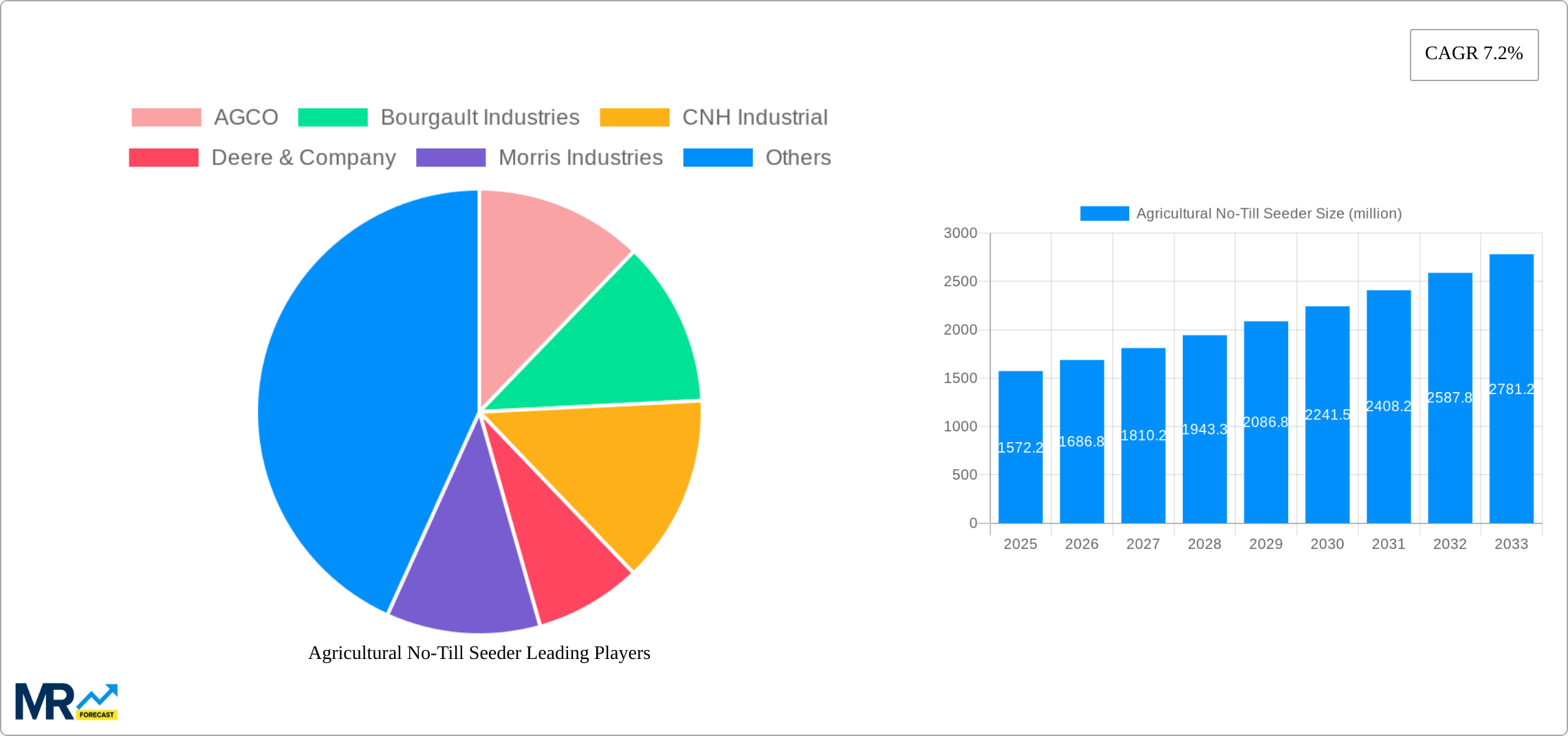

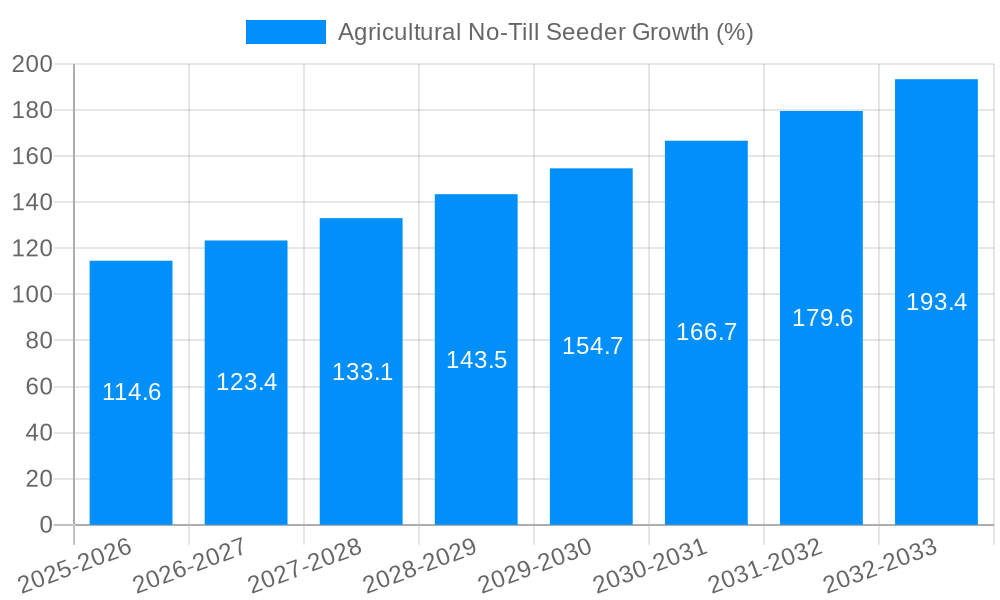

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agricultural No-Till Seeder?

The projected CAGR is approximately 7.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Agricultural No-Till Seeder

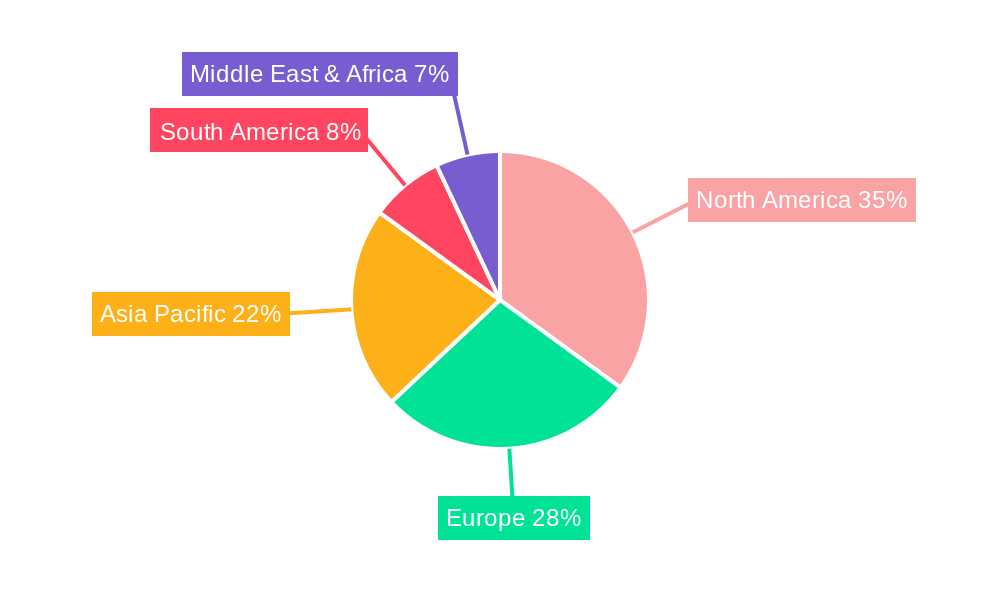

Agricultural No-Till SeederAgricultural No-Till Seeder by Type (Vacuum Seed Spreader, Seed Drill, Hole Seeder), by Application (Personal, Agricultural Business), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global agricultural no-till seeder market is experiencing robust growth, projected to reach $1572.2 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 7.2% from 2025 to 2033. This expansion is driven by several key factors. Increasing awareness of soil health and the environmental benefits of no-till farming practices is a significant driver. No-till seeding minimizes soil erosion, improves water retention, and reduces the need for chemical herbicides, aligning with the growing global focus on sustainable agriculture. Technological advancements in seeder design, including precision seeding technologies and GPS integration for improved accuracy and efficiency, are further fueling market growth. The rising demand for food production to meet a growing global population, coupled with the need for efficient and cost-effective farming practices, is creating a favorable environment for no-till seeder adoption. Growth is particularly strong in regions with large-scale agricultural operations and favorable government policies promoting sustainable farming methods, like parts of North America and Europe. Market segmentation reveals strong demand across both agricultural business and personal applications, with vacuum seed spreaders, seed drills, and hole seeders being the most prevalent types. Competition amongst major players such as AGCO, Deere & Company, and Bourgault Industries is driving innovation and affordability, benefiting farmers worldwide.

The market's future growth will likely be influenced by factors such as fluctuations in commodity prices, government regulations regarding farming practices, and technological advancements in precision agriculture. The continued development of more efficient and precise no-till seeders, coupled with increased awareness of the environmental and economic advantages of this method, will contribute to continued market expansion. However, high initial investment costs for advanced no-till seeding equipment may present a barrier to entry for some smaller farmers. This challenge may be overcome through leasing programs, financial incentives, and the development of more cost-effective technologies. Further research and development will be critical for the creation of even more efficient and sustainable no-till seeders.

The global agricultural no-till seeder market is experiencing robust growth, projected to reach multi-million unit sales by 2033. Driven by increasing awareness of soil health and the environmental benefits of no-till farming, this market segment shows significant promise. The historical period (2019-2024) witnessed a steady rise in adoption, particularly amongst agricultural businesses, as farmers seek to improve efficiency and reduce operational costs. The estimated market value in 2025 serves as a crucial benchmark, highlighting the accelerating adoption rate. This growth is further fueled by technological advancements in seeder design, leading to improved accuracy, efficiency, and adaptability to diverse soil conditions. Vacuum seed spreaders and seed drills are currently dominating the market, owing to their versatility and suitability for various crops and farming scales. However, hole seeders are also gaining traction, especially in specialized applications. The forecast period (2025-2033) anticipates continued expansion, influenced by factors such as government support for sustainable agriculture, rising demand for food production, and growing investment in agricultural technology. Key players in the market are continuously innovating, introducing advanced features such as GPS guidance, precision seeding technology, and improved seed metering systems. This ongoing technological development contributes significantly to the market's expanding potential and reinforces the transition towards more efficient and environmentally responsible farming practices. The study period (2019-2033) offers a comprehensive view of the market's evolution, from its initial growth phase to its projected maturity. The base year, 2025, provides a solid foundation for future projections. This report delves into the specifics of this growth, analyzing market segmentation and identifying key drivers and challenges across different regions and application types. The ongoing shift towards precision agriculture and the increasing emphasis on sustainable farming practices are key catalysts for this dynamic and evolving market.

Several key factors are driving the growth of the agricultural no-till seeder market. Firstly, the rising awareness of the environmental benefits of no-till farming is a major impetus. No-till practices significantly reduce soil erosion, improve water retention, and enhance carbon sequestration, all contributing to a more sustainable agricultural ecosystem. Secondly, the increasing demand for food production globally is pushing farmers to adopt more efficient farming techniques. No-till seeders enhance planting speed and accuracy, leading to improved yields and reduced operational costs. This aligns with the need for increased food output while minimizing environmental impact. Thirdly, advancements in technology are playing a pivotal role. Modern no-till seeders incorporate GPS guidance, variable rate technology, and precision seed placement, significantly increasing planting accuracy and optimizing seed distribution. This technological leap translates to improved yields and reduced seed wastage, making the investment in no-till technology increasingly attractive. Finally, government initiatives and subsidies promoting sustainable agricultural practices are further boosting market growth. Many governments are actively encouraging the adoption of no-till farming through financial incentives and awareness campaigns, adding significant momentum to the market expansion. The combination of environmental benefits, improved efficiency, technological progress, and supportive government policies creates a powerful synergy that is fueling the rapid growth of this sector.

Despite the significant growth potential, several challenges and restraints hinder the widespread adoption of agricultural no-till seeders. High initial investment costs represent a major barrier for many small-scale farmers, particularly in developing countries. The purchase of advanced no-till seeders often requires substantial capital outlay, making them inaccessible to a significant portion of the farming community. Furthermore, the effectiveness of no-till systems can be influenced by soil type and climatic conditions. In regions with specific soil properties or challenging weather patterns, the benefits of no-till farming may be less pronounced, creating a limitation on its applicability. Another challenge is the need for adequate pre-planting weed control. Since no-till farming eliminates traditional tillage methods, effective weed management strategies are critical for successful crop establishment. This often requires precise herbicide application or other weed control techniques, adding to the overall cost and complexity. Finally, a lack of awareness and technical expertise among farmers can also hinder adoption. Proper training and education are crucial for farmers to effectively operate and maintain no-till seeders, ensuring optimal results. Overcoming these challenges requires addressing affordability through financing options, targeted research for diverse soil and climatic conditions, and expanding farmer training and support programs.

The agricultural no-till seeder market is witnessing significant growth across various regions and segments. North America and Europe are currently leading the market, driven by high adoption rates among large-scale agricultural businesses. However, growth is expected to accelerate in emerging economies in Asia and Latin America, as awareness of no-till farming benefits increases and farmer access to technology improves. Among the application segments, Agricultural Businesses represent the dominant force, accounting for a significant portion of the market share. Large-scale farms are particularly attracted to the efficiency and cost-saving advantages of no-till seeding, especially those specializing in row crops. The high-volume, high-efficiency demands of these businesses greatly contribute to the market’s expansion. The Vacuum Seed Spreader segment also shows strong performance due to its versatility and adaptability to diverse cropping systems, making it a favored choice for both small and large agricultural enterprises.

Several factors are catalyzing growth within the agricultural no-till seeder industry. Firstly, the growing awareness of soil health and the associated environmental benefits of no-till farming is a significant driver. This environmental consciousness, coupled with stringent environmental regulations in many countries, is pushing farmers towards more sustainable farming practices. Secondly, technological advancements are continually improving the efficiency and accuracy of no-till seeders. Improved GPS guidance, precision seeding technology, and variable-rate application systems are boosting adoption rates. Thirdly, government incentives and subsidies aimed at promoting sustainable agriculture are fostering market expansion. These policies provide crucial financial support, making no-till technology more accessible to farmers. Finally, the increasing demand for food production globally, combined with the need for sustainable farming practices, creates a strong market demand for efficient and environmentally responsible planting solutions, such as no-till seeders.

This report provides a comprehensive analysis of the agricultural no-till seeder market, encompassing historical data, current market dynamics, and future projections. It offers detailed insights into market trends, key driving forces, challenges, and opportunities. The report further examines market segmentation by type (vacuum seed spreaders, seed drills, hole seeders), application (personal, agricultural business), and geographic regions. It also profiles leading industry players, highlighting their strategies, innovations, and market share. This detailed analysis enables stakeholders to make informed decisions regarding investments, strategic planning, and market penetration strategies within this dynamic and rapidly expanding sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.2% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.2%.

Key companies in the market include AGCO, Bourgault Industries, CNH Industrial, Deere & Company, Morris Industries, Seed Hawk, Amity Technology, Clean Seed Capital Group, Gandy Company, Great Plains Manufacturing, HFL Fabricating, HORSCH Maschinen, Salford Group.

The market segments include Type, Application.

The market size is estimated to be USD 1572.2 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Agricultural No-Till Seeder," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Agricultural No-Till Seeder, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.