1. What is the projected Compound Annual Growth Rate (CAGR) of the Agricultural Chelates?

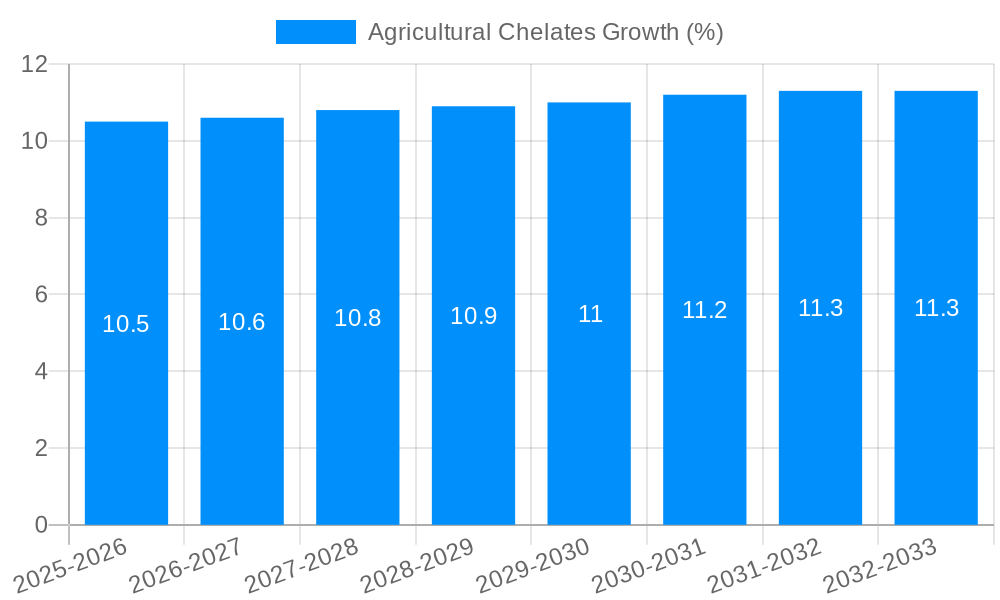

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Agricultural Chelates

Agricultural ChelatesAgricultural Chelates by Type (EDTA, EDDHA, DTPA, IDHA, Others, World Agricultural Chelates Production ), by Application (Soil Application, Seed Dressing, Foliar Sprays, Fertigation, Others, World Agricultural Chelates Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

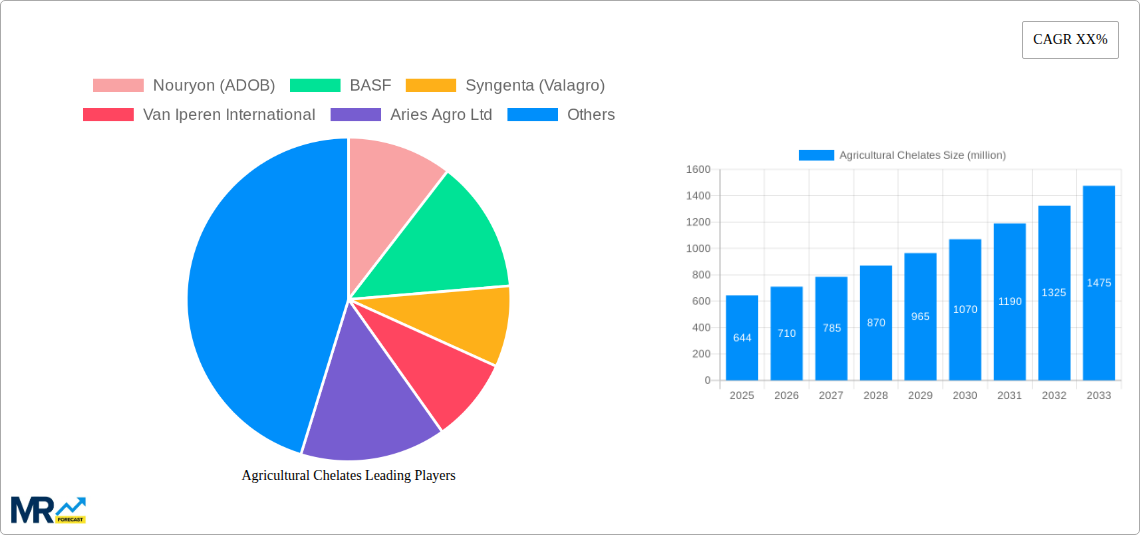

The global agricultural chelates market is poised for significant growth, projected to reach a substantial market size of approximately $644 million by 2025. This expansion is driven by the increasing global demand for enhanced crop yields and improved nutrient uptake efficiency in agriculture. As arable land becomes scarcer and the need to feed a growing world population intensifies, farmers are increasingly turning to advanced solutions like chelates to optimize fertilizer performance. These compounds effectively prevent micronutrients from becoming immobile in the soil, ensuring that crops receive essential elements like iron, zinc, manganese, and copper, which are vital for healthy growth and productivity. The rising adoption of modern farming techniques, including precision agriculture and fertigation, further bolsters market expansion, as chelates are integral to these nutrient delivery systems.

The market is characterized by a dynamic landscape with various segments catering to diverse agricultural needs. In terms of type, EDTA, EDDHA, and DTPA are leading chelating agents, each offering specific benefits for different soil conditions and crop requirements. The application segment is dominated by soil application and fertigation, reflecting the widespread use of chelates to address soil deficiencies and deliver nutrients directly to the root zone. Foliar sprays and seed dressing also represent important application areas, providing rapid nutrient correction and improved seedling establishment, respectively. Key players like Nouryon (ADOB), BASF, and Syngenta (Valagro) are actively investing in research and development, introducing innovative chelated micronutrient formulations and expanding their global presence to meet the evolving demands of the agricultural sector. The market is expected to witness robust growth driven by these technological advancements and strategic collaborations.

Here is a unique report description on Agricultural Chelates, incorporating your specified elements:

The global agricultural chelate market is poised for significant expansion, projected to reach an estimated USD 3,200 million by the year 2025. This robust growth is underpinned by a confluence of factors, including the escalating demand for enhanced crop yields and improved nutrient uptake in the face of a growing global population and diminishing arable land. The study period, spanning from 2019 to 2033, with a focus on the base and estimated year of 2025 and a forecast period from 2025 to 2033, highlights a dynamic market landscape. During the historical period (2019-2024), the market has witnessed steady progress, laying the groundwork for accelerated advancements. Key market insights reveal a pronounced shift towards precision agriculture and sustainable farming practices, where chelates play a pivotal role in optimizing nutrient delivery and minimizing environmental impact. The versatility of chelates in addressing micronutrient deficiencies across a wide spectrum of crops, from cereals and fruits to vegetables and ornamental plants, further fuels their adoption. Furthermore, increasing awareness among farmers regarding the efficacy of chelates in boosting plant health, disease resistance, and overall produce quality is a significant driver. Innovations in chelate formulation and delivery mechanisms are also contributing to market dynamism, offering more efficient and targeted solutions. The market is characterized by a healthy competitive environment, with established players and emerging innovators constantly introducing advanced products to cater to evolving agricultural needs. The production of agricultural chelates is expected to exceed USD 4,500 million by 2033, indicating sustained investor confidence and market optimism. This trajectory underscores the critical importance of agricultural chelates in modern farming systems and their integral role in ensuring global food security.

The agricultural chelates market is experiencing a powerful surge driven by several interconnected forces. Foremost among these is the unrelenting pressure to enhance food production to feed a burgeoning global population, estimated to reach over 9 billion by 2050. This necessitates maximizing yields from existing agricultural land, a feat often hampered by micronutrient deficiencies in soils. Chelates provide a highly effective solution by keeping essential micronutrients like iron, zinc, manganese, and copper soluble and available for plant uptake, even in challenging soil conditions such as high pH or saline environments. Another significant propellant is the global paradigm shift towards sustainable agriculture and eco-friendly farming practices. As environmental regulations tighten and consumer demand for responsibly produced food grows, farmers are actively seeking solutions that improve nutrient use efficiency and reduce the environmental footprint of their operations. Chelates excel in this regard by preventing micronutrient leaching and volatilization, thus minimizing nutrient loss into waterways and the atmosphere. Moreover, the increasing adoption of advanced agricultural technologies, including precision farming, fertigation, and controlled-environment agriculture, further fuels the demand for chelates. These technologies rely on precise nutrient delivery, and chelates are indispensable for ensuring the availability and efficacy of micronutrients within these sophisticated systems. The growing awareness of the direct correlation between adequate micronutrient supply and crop quality, resilience to stress, and overall plant health is also a crucial driver, compelling farmers to invest in chelated micronutrients.

Despite the promising growth trajectory, the agricultural chelates market encounters several challenges and restraints that can impede its full potential. One of the primary hurdles is the higher initial cost associated with chelated micronutrients compared to their inorganic counterparts. While the long-term benefits in terms of improved crop performance and nutrient use efficiency are evident, the upfront investment can be a significant deterrent for smallholder farmers or those operating with tight margins, especially in developing economies. Furthermore, the awareness and understanding of chelate technology among a segment of the farming community remain limited. Effective adoption hinges on educating farmers about the benefits, proper application methods, and the specific chelates best suited for their soil types and crop requirements. Without adequate knowledge transfer, the market's penetration can be constrained. Another restraint lies in the availability and accessibility of specific chelated products in certain geographical regions. While major players have a global presence, localized distribution networks and product availability can be a bottleneck in remote or less developed agricultural areas. The regulatory landscape concerning agricultural inputs, including chelates, can also pose challenges. Varying registration processes and stringent approval requirements in different countries can slow down market entry and product launches. Lastly, the potential for over-application and improper handling of chelates, if not managed correctly, could lead to unforeseen environmental or plant health issues, necessitating careful guidance and product stewardship from manufacturers.

The global agricultural chelates market is characterized by a dynamic interplay between regions and segments, with certain areas and product types poised to dominate. Among the segments, EDTA (Ethylenediaminetetraacetic acid) is anticipated to continue its reign as a leading type of agricultural chelate. This dominance stems from its well-established efficacy, cost-effectiveness for certain micronutrients like iron, and broad applicability across various soil types and crops. The production volume for EDTA-based chelates is expected to remain substantial throughout the forecast period, contributing significantly to the overall market value, potentially reaching over USD 1,800 million by 2025.

In terms of applications, Fertigation is emerging as a dominant application method. This technique, which involves the application of fertilizers, including chelates, through irrigation systems, offers unparalleled precision and efficiency in nutrient delivery. As water scarcity becomes a more pressing concern globally and water-use efficiency is paramount, fertigation allows for targeted nutrient application directly to the root zone, minimizing waste and maximizing absorption. The market share of fertigation is expected to grow substantially, driven by advancements in irrigation technology and the inherent benefits of delivering soluble nutrients in a controlled manner. Projections indicate the fertigation segment could account for a significant portion of the USD 3,200 million market in 2025.

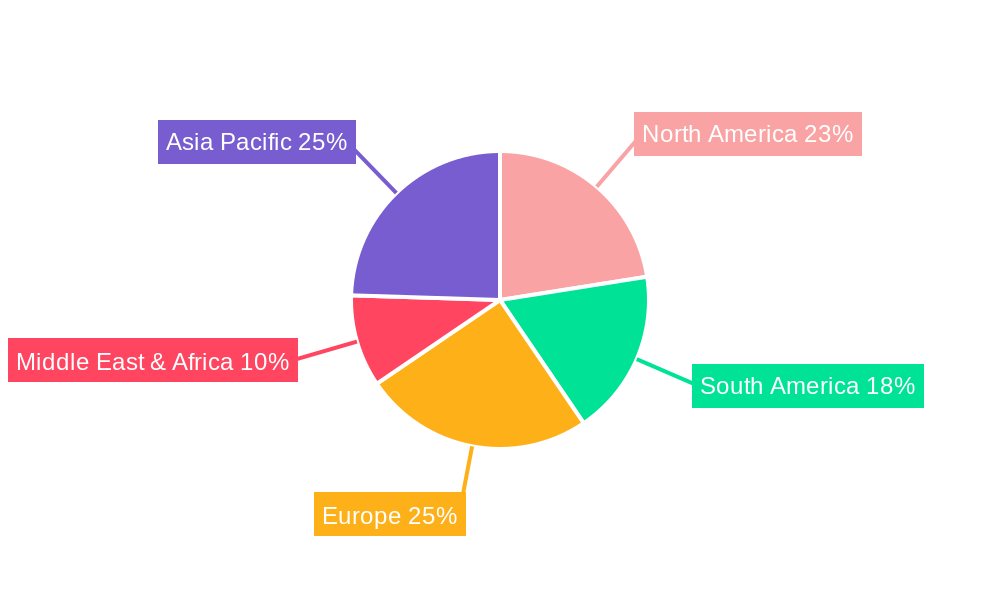

Geographically, Asia-Pacific is set to dominate the agricultural chelates market. This dominance is fueled by several compelling factors:

While Asia-Pacific leads, North America and Europe are also significant markets, driven by a mature agricultural sector, stringent environmental regulations promoting nutrient use efficiency, and a strong emphasis on high-value crop production. However, the sheer scale of agricultural activity and the urgent need to boost food production in Asia-Pacific positions it as the undeniable dominator in terms of production volume and market value for agricultural chelates, projected to contribute over USD 1,000 million in 2025 alone.

Several key factors are acting as powerful growth catalysts for the agricultural chelates industry. The increasing global demand for food, driven by a rising population, is a primary catalyst, pushing farmers to optimize yields and overcome nutrient limitations. Furthermore, the growing emphasis on sustainable agriculture and environmental stewardship encourages the adoption of chelates, which enhance nutrient use efficiency and minimize environmental pollution. Advancements in agricultural technologies, such as precision farming and fertigation, also act as catalysts by creating a need for highly bioavailable and efficiently delivered micronutrients. Finally, increasing farmer awareness regarding the direct impact of micronutrient deficiencies on crop health and quality is propelling the demand for effective chelated solutions.

This comprehensive report on Agricultural Chelates provides an in-depth analysis of market trends, drivers, challenges, and opportunities from 2019 to 2033, with a focused estimation for 2025. It meticulously examines key segments, including chelate types like EDTA and EDDHA, and applications such as fertigation and foliar sprays, offering detailed insights into their market share and growth projections. The report further delves into the competitive landscape, highlighting the strategies and developments of leading global players like BASF, Syngenta (Valagro), and Nouryon. Special attention is given to regional market dynamics, with a particular emphasis on the anticipated dominance of the Asia-Pacific region due to its vast agricultural sector and increasing demand for enhanced crop yields. The report also forecasts the global agricultural chelates production to exceed USD 4,500 million by 2033, indicating a robust and expanding market driven by the imperative for sustainable and efficient food production.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Nouryon (ADOB), BASF, Syngenta (Valagro), Van Iperen International, Aries Agro Ltd, Deretil Agronutritional, LidoChem, Inc., Protex International, BMS Micro-Nutrients, CHS Inc, Wilbur-Ellis company, Nufarm, Rovensa Next (Tradecorp), Liaoning Jinda, Shandong King Runzi, Sichuan Ruilong Chelate Fertilizer Technology.

The market segments include Type, Application.

The market size is estimated to be USD 644 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Agricultural Chelates," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Agricultural Chelates, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.