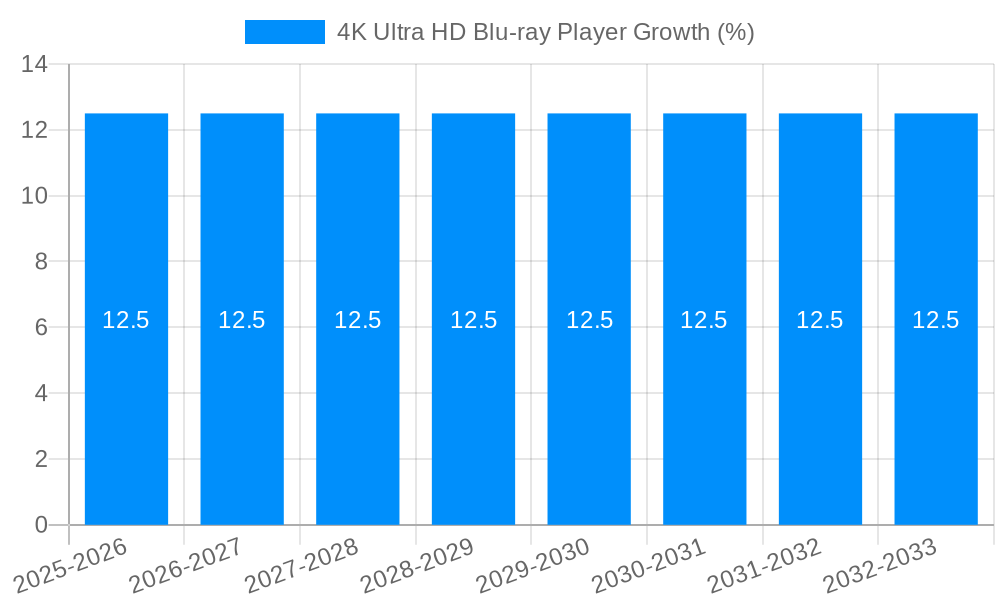

1. What is the projected Compound Annual Growth Rate (CAGR) of the 4K Ultra HD Blu-ray Player?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

4K Ultra HD Blu-ray Player

4K Ultra HD Blu-ray Player4K Ultra HD Blu-ray Player by Type (Wired 4K Ultra HD Blu-ray Player, Wireless 4K Ultra HD Blu-ray Player, World 4K Ultra HD Blu-ray Player Production ), by Application (School Use, Home Use, Commercial Use, Others, World 4K Ultra HD Blu-ray Player Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global 4K Ultra HD Blu-ray player market, while facing challenges from streaming services, maintains a steady presence driven by specific consumer segments and technological advancements. The market size in 2025 is estimated at $250 million, reflecting a continued, albeit modest, growth trajectory. A Compound Annual Growth Rate (CAGR) of 3% from 2025 to 2033 projects a market value of approximately $350 million by 2033. This growth is fueled primarily by continued demand in home use, particularly among enthusiasts prioritizing high-quality audio-visual experiences for physical media collections. Furthermore, niche markets like commercial and school use provide consistent, albeit smaller, contributions. Technological advancements in player features, such as enhanced HDR support and improved upscaling capabilities, also contribute to ongoing sales.

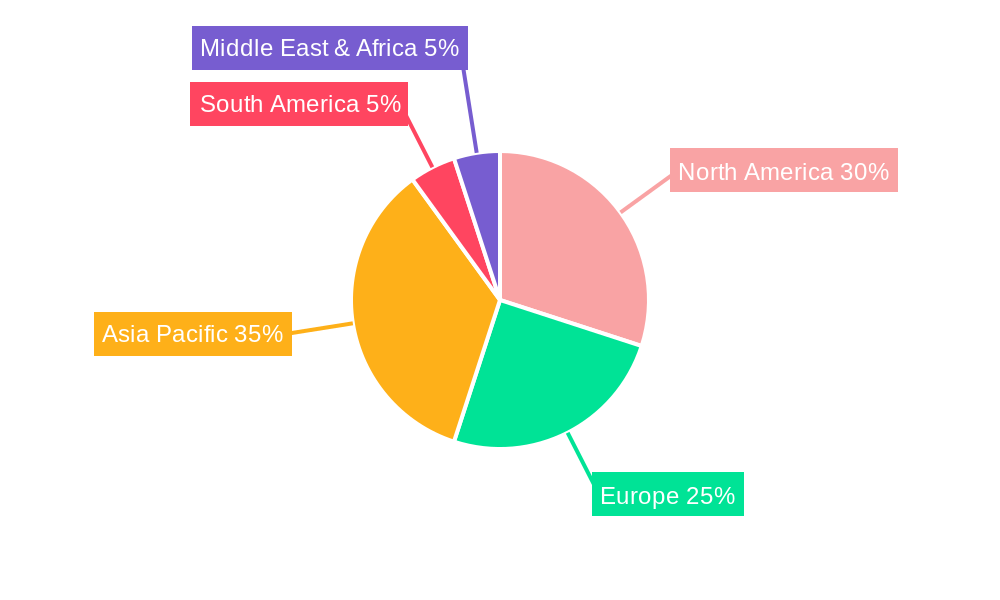

However, the market faces significant headwinds. The rise of streaming platforms offering extensive 4K content at competitive price points presents a major restraint. The convenience and accessibility of streaming services pose a considerable threat to the physical media format. Furthermore, the increasing prevalence of smart TVs with built-in streaming apps further reduces the need for dedicated Blu-ray players in many households. Despite these challenges, the market is expected to endure, albeit at a slower pace than in its peak years, driven by a loyal customer base valuing the superior quality and ownership aspects of physical media. Specific segmentation analysis reveals that the wired 4K Ultra HD Blu-ray player segment currently dominates the market due to its superior performance and reliability, though wireless options are seeing steady growth as technology improves. Geographic analysis indicates North America and Asia Pacific as leading regions, reflecting high levels of disposable income and consumer electronics adoption.

The global 4K Ultra HD Blu-ray player market, while facing headwinds from streaming services, continues to exhibit nuanced trends. The historical period (2019-2024) saw a decline in unit sales, primarily due to the rise in popularity of streaming platforms offering high-definition content. However, the market hasn't completely stagnated. A niche segment persists, driven by consumers who prioritize physical media ownership, appreciate the superior audio-visual quality of 4K Blu-ray discs, especially for cinematic experiences, and value the lack of streaming dependencies. The estimated year (2025) reveals a stabilization, with production numbers holding relatively steady around the low tens of millions of units. The forecast period (2025-2033) projects a slow but consistent growth, primarily fueled by the continued release of 4K Ultra HD Blu-ray titles, particularly in specific genres like action and documentaries where high-resolution visuals are highly prized. This growth, however, will likely remain within a specific market segment, and won't approach the scale of previous years or match the overall growth witnessed in the streaming market. The study period (2019-2033) highlights the dynamic interplay between evolving consumer preferences and technological advancements, showcasing a market striving for sustainability in a rapidly changing entertainment landscape. Furthermore, the production landscape is likely to consolidate, with fewer major players dominating the manufacturing side. While overall unit sales may not reach hundreds of millions, the market retains its value in terms of specialized high-quality reproduction of movie releases which will see continued demand.

Several factors contribute to the continued, albeit modest, growth of the 4K Ultra HD Blu-ray player market. Firstly, the superior picture and sound quality compared to even the highest streaming resolutions remain a key selling point for discerning audio-visual enthusiasts. The uncompressed nature of Blu-ray discs allows for a level of detail and fidelity that streaming services, even with increasing bandwidth, often struggle to match. Secondly, the appeal of physical media ownership remains strong for a significant segment of the population. Collectors value the tangible nature of owning films and the ability to build a personal library. Thirdly, the lack of reliance on internet connectivity and streaming subscriptions is a significant advantage for consumers in areas with unreliable internet access or those who prefer a cost-predictable entertainment option. Finally, the continued release of 4K Ultra HD Blu-ray titles, particularly those with exclusive features or special editions, also sustains demand. While streaming is dominating the market for convenience, the quality and ownership aspects of Blu-ray provide a sustainable niche, attracting a loyal consumer base that doesn't align itself exclusively with digital consumption. This dedicated niche ensures a consistent, albeit limited, market for the foreseeable future.

The 4K Ultra HD Blu-ray player market faces considerable challenges. The most significant is the overwhelming dominance of streaming services. The convenience and vast library offered by platforms like Netflix, Disney+, and Amazon Prime Video have significantly shifted consumer preferences towards on-demand digital content. The cost of physical media, including the price of the player itself and the individual discs, is another significant factor. Streaming services often offer significantly cheaper monthly subscriptions offering comparable visual quality. The technological advancements in streaming technology, such as improvements in compression algorithms, HDR, and higher frame rates continue to shrink the quality gap between Blu-ray and streaming. Furthermore, limited new 4K Ultra HD Blu-ray releases compared to the constant influx of new content on streaming platforms further restrict the attractiveness of the format for most consumers. The overall impact is a limited market focused on specific consumer segments, leaving the overall market growth potential constrained.

The Home Use segment is projected to dominate the 4K Ultra HD Blu-ray player market throughout the forecast period. This dominance stems from the enduring appeal of home theater setups and the desire for high-quality entertainment experiences within the home environment.

The continued appeal of home theaters, coupled with the need for higher quality viewing among home theater enthusiasts is expected to ensure this segment sustains a relatively healthy consumer base despite the strong trends toward streaming. However, growth in this segment is likely to be moderate and largely driven by replacement purchases, rather than mass market adoption. The high initial investment cost for a high-quality home theater system including a 4K Blu-ray player, compared to the simpler setup of streaming services, continues to be a barrier for many consumers. The gradual decline of retail space for physical media also poses a challenge to long term growth, though loyal collectors and high-end audiophiles are expected to provide continued demand.

The continued release of high-profile 4K Ultra HD Blu-ray titles, particularly those with exclusive bonus features, is a key growth catalyst. Furthermore, improvements in player technology, such as enhanced HDR support and Dolby Vision compatibility, can attract new buyers and retain existing ones. Strategic partnerships between studios and manufacturers to offer exclusive releases could also bolster sales. Though these factors offer limited growth in a highly competitive market, they offer sustainable demand within a specific niche.

This report offers a comprehensive analysis of the 4K Ultra HD Blu-ray player market, covering historical performance, current trends, and future projections. It provides detailed insights into market segments, key players, and driving forces, along with a comprehensive overview of the challenges and restraints influencing the market's trajectory. This includes market size in millions of units, examining both production and sales data. This detailed analysis provides a clear understanding of the opportunities and challenges within the 4K Ultra HD Blu-ray player market and provides informed forecasts for future market trends.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

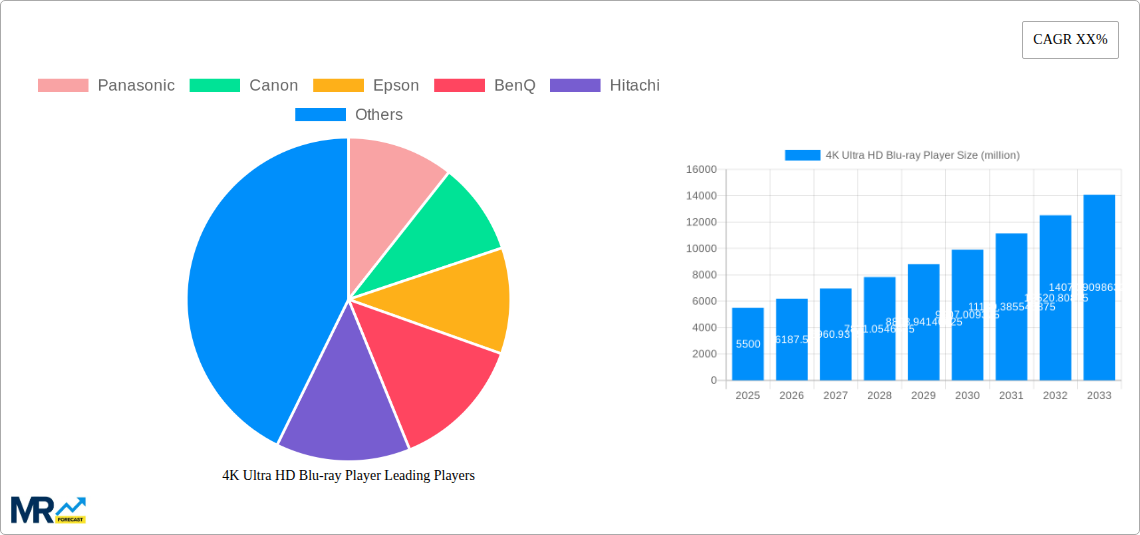

Key companies in the market include Panasonic, Canon, Epson, BenQ, Hitachi, Casio, Sony, ViewSonic, Acer, Dell, Ricoh, Sharp, Delta, InFocus, NEC, Optoma.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "4K Ultra HD Blu-ray Player," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the 4K Ultra HD Blu-ray Player, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.