization, and address the escalating challenges of labor shortages and climate change. The global market size, estimated to be approximately $8.5 billion in the base year of 2025, is anticipated to reach a staggering $35.2 billion by 2033, underscoring the transformative potential of these intelligent machines. Key trends shaping this landscape include the increasing adoption of AI and machine learning for enhanced decision-making capabilities in robots, enabling them to perform complex tasks with greater precision and autonomy. Furthermore, the miniaturization and cost reduction of sensor technologies are making sophisticated monitoring and data collection more accessible to a wider range of agricultural operations. The demand for specialized robots catering to specific crop types and farming methodologies is also on the rise, moving beyond generalized solutions.

The historical period of 2019-2024 laid the groundwork for this rapid advancement, marked by initial investments, pilot projects, and the gradual integration of early-stage autonomous systems. During this phase, the market witnessed the emergence of crop monitoring robots, leveraging their ability to collect invaluable data on soil health, plant growth, and pest infestations, thereby empowering farmers with actionable insights. Simultaneously, crop harvesting robots began to gain traction, particularly in high-value crops, addressing labor-intensive harvesting processes and reducing post-harvest losses. The estimated year of 2025 marks a critical inflection point, where these technologies are moving from niche applications to broader market penetration. The focus is increasingly shifting towards integrated solutions that combine multiple functionalities, such as autonomous navigation, precision spraying, and targeted harvesting, all within a single platform. The interplay of advanced robotics, artificial intelligence, and data analytics is creating a new paradigm in agriculture, where data-driven decisions and automated processes are becoming the norm. The trend towards sustainable agriculture is also a significant driver, with autonomous robots enabling reduced reliance on chemical inputs through precision application and optimized resource management. This report delves into the intricate dynamics of this evolving market, exploring the drivers, challenges, regional dominance, and the key players shaping its future.

Several potent forces are propelling the agriculture autonomous robot market forward. Foremost among these is the persistent and growing global labor shortage in agriculture. As younger generations are less inclined to pursue agricultural labor and rural populations continue to urbanize, the scarcity of skilled and unskilled farm workers presents a significant hurdle to efficient food production. Autonomous robots offer a viable and increasingly necessary solution to bridge this gap, performing repetitive and physically demanding tasks with unwavering consistency and without the need for constant human supervision. Compounding this is the escalating demand for food driven by a burgeoning global population, which necessitates a substantial increase in agricultural output. Traditional farming methods are often insufficient to meet this demand sustainably, creating a strong impetus for technological innovation that can boost yields and improve efficiency. Furthermore, the imperative for sustainable and environmentally friendly agricultural practices is a major catalyst. Autonomous robots enable precision farming, allowing for the targeted application of water, fertilizers, and pesticides, thereby minimizing waste, reducing environmental impact, and promoting healthier ecosystems. This precision also leads to improved crop quality and reduced operational costs for farmers, making the investment in autonomous technology increasingly attractive.

The pursuit of enhanced operational efficiency and profitability is another critical driver. Autonomous robots can operate 24/7, optimizing planting, monitoring, and harvesting schedules without being constrained by human limitations. This leads to increased productivity, reduced downtime, and a more predictable agricultural output. The ability of these robots to collect vast amounts of granular data on crop health, soil conditions, and environmental factors empowers farmers with unprecedented insights, enabling them to make more informed decisions, optimize resource allocation, and ultimately improve their bottom line. The increasing affordability and sophistication of robotic technology, coupled with advancements in AI and sensor technology, are making these solutions more accessible to a broader spectrum of agricultural enterprises, from large-scale commercial farms to smaller, specialized operations.

Despite the promising trajectory, the agriculture autonomous robot market faces several significant challenges and restraints that temper its immediate widespread adoption. A primary hurdle is the substantial upfront investment required for acquiring and implementing these advanced robotic systems. The cost of autonomous robots, coupled with the necessary infrastructure for charging, maintenance, and data management, can be prohibitive for many small to medium-sized farms, particularly in developing economies. This financial barrier necessitates supportive government policies, subsidies, or innovative financing models to facilitate broader market penetration. Another critical challenge is the current lack of widespread digital infrastructure and connectivity in many rural agricultural regions. Autonomous robots rely heavily on reliable internet access for data transmission, remote monitoring, and software updates. The absence of robust and consistent connectivity can severely limit the functionality and effectiveness of these systems, hindering their deployment and operational efficiency.

The technical expertise required for operating, maintaining, and troubleshooting autonomous robots also presents a significant restraint. Farmers and agricultural workers may lack the necessary skills and training to effectively manage these sophisticated machines. This necessitates comprehensive training programs and accessible technical support services to ensure successful integration and adoption. Furthermore, regulatory frameworks and standardization for autonomous agricultural machinery are still in their nascent stages in many regions. The absence of clear guidelines concerning safety, liability, and operational protocols can create uncertainty for manufacturers and end-users, potentially slowing down market development. Finally, farmer acceptance and trust in autonomous technology remain crucial factors. Overcoming skepticism regarding the reliability, safety, and effectiveness of robots in performing complex agricultural tasks requires robust demonstration projects, transparent performance data, and a focus on building user confidence through education and positive user experiences.

The Crop Harvesting Robots segment is poised to be a dominant force in the agriculture autonomous robot market, driven by its direct impact on labor-intensive and time-sensitive agricultural processes. The need to reduce harvesting costs, minimize crop damage, and address labor shortages, especially in the harvesting of high-value crops like fruits, vegetables, and berries, makes this segment particularly attractive. The application of Harvesting and Picking within this segment will see significant growth, with advancements in robotic manipulation, computer vision for ripeness detection, and delicate handling techniques enabling robots to perform these tasks with increasing accuracy and efficiency.

North America, particularly the United States, is projected to be a leading region in the agriculture autonomous robot market. This dominance is attributed to several factors:

While Crop Harvesting Robots are expected to dominate, Crop Monitoring Robots will also witness substantial growth. Their application in Crop Monitoring is crucial for optimizing irrigation, detecting early signs of disease and pest infestation, and assessing overall crop health. This data-driven approach allows for proactive interventions, reducing crop losses and improving resource allocation. The ability of these robots to cover vast areas efficiently and collect detailed multispectral and hyperspectral imagery provides invaluable insights that are difficult and time-consuming to obtain through manual methods. This segment is expected to see strong adoption in regions with diverse crop types and varied environmental conditions, where real-time, accurate data is paramount for effective farm management. The integration of AI with crop monitoring robots will further enhance their capabilities, enabling predictive analytics for yield forecasting and disease outbreak prediction.

The agriculture autonomous robot industry is experiencing powerful growth catalysts. The ongoing digital transformation in agriculture, coupled with increasing government initiatives promoting smart farming and sustainable practices, provides a fertile ground for innovation. Advancements in AI, machine learning, and sensor technology are continuously enhancing the capabilities and reducing the cost of autonomous systems. Furthermore, the growing consumer demand for ethically produced and sustainably grown food is driving the need for greater efficiency and reduced environmental impact, which autonomous robots can significantly contribute to.

This report provides an exhaustive analysis of the agriculture autonomous robot market, offering a deep dive into its intricate dynamics. It meticulously examines the market size and forecast for the historical period of 2019-2024, the base year of 2025, and the extensive forecast period from 2025-2033. The report details the driving forces, challenges, and growth catalysts that are shaping the industry, alongside an in-depth exploration of regional and segmental dominance. With a comprehensive understanding of the leading players and significant developments, this report serves as an indispensable resource for stakeholders seeking to navigate and capitalize on the transformative potential of autonomous robots in agriculture.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15%.

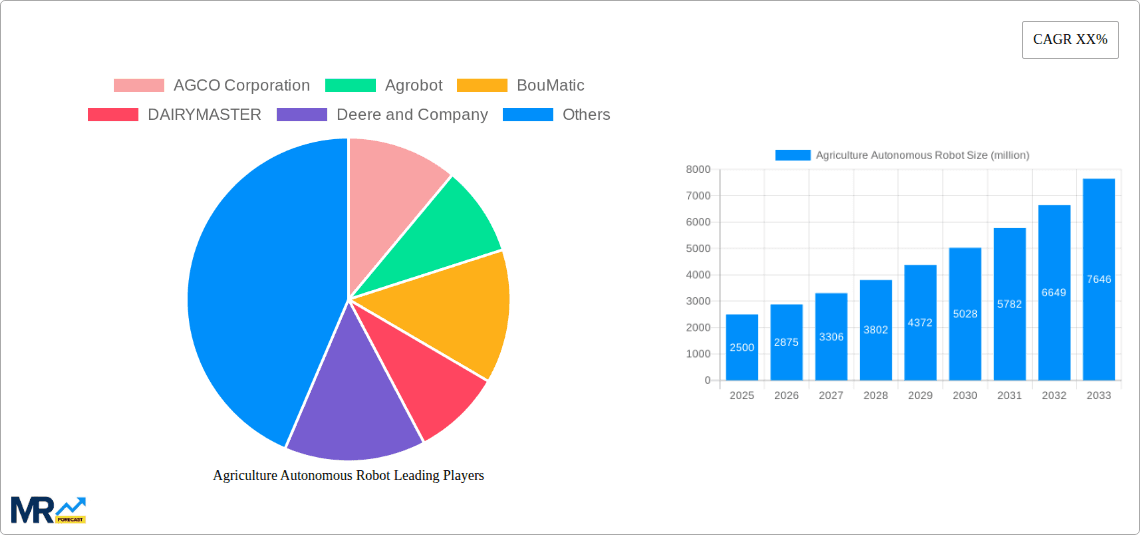

Key companies in the market include AGCO Corporation, Agrobot, BouMatic, DAIRYMASTER, Deere and Company, Ecorobotix SA, GEA Group Aktiengesellschaft, KUBOTA Corporation, Lely, Naio Technologies, Robert Bosch GmbH, Saga Robotics AS, Uniseed, Verdant Robotics.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Agriculture Autonomous Robot," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Agriculture Autonomous Robot, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.