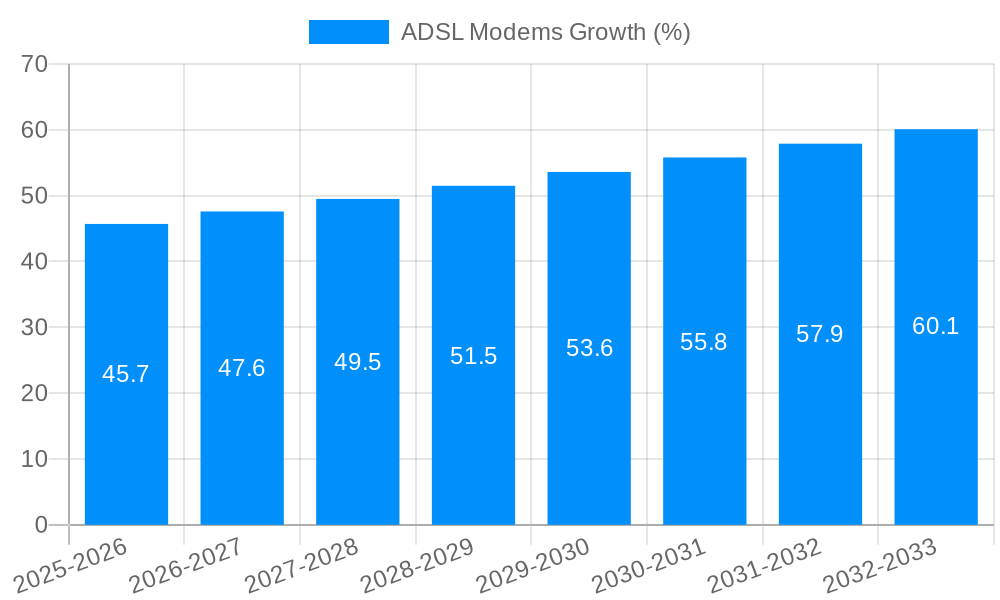

1. What is the projected Compound Annual Growth Rate (CAGR) of the ADSL Modems?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

ADSL Modems

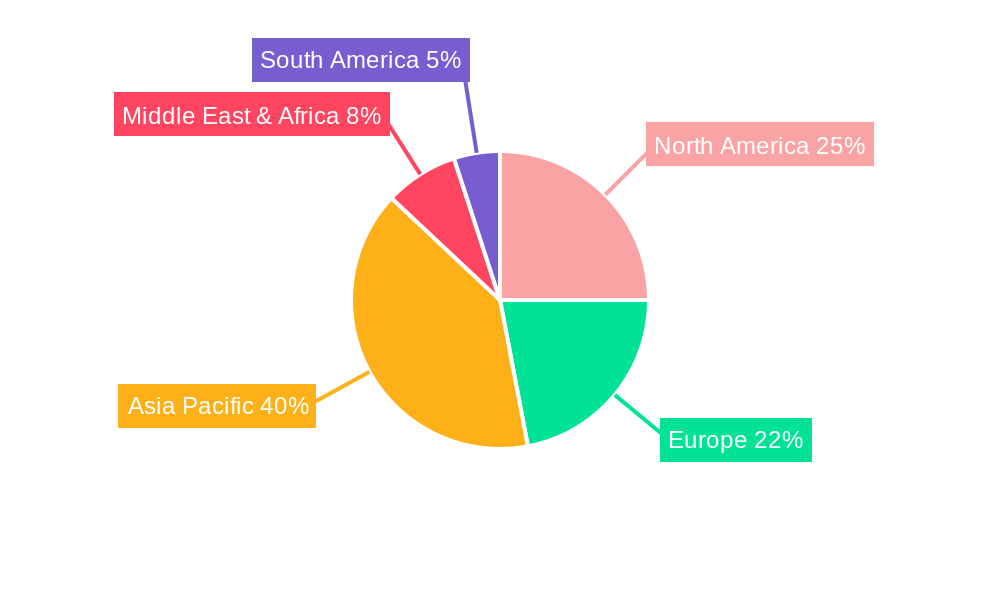

ADSL ModemsADSL Modems by Type (External Modems, Built-in Modems, Others, World ADSL Modems Production ), by Application (Home use, Commerical use, World ADSL Modems Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

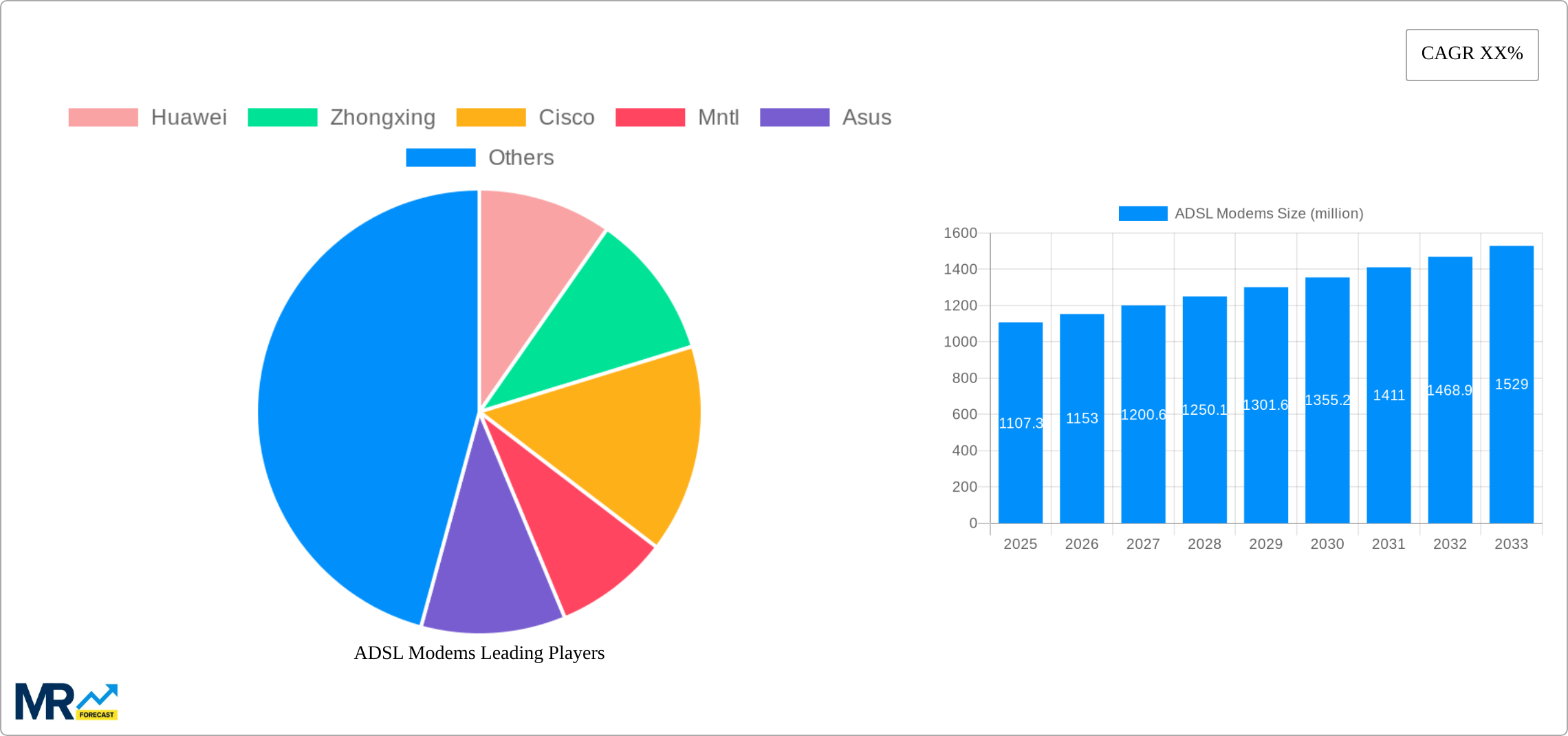

The global ADSL modem market, valued at $1107.3 million in 2025, is poised for steady growth driven by increasing broadband penetration, particularly in developing economies. While the adoption of faster technologies like fiber optics and cable is undeniable, a significant portion of the market, especially in areas with limited infrastructure investment, continues to rely on ADSL technology. This sustained demand, coupled with ongoing improvements in ADSL modem technology such as enhanced performance and improved compatibility, ensures continued market relevance. The market segmentation reveals a strong preference for external modems, owing to their flexibility and upgradeability. However, built-in modems, especially in budget-friendly devices, are anticipated to experience moderate growth. Home use remains the dominant application segment, with commercial use contributing a smaller, albeit steady, share. Geographic analysis suggests robust growth in Asia-Pacific, fueled by expanding internet connectivity in rapidly developing countries like India and China. North America and Europe, while already exhibiting relatively high penetration, will contribute significantly to overall market value due to continued upgrades and replacement cycles. Competition among established players like Huawei, ZTE, Cisco, and others, drives innovation and price competitiveness, benefiting end-users. However, increasing competition from alternative broadband technologies represents a key restraint on market expansion.

The forecast period (2025-2033) predicts a moderate growth trajectory for the ADSL modem market. While the CAGR is not explicitly provided, a reasonable estimate, considering the factors mentioned above, would place it within the range of 3-5%. This conservative estimate reflects the gradual shift towards faster broadband technologies while acknowledging the enduring presence of ADSL in underserved regions and the continued demand for reliable, cost-effective internet access. Further segmentation analysis, beyond the provided categories, could provide a more granular understanding of market dynamics, such as focusing on specific price segments or exploring niche applications within the commercial sector. Strategic investments in improving energy efficiency and incorporating advanced security features in ADSL modems are anticipated to gain traction in the coming years.

The global ADSL modem market, while facing a decline in overall unit shipments due to the rise of faster broadband technologies like fiber and cable, still retains a significant presence, particularly in underserved regions and areas with limited infrastructure upgrades. Between 2019 and 2024, the market witnessed a gradual reduction in production, with an estimated total of several hundred million units manufactured. However, the persistent demand in specific geographical locations and for certain applications continues to sustain a niche market for ADSL modems. This report analyzes the market dynamics from 2019 to 2033, focusing on production volumes, key players (including Huawei, ZTE, Cisco, Mntl, Asus, and Tenda), and the evolving landscape shaped by technological advancements and consumer preferences. The study highlights the regional variations in ADSL modem adoption, with some areas exhibiting sustained demand while others experience rapid decline. The forecast period (2025-2033) projects a continued, albeit slow, decrease in overall production volumes, primarily due to the ongoing transition to higher-speed internet technologies. Despite this downward trend, the market remains relevant due to its cost-effectiveness and availability in regions lacking access to advanced broadband solutions. The report segments the market by type (external, built-in, others), application (home, commercial), and geographical region to provide a comprehensive understanding of the market's structure and future trajectory. Key insights from the data reveal that external modems maintain a higher market share, primarily driven by their versatility and compatibility with diverse hardware setups. The commercial sector, though smaller compared to home usage, retains a notable presence due to the cost-effectiveness of ADSL in certain business applications. The report also identifies emerging trends, such as the integration of ADSL capabilities into other networking devices, as a factor influencing the market’s future evolution.

Several factors continue to sustain the ADSL modem market, albeit within a shrinking overall volume. Firstly, the cost-effectiveness of ADSL remains a crucial driver, particularly in developing economies and rural areas with limited access to high-speed broadband infrastructure. ADSL technology provides a viable and affordable internet solution compared to fiber or cable installations, which often require substantial infrastructure investment. Secondly, the existing infrastructure of ADSL networks in many regions still supports a considerable user base. Upgrading this infrastructure to newer technologies might be economically unfeasible or impractical in certain locations, thus sustaining the need for ADSL modems. Thirdly, some specific applications still heavily rely on the stability and relatively low latency of ADSL connections. Industries with critical data transmission needs, where high bandwidth isn't always the primary requirement, may choose ADSL as a dependable option. Lastly, the continued production and availability of ADSL modems by major manufacturers demonstrate the persistence of this market segment, albeit its steadily decreasing size. This sustained supply chain assures that replacement parts and devices will be available in the foreseeable future. These factors together contribute to the continued, albeit diminished, role of ADSL modems within the global broadband landscape.

The primary challenge facing the ADSL modem market is the relentless expansion of faster broadband technologies like fiber optics and cable internet. These alternatives offer significantly higher speeds and bandwidth, making them increasingly attractive to consumers and businesses. The gradual phasing out of ADSL networks by many internet service providers (ISPs) further contributes to this market decline. Competition from integrated devices, where ADSL capabilities are embedded within routers or other networking hardware, also poses a threat to standalone ADSL modems. This integration offers cost savings and streamlined functionality for consumers. Furthermore, the increasing demand for higher-bandwidth applications such as streaming video and online gaming, which are poorly served by ADSL speeds, continuously shifts consumer preference toward faster broadband options. Lastly, technological advancements in other broadband technologies continue to make ADSL progressively less competitive, leading to a reduction in its overall market share and production volumes. The challenges are compounded by the fact that the cost advantages of ADSL diminish as faster technologies become more widely available and affordable.

While the overall ADSL modem market is contracting, certain regions and segments exhibit more resilience than others.

Key Segments:

External Modems: This segment continues to hold a dominant position. The flexibility offered by external modems, allowing for easier upgrades and compatibility with various setups, outweighs the convenience of built-in models. The market for external modems will likely contract, but at a slower rate than the built-in segment. Millions of units are still manufactured and sold annually.

Home Use: Although commercial applications exist, the vast majority of ADSL modems are still used in residential settings. This segment's dominance stems from the cost-effectiveness of ADSL for home internet access, especially in areas lacking faster alternatives. This is likely to remain the primary application for the foreseeable future, though demand will gradually decrease.

Key Regions:

Developing Economies: Countries with less developed broadband infrastructure witness relatively higher demand for ADSL modems due to cost-effectiveness and existing network availability. While the total units sold may be smaller than in developed nations historically, the percentage decline is often slower due to ongoing infrastructure development. Millions of units are deployed annually in these regions.

Rural Areas: In developed countries, rural areas often lag in broadband infrastructure upgrades. This creates pockets of continued demand for ADSL, ensuring a segment of the market persists.

In summary, while the overall market shrinks, external modems used for home internet access in developing economies and rural areas will likely remain the most resilient segments. The continued sales of millions of units annually indicates the prolonged lifespan of this technology in specific niches. The transition to faster broadband technologies, however, will remain a powerful force pushing ADSL toward a smaller, albeit persistent, niche market.

Despite the overall decline, certain factors could potentially stimulate limited growth in specific niches. The focus on bridging the digital divide in developing nations could spur demand for affordable ADSL solutions in underserved areas where faster technologies aren't readily accessible. Also, specialized applications requiring robust and stable connections but not necessarily high bandwidth could maintain a market for ADSL. Finally, ongoing support and availability of parts for existing ADSL infrastructure ensure a certain level of demand for replacement units for many years to come. These factors, however, are unlikely to reverse the overall downward trend in the market.

This report offers a comprehensive overview of the ADSL modem market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). The detailed analysis considers various segments, key players, regional variations, and technological advancements influencing the market's trajectory. The report provides valuable insights for businesses operating within the telecom industry, helping them understand the evolving landscape and make informed strategic decisions. The data-driven analysis and market projections provide a strong foundation for stakeholders to assess future opportunities and challenges within the shrinking yet persistent ADSL modem market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Huawei, Zhongxing, Cisco, Mntl, Asus, Tenda.

The market segments include Type, Application.

The market size is estimated to be USD 1107.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "ADSL Modems," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the ADSL Modems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.