1. What is the projected Compound Annual Growth Rate (CAGR) of the Activewear?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Activewear

ActivewearActivewear by Type (Polyester, Nylon, Neoprene, Polypropylene, Spandex, Cotton, Others, World Activewear Production ), by Application (Man, Woman, Child, World Activewear Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

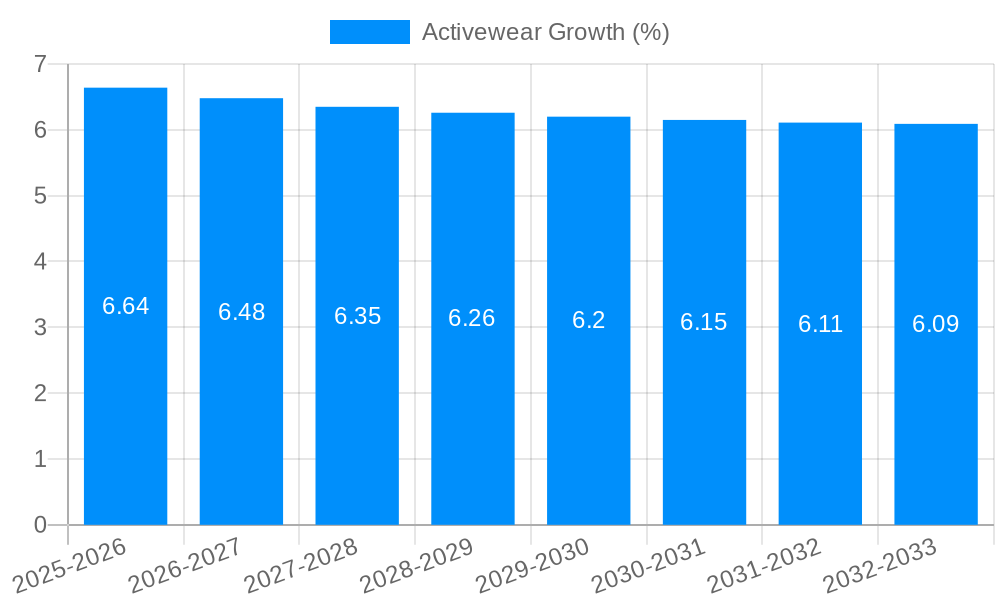

The global activewear market is poised for significant expansion, projected to reach approximately USD 45,007 million by 2025. This robust growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of around 6.5% over the forecast period of 2025-2033, indicating a dynamic and expanding industry. Key drivers fueling this surge include the increasing global adoption of healthy lifestyles, a growing emphasis on fitness and wellness, and the rising popularity of athleisure as everyday wear. Furthermore, innovations in fabric technology, such as moisture-wicking, breathable, and sustainable materials, are enhancing product appeal and performance, directly contributing to market demand. The market is segmented by material type, with Polyester and Nylon leading the way due to their durability, comfort, and widespread application in athletic apparel. Other significant segments include Neoprene, Polypropylene, Spandex, and Cotton, each catering to specific performance needs and consumer preferences.

The activewear market is experiencing a strong upward trajectory driven by evolving consumer behavior and technological advancements. The increasing participation in sports and fitness activities globally, coupled with a growing awareness of the health benefits of an active lifestyle, are paramount drivers. Simultaneously, the "athleisure" trend, which blurs the lines between athletic and casual wear, continues to gain momentum, expanding the consumer base beyond traditional athletes to include everyday wearers seeking comfort and style. Emerging trends such as the demand for sustainable and eco-friendly activewear, driven by heightened environmental consciousness, are shaping product development and consumer choices. While market growth is substantial, potential restraints include intense competition among established players and emerging brands, fluctuating raw material costs, and the economic sensitivity of discretionary spending. The market is further categorized by application across Men, Women, and Children, with each segment exhibiting unique growth patterns influenced by evolving fashion trends and demographic shifts in various regions like Asia Pacific and North America, which are anticipated to be significant growth hubs.

This comprehensive report offers an in-depth analysis of the global activewear market, delving into production volumes, segment-specific trends, and future projections. Spanning a Study Period from 2019 to 2033, with a Base Year of 2025 and a Forecast Period of 2025-2033, the report provides crucial insights into the market's dynamics. It examines the Historical Period from 2019-2024, highlighting past performance and laying the groundwork for future estimations. The report quantifies the market in millions of units, offering a concrete understanding of production scales and consumption patterns.

The activewear market is experiencing a profound transformation, driven by a convergence of lifestyle shifts, technological advancements, and a growing emphasis on personal well-being. XXX The most significant trend is the continued blurring of lines between athletic apparel and everyday fashion, a phenomenon often termed "athleisure." Consumers are increasingly seeking versatile clothing that seamlessly transitions from workout sessions to social engagements and casual outings. This demand has fueled the growth of performance-oriented yet stylish activewear, characterized by innovative fabrics, ergonomic designs, and a wider range of aesthetic options beyond traditional athletic colors and cuts. Sustainability has also emerged as a dominant force. Brands are under immense pressure from consumers and regulators to adopt eco-friendly practices, leading to a surge in the use of recycled materials like recycled polyester and nylon, organic cotton, and bio-based alternatives. Furthermore, the integration of smart technologies within activewear, such as biometric sensors embedded in fabrics to track fitness data or temperature-regulating materials, is gaining traction, catering to the tech-savvy consumer. The rise of virtual fitness and home workouts during the recent historical period has further accelerated the adoption of comfortable and functional activewear for at-home activities. This trend is expected to persist, albeit with a resurgence in outdoor and gym-based activities. The inclusivity movement is also making significant inroads, with brands offering a broader spectrum of sizes, styles catering to diverse body types, and designs that accommodate various athletic pursuits, from yoga and running to extreme sports. The focus is shifting from purely performance enhancement to providing comfort, style, and functionality for a broader demographic, reflecting a more holistic approach to an active lifestyle. The market is witnessing a premiumization of activewear, where consumers are willing to invest in high-quality, durable, and technologically advanced pieces that offer long-term value and performance benefits. This extends to the aesthetic appeal, with activewear becoming a statement piece that reflects personal style and brand affinity.

The global activewear market's impressive growth trajectory is being propelled by a potent combination of socio-cultural and economic factors. The escalating global health and wellness consciousness is arguably the primary engine. More individuals are actively participating in fitness activities, from traditional gym workouts and running to emerging trends like yoga, Pilates, and high-intensity interval training. This heightened participation directly translates into a greater demand for specialized and comfortable apparel designed to enhance performance and provide unrestricted movement. Furthermore, the "athleisure" phenomenon continues to exert a strong influence, as consumers increasingly embrace activewear as a fashionable and functional choice for everyday wear. This crossover appeal has significantly expanded the market's reach beyond dedicated athletes to a broader consumer base seeking comfort and style. The rapid advancements in textile technology are also playing a crucial role. Manufacturers are consistently developing innovative fabrics that offer enhanced moisture-wicking properties, breathability, temperature regulation, and durability. These technological breakthroughs not only improve the wearer's experience during physical activity but also contribute to the perceived value and desirability of activewear products. The growing disposable income in many developing economies is also contributing to the market's expansion, as consumers have more discretionary spending power to invest in lifestyle-oriented apparel. The influence of social media and fitness influencers further amplifies demand, showcasing aspirational lifestyles and promoting specific activewear brands and trends to a vast audience.

Despite its robust growth, the activewear market is not without its hurdles and limitations. Intense competition is a significant challenge. The market is populated by numerous global giants, established sportswear brands, fast-fashion retailers venturing into the segment, and a growing number of niche direct-to-consumer (DTC) brands. This saturation can lead to price wars and a constant need for brands to innovate and differentiate themselves to capture market share. The fluctuating costs of raw materials, particularly synthetic fibers derived from petrochemicals, can impact production costs and ultimately influence pricing strategies. Geopolitical instability and global supply chain disruptions, as witnessed in recent years, can also lead to production delays and increased logistics expenses, affecting the availability and affordability of activewear. Furthermore, the increasing demand for sustainable and ethically produced activewear presents a complex challenge. While it is a significant growth driver, implementing truly sustainable practices across the entire supply chain, from sourcing raw materials to manufacturing and packaging, can be costly and technically challenging. Brands face scrutiny regarding greenwashing, requiring transparent and verifiable sustainability claims to maintain consumer trust. The rapid pace of fashion trends, even within activewear, can also pose a challenge, leading to potential obsolescence of designs and increased inventory management complexity. Adapting to ever-changing consumer preferences and seasonal demands while maintaining efficient production cycles requires agile and responsive strategies. Lastly, counterfeiting remains a persistent issue, particularly for high-demand brands, leading to reputational damage and lost revenue.

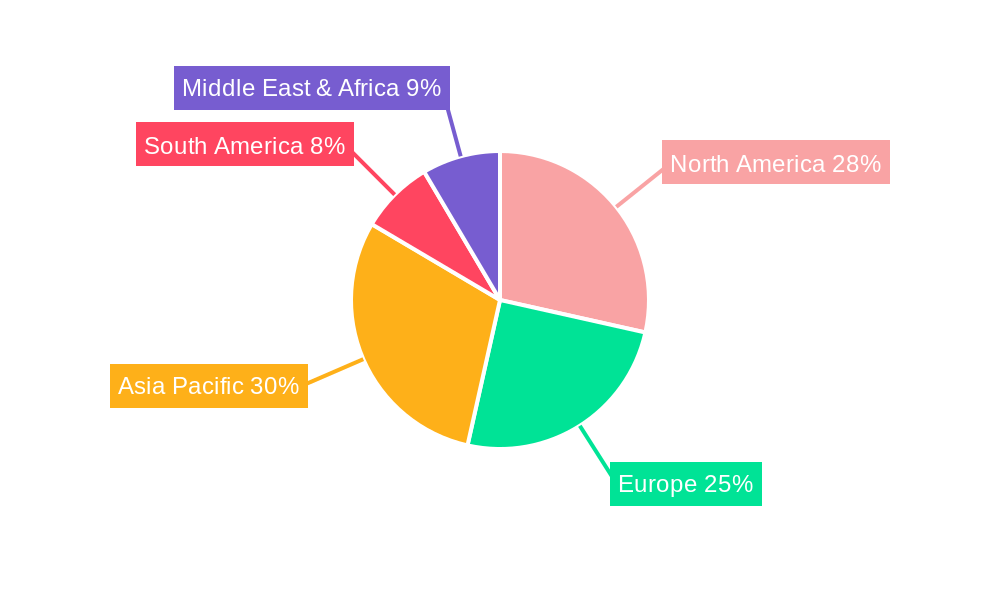

The global activewear market is characterized by a dynamic interplay of dominant regions and thriving segments, each contributing significantly to its overall growth. The North America region is a powerhouse, consistently exhibiting strong consumer spending and a deeply ingrained culture of fitness and athleisure. The United States, in particular, represents a substantial portion of the global demand due to its high disposable incomes, widespread adoption of fitness trends, and a mature retail infrastructure. The prevalence of various sports and recreational activities, coupled with a strong emphasis on health and wellness, makes it a perpetually fertile ground for activewear.

However, Asia Pacific is rapidly emerging as a key growth driver, fueled by a burgeoning middle class, increasing urbanization, and a growing awareness of health and fitness among its vast population. Countries like China and India are witnessing a significant surge in activewear consumption as more individuals embrace active lifestyles and seek performance-oriented apparel. The growing popularity of fitness apps and online retail platforms further facilitates access to activewear in this region.

When examining segment dominance, Polyester stands out as a cornerstone material in activewear production. Its excellent moisture-wicking properties, durability, and affordability make it an indispensable component for a wide range of activewear, from running shorts and sports bras to training tops and leggings. The ability of polyester to be engineered with specific performance characteristics, such as breathability and stretch, further cements its position.

Nylon is another critical segment, particularly prized for its strength, elasticity, and smooth texture. It is frequently utilized in higher-performance activewear, including compression wear, swimwear, and outerwear, where its resilience and ability to retain shape are paramount. The demand for nylon in activewear is expected to continue its upward trajectory due to its superior tactile feel and performance attributes.

The Application segment of Woman activewear is a dominant force and is projected to continue its leading position. This is driven by a combination of factors, including the increasing participation of women in sports and fitness activities, the strong influence of social media and fashion trends, and a growing demand for stylish and functional activewear that can transition from workouts to everyday life. Brands are increasingly focusing on designing and marketing activewear specifically tailored to women's needs and preferences, incorporating innovative fabrics, flattering silhouettes, and a wide array of colors and patterns. The rise of athleisure has particularly benefited this segment, as women embrace comfortable yet chic activewear for various occasions.

The activewear industry's growth is being significantly catalyzed by the persistent global trend towards health and wellness. As more individuals prioritize fitness and an active lifestyle, the demand for specialized, comfortable, and performance-enhancing apparel naturally escalates. The burgeoning "athleisure" trend, which seamlessly blends athletic wear with everyday fashion, is another potent catalyst, broadening the consumer base and increasing purchase occasions. Technological advancements in fabric innovation, leading to lighter, more breathable, and moisture-wicking materials, further drive demand by improving wearer comfort and performance.

This comprehensive report on the activewear market offers a holistic view, encompassing detailed production volume analysis in millions of units across various segments and applications. It delves into the intricate workings of the market from 2019 to 2033, with 2025 serving as the pivotal Base Year and Estimated Year, and a robust Forecast Period extending to 2033. The report meticulously analyzes the Historical Period of 2019-2024, providing a strong foundation for its projections. It dissects market trends, driving forces, and challenges, offering strategic insights for stakeholders. Key regions and segments dominating the market are identified and analyzed in detail, providing a granular understanding of where growth is most concentrated. This report is an indispensable tool for businesses seeking to navigate the dynamic and evolving landscape of the global activewear industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Adidas AG, Asics Corporation, Columbia Sportswear Company, Dick's Sporting Goods, Gap, Nike, The North Face, Phillips-Van Heusen Corporation, Puma, Under Armour, .

The market segments include Type, Application.

The market size is estimated to be USD 450070 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Activewear," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Activewear, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.