1. What is the projected Compound Annual Growth Rate (CAGR) of the Agricultural Plant Growth LED Lights?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Agricultural Plant Growth LED Lights

Agricultural Plant Growth LED LightsAgricultural Plant Growth LED Lights by Type (Low Power (<300W), High Power (≥300W), World Agricultural Plant Growth LED Lights Production ), by Application (Vegetables Irradiation, Landscaped Plant Irradiation, World Agricultural Plant Growth LED Lights Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

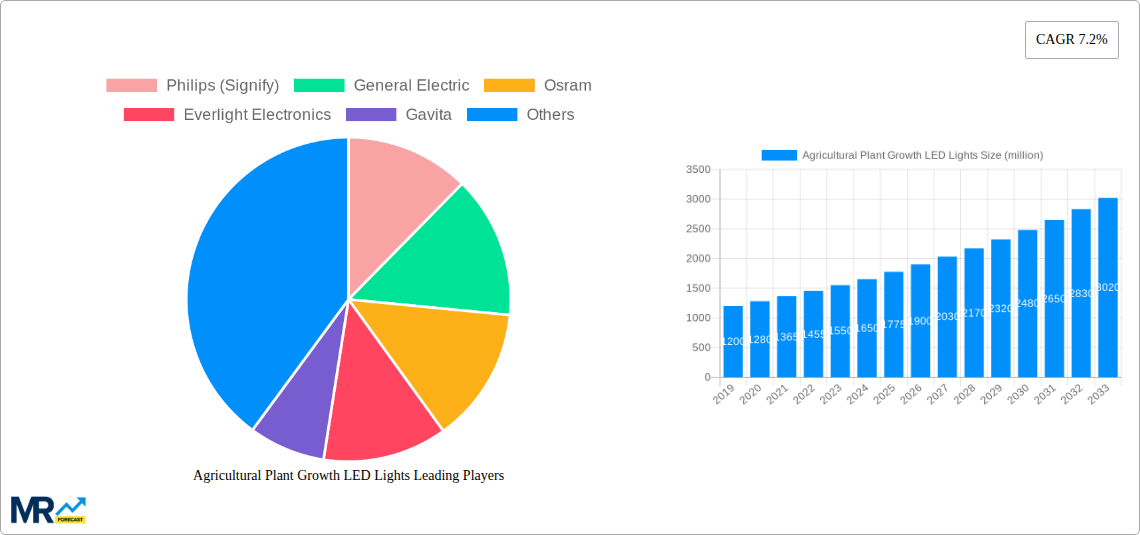

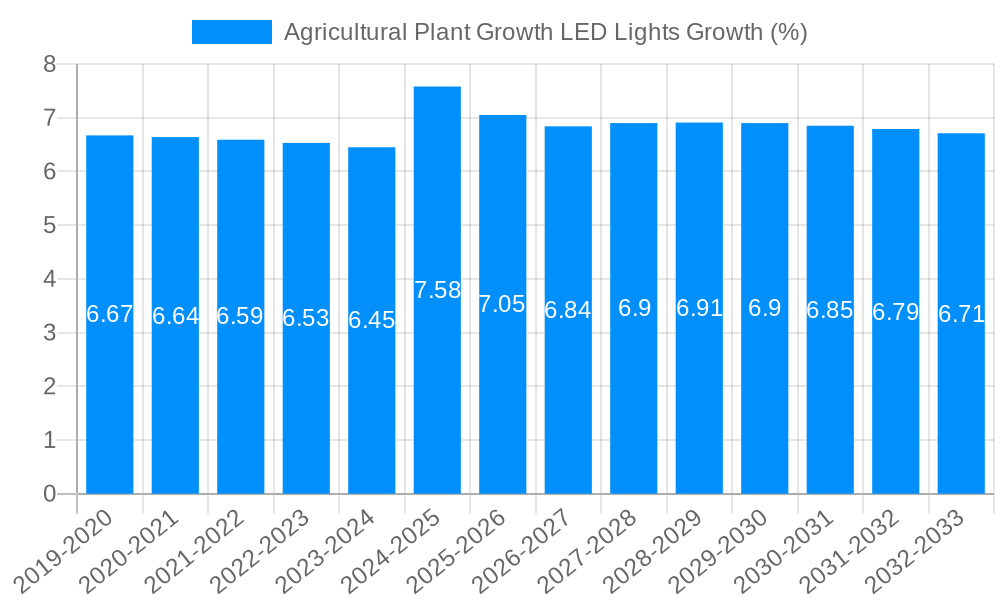

The global agricultural plant growth LED lights market, currently valued at $1596.8 million in 2025, is poised for significant growth. Driven by increasing demand for high-yield, sustainable agriculture and advancements in LED technology offering energy efficiency and precise spectral control, the market is expected to expand considerably over the next decade. Key trends include the rising adoption of vertical farming and controlled environment agriculture (CEA), fostering a preference for energy-efficient and precisely controllable lighting solutions. Furthermore, government initiatives promoting sustainable agricultural practices and technological advancements in LED horticulture lighting, such as advancements in spectral tuning and smart control systems, are further propelling market growth. The market is segmented by power (low power <300W and high power ≥300W) and application (vegetables, landscaping plants). High-power LED systems are gaining traction due to their suitability for large-scale commercial operations, while low-power options cater to smaller-scale operations and home cultivation. Competitive pressures among major players such as Philips (Signify), General Electric, Osram, and others are driving innovation and price reductions, making LED lighting increasingly accessible to a wider range of agricultural producers. While initial investment costs might pose a restraint for some smaller farmers, the long-term benefits in terms of energy savings and improved crop yields are increasingly outweighing this concern.

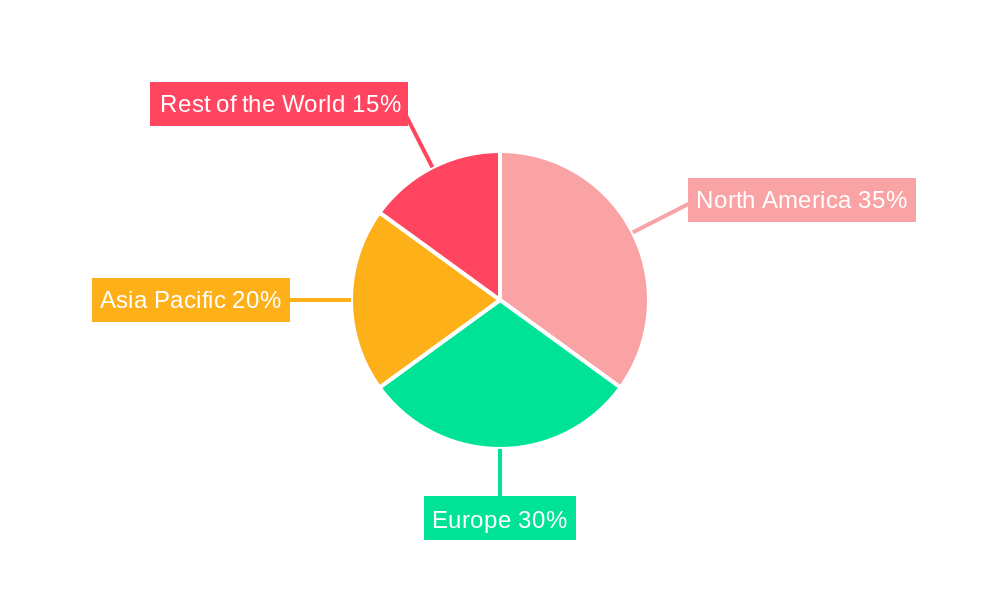

Geographic distribution shows a strong presence across North America and Europe, attributed to early adoption of advanced agricultural technologies and a significant concentration of greenhouse operations. However, rapid growth is expected in the Asia-Pacific region driven by increasing agricultural production needs and government support for sustainable farming practices, particularly in China and India. The market is characterized by continuous innovation, with companies focusing on developing customized spectral outputs to optimize plant growth for specific crops and environmental conditions. This specialization and the ongoing miniaturization of LED components contribute to the overall growth trajectory, paving the way for a more efficient and sustainable future in agriculture. Future projections indicate a sustained period of expansion, driven by technological advancements and increasing global awareness of sustainable agricultural practices.

The global agricultural plant growth LED lights market is experiencing robust growth, projected to reach multi-million unit sales by 2033. Driven by increasing demand for high-yield, year-round crop production and a growing awareness of the energy efficiency and environmental benefits of LED technology, this sector is attracting significant investment. Over the historical period (2019-2024), the market witnessed steady expansion, primarily fueled by advancements in LED technology and a burgeoning controlled environment agriculture (CEA) sector. The estimated year 2025 reveals a market already demonstrating significant maturity, with established players and newer entrants vying for market share. This competitive landscape is fostering innovation, resulting in the development of increasingly sophisticated and efficient LED lighting solutions tailored to specific plant needs. The forecast period (2025-2033) anticipates continued strong growth, propelled by factors such as the rising global population and the subsequent need to enhance food security, increasing adoption of vertical farming and indoor agriculture techniques, and government incentives promoting sustainable agricultural practices. Specific trends include a shift towards higher-power LED systems for larger-scale operations, a growing focus on spectral customization for optimized plant growth, and the integration of smart technologies for remote monitoring and control of lighting systems. The market is also witnessing increasing adoption of sophisticated light recipes for various plant species, leading to improved yields and enhanced quality. Furthermore, the increasing awareness of the environmental impact of traditional lighting methods is driving the transition to energy-efficient LED solutions, contributing to the market's overall expansion. Cost reduction and technological advancements are also making LED lighting more accessible to smaller-scale agricultural operations, further stimulating market growth.

Several key factors are driving the growth of the agricultural plant growth LED lights market. Firstly, the ever-increasing global population necessitates a substantial increase in food production to meet rising demands. Traditional agricultural methods are struggling to keep pace, making innovative solutions like LED lighting crucial for improving crop yields and ensuring food security. Secondly, the rise of controlled environment agriculture (CEA), including vertical farming and indoor agriculture, is creating a significant demand for advanced lighting solutions. LEDs offer precise light spectrum control, allowing for optimized plant growth in these controlled environments. Thirdly, the energy efficiency of LED lights compared to traditional high-pressure sodium (HPS) lamps is a major selling point. LEDs consume significantly less energy, leading to lower operational costs and reduced carbon footprints, making them an attractive option for environmentally conscious growers. Furthermore, advancements in LED technology are continually improving their efficacy, further reducing energy consumption and increasing cost-effectiveness. Government initiatives and subsidies aimed at promoting sustainable agricultural practices and technological advancements are also bolstering market growth. Finally, the ability of LEDs to provide highly customizable light spectra tailored to specific plant types and growth stages is a significant advantage, leading to improved crop quality and yield. This precision light control is impossible to achieve with traditional lighting technologies.

Despite the promising growth trajectory, the agricultural plant growth LED lights market faces certain challenges. The high initial investment cost associated with implementing LED lighting systems can be a significant barrier for smaller-scale farmers and agricultural operations with limited capital. This high upfront cost can outweigh the long-term energy savings, especially for operations with short investment horizons. Furthermore, the complexity of designing and implementing optimal lighting strategies for various plant species requires expertise and technical knowledge, potentially hindering widespread adoption. The market also faces competition from established lighting technologies, such as high-pressure sodium (HPS) lamps, which, despite being less efficient, remain a cost-effective option for some growers. Technological advancements in HPS lamps are also slowing the transition to LED, as they too improve in terms of efficiency, although not at the same rate. In addition, the durability and lifespan of LED lights, while significantly improved compared to traditional lamps, still remain a concern, particularly in harsh agricultural environments. Finally, maintaining the LEDs and the associated technology can require specialized maintenance and technical support, potentially increasing operational costs.

The North American and European regions are currently leading the market due to high technological advancements and significant investments in research and development of LED technologies within the agricultural sector. These regions also boast a strong presence of major LED manufacturers and a growing interest in controlled environment agriculture (CEA). However, the Asia-Pacific region is projected to experience the fastest growth rate due to the large-scale adoption of indoor farming and vertical farming techniques, especially in densely populated areas with limited land availability. China and other Asian countries are increasingly investing in modern agricultural technologies, providing fertile ground for the adoption of LED plant growth lights.

High-Power (≥300W) Segment Dominance: The high-power segment is expected to witness significant growth over the forecast period. Large-scale commercial greenhouses and indoor farms are increasingly adopting high-power systems to optimize light distribution and achieve higher yields in vast cultivation areas. The higher initial cost of these systems is justified by their superior energy efficiency and production capabilities for larger operations. The increased light intensity provided by high-power LEDs also promotes faster plant growth, resulting in shorter crop cycles and greater overall profitability. This segment's growth is directly tied to the expansion of large-scale agricultural operations and the increasing adoption of CEA methodologies. The cost-effectiveness of high-power systems in large-scale applications makes them the preferred choice for maximizing return on investment.

Vegetables Irradiation Application: The vegetables irradiation application segment dominates the market due to the high demand for fresh produce year-round, irrespective of climatic conditions. LED lights allow for precise control of the light spectrum crucial for optimal growth of various vegetables, improving yield, and enhancing nutritional value. The growing popularity of hydroponics and vertical farming systems further fuels the demand for specialized LED lights designed for vegetable cultivation. Consumers are increasingly demanding locally sourced and sustainably grown vegetables, increasing the need for efficient and controlled growing environments powered by LED lighting.

The global market exhibits a strong correlation between the high-power segment and the vegetables irradiation application. Large-scale vegetable production facilities are increasingly investing in high-power LEDs to maximize yields and maintain quality consistently across their operations.

Several factors are significantly catalyzing growth within the agricultural plant growth LED lights industry. Advancements in LED technology continuously improve efficiency, spectral control, and cost-effectiveness. Growing concerns about climate change and food security are pushing adoption of sustainable agricultural practices, with LED lighting playing a crucial role. Increased government support and funding for research and development in agricultural technologies further stimulate innovation and market expansion. Finally, the rise of vertical farming and indoor agriculture creates a high demand for advanced lighting solutions, making the market poised for strong and sustained growth.

This report provides a comprehensive analysis of the agricultural plant growth LED lights market, offering detailed insights into market trends, driving forces, challenges, key players, and future growth prospects. The report covers various segments, including different power levels, applications, and geographical regions, providing a granular understanding of the market dynamics. The detailed analysis offers valuable information for stakeholders involved in the development, manufacturing, and adoption of agricultural plant growth LED lights, allowing them to make informed business decisions and strategically position themselves for success in this rapidly expanding market. The report combines qualitative insights with quantitative data, including market size estimations, growth forecasts, and competitive analysis, forming a crucial resource for effective decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Philips (Signify), General Electric, Osram, Everlight Electronics, Gavita, Hubbell Lighting, Kessil, Cree, Illumitex, Lumigrow, Fionia Lighting, Valoya, Heliospectra AB, Cidly, Ohmax Optoelectronic.

The market segments include Type, Application.

The market size is estimated to be USD 1596.8 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Agricultural Plant Growth LED Lights," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Agricultural Plant Growth LED Lights, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.