1. What is the projected Compound Annual Growth Rate (CAGR) of the 4G Security Camera?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

4G Security Camera

4G Security Camera4G Security Camera by Type (1080p, 4MP (1440p), 5MP (1920p), 4K (8MP), Others), by Application (Residential Security, Commercial Security, Public Safety, Industrial Security), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

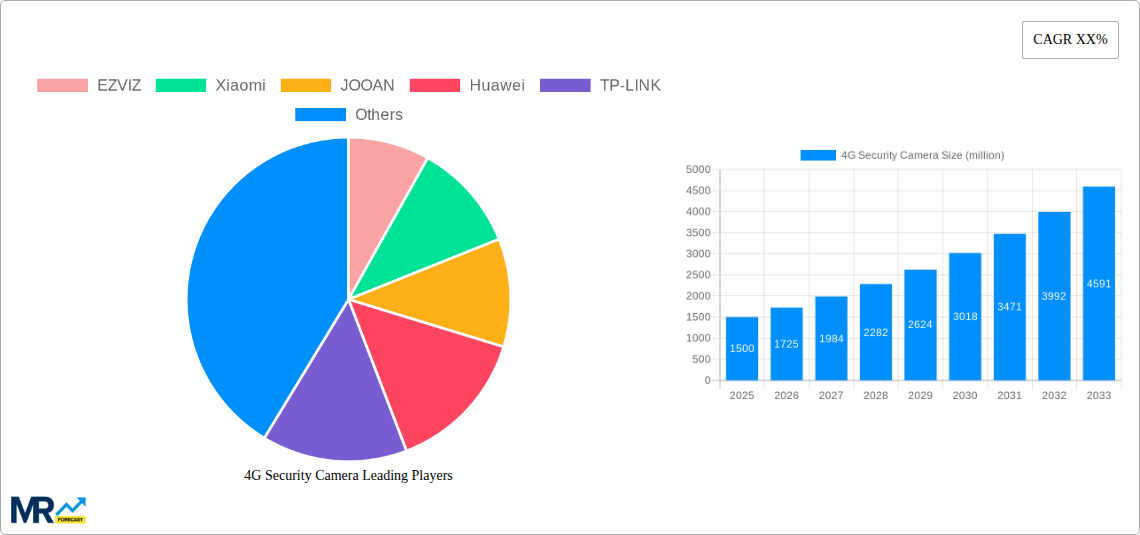

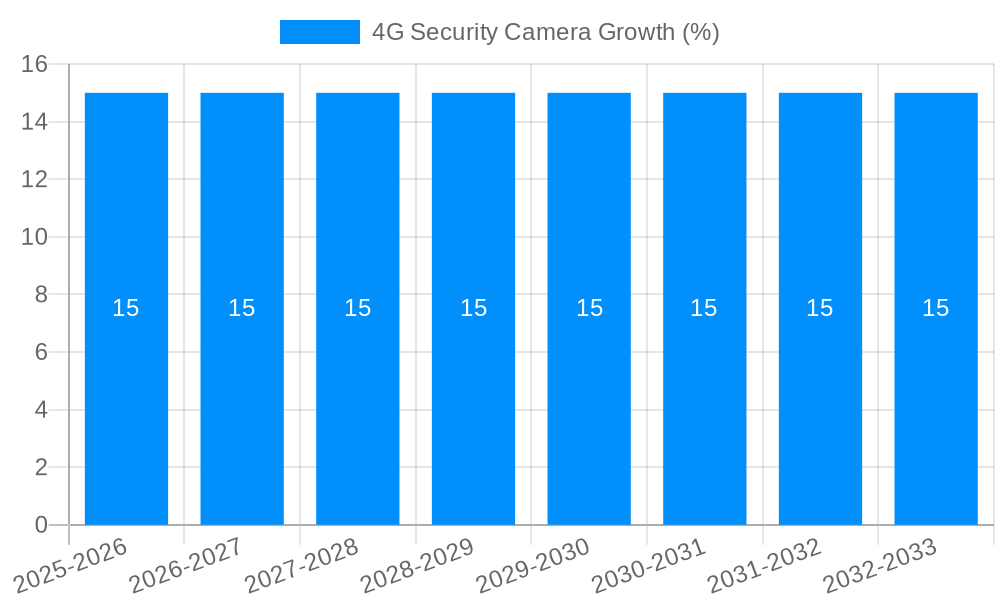

The global 4G security camera market is experiencing robust expansion, projected to reach an estimated market size of \$1,500 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 15% anticipated throughout the forecast period of 2025-2033. This significant growth is primarily fueled by the increasing demand for enhanced surveillance solutions in both residential and commercial sectors, driven by rising security concerns and the proliferation of smart home technology. The convenience of wire-free installation and the ability to transmit high-definition video feeds over cellular networks make 4G security cameras an attractive option for locations lacking reliable Wi-Fi infrastructure. Furthermore, advancements in battery technology and improved data transmission speeds are contributing to the adoption of these devices.

The market is segmented by resolution, with 4K (8MP) cameras gaining traction due to their superior clarity and detail, crucial for accurate identification and evidence gathering. The "Others" category, likely encompassing specialized resolutions and functionalities, also shows potential. Application-wise, residential security remains a dominant segment, followed closely by commercial security, as businesses increasingly leverage these cameras for remote monitoring and operational efficiency. Public safety and industrial security applications are also expected to witness steady growth. Key market restraints include the cost of cellular data plans and potential network coverage limitations in remote areas, though ongoing infrastructure development is mitigating these challenges. Leading companies like Dahua, EZVIZ, and Xiaomi are actively innovating, introducing smarter features and more affordable solutions to capture market share.

The global 4G security camera market is experiencing a substantial surge, projected to reach a valuation of $12,500 million by 2033, demonstrating a robust Compound Annual Growth Rate (CAGR) of 18.5% during the forecast period of 2025-2033. This significant expansion is underpinned by a confluence of technological advancements, evolving security needs, and increasing global connectivity. The historical period from 2019 to 2024 witnessed a foundational growth phase, where early adopters and increasing awareness of the benefits of wireless, untethered surveillance laid the groundwork for the current accelerated trajectory. The base year of 2025 is estimated to represent a market value of $6,800 million, setting a strong starting point for the projected boom.

A primary trend is the increasing demand for higher resolution cameras, with 4K (8MP) and 5MP (1920p) segments collectively expected to dominate the market share, driven by the need for crystal-clear imagery for detailed surveillance and evidence collection. This move towards superior video quality is directly impacting product development and consumer expectations. Furthermore, the "Others" category within types, encompassing emerging resolutions and specialized camera functionalities, is also poised for significant growth as manufacturers innovate with advanced features. The application landscape is equally dynamic, with Residential Security emerging as a dominant segment, fueled by heightened concerns about personal safety and property protection in an increasingly complex world. The adoption of smart home technologies and the desire for remote monitoring are key drivers in this segment.

Simultaneously, Commercial Security is demonstrating substantial traction, as businesses of all sizes recognize the imperative of robust surveillance for asset protection, loss prevention, and operational efficiency. This trend is amplified by the growing adoption of cloud-based storage and analytics solutions, which enhance the functionality and accessibility of 4G security cameras in commercial settings. The report will delve into the intricate interplay of these trends, analyzing how technological innovations like AI-powered analytics, advanced night vision, and improved battery life are shaping the market. The increasing affordability and wider availability of 4G network infrastructure across various regions are also crucial factors contributing to the market's expansion. The market's evolution is also characterized by the integration of these cameras into broader smart security ecosystems, offering users comprehensive control and monitoring capabilities through mobile applications. This integrated approach is fostering a more holistic security experience, moving beyond standalone camera solutions.

The relentless march of technological innovation stands as a paramount driver for the 4G security camera market. The widespread availability and improving performance of 4G LTE networks worldwide have removed a significant infrastructure barrier, enabling seamless and reliable video transmission from remote locations without the need for wired internet connections. This untethered nature is a fundamental advantage, allowing for flexible deployment in areas previously underserved by traditional broadband. Furthermore, the continuous miniaturization and cost reduction of 4G modems and chipsets have made these cameras more accessible to a broader consumer and commercial base. The development of advanced image sensors capable of capturing high-resolution footage, even in low-light conditions, coupled with sophisticated video compression technologies, ensures that the quality of surveillance is not compromised by the wireless connection.

Moreover, a growing global consciousness regarding security and safety is a powerful propellant. In residential settings, concerns over burglaries, vandalism, and the need for remote monitoring of children, elderly family members, or pets are driving demand. Commercially, businesses are increasingly leveraging 4G security cameras for perimeter surveillance, inventory management, employee safety, and operational oversight, especially in distributed or mobile environments. The rise of the "Internet of Things" (IoT) ecosystem also plays a crucial role, with 4G security cameras being integrated into broader smart home and smart city initiatives, offering enhanced connectivity and interoperability with other smart devices. The ongoing advancements in battery technology are also contributing, enabling longer operational periods for battery-powered 4G cameras, thus enhancing their suitability for remote or power-constrained applications.

Despite the robust growth trajectory, the 4G security camera market faces several notable challenges and restraints that could temper its expansion. Foremost among these is the issue of data security and privacy. As these cameras transmit sensitive video data wirelessly, concerns about unauthorized access, data breaches, and potential misuse of surveillance footage are significant deterrents for both individual consumers and commercial entities, especially in regions with stringent data protection regulations. The reliance on mobile network coverage also presents a constraint. While 4G networks are widespread, coverage gaps and inconsistent signal strength in remote or rural areas can lead to intermittent connectivity and unreliable performance, hindering the effectiveness of the security system.

The cost of data plans associated with continuous video streaming can also be a substantial restraint, particularly for prolonged surveillance applications or in regions where mobile data is expensive. While camera hardware costs are decreasing, the ongoing expense of a reliable data subscription can deter budget-conscious buyers. Furthermore, bandwidth limitations on some 4G plans might restrict the ability to stream high-resolution video or multiple camera feeds simultaneously, impacting the overall functionality. Power consumption remains a challenge for battery-operated 4G cameras, requiring frequent recharging or battery replacements, which can be inconvenient for users. Finally, technical complexity and user-friendliness can also pose a barrier, with some users finding the setup, configuration, and management of these devices daunting, especially for less tech-savvy individuals.

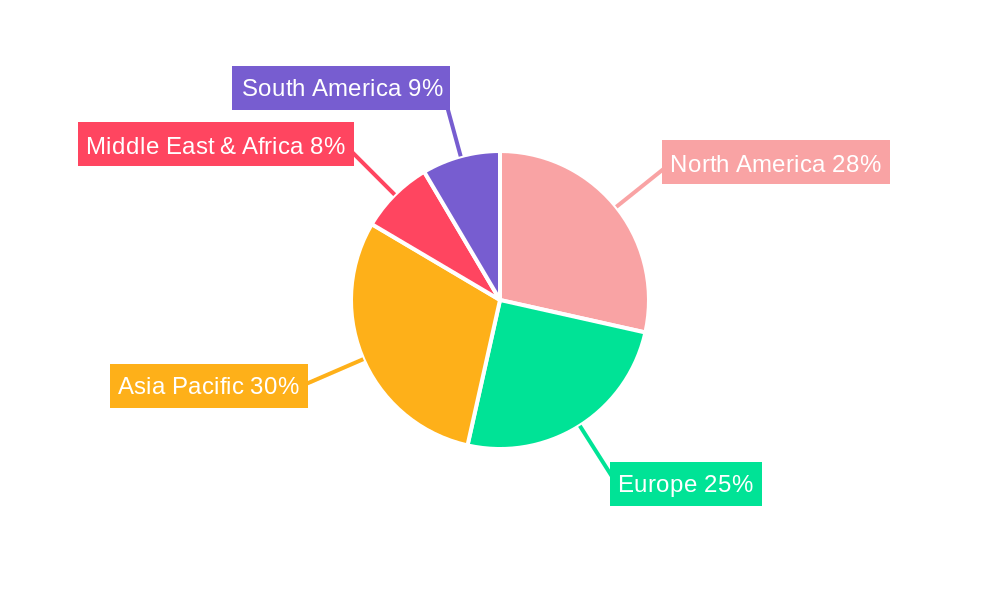

The Asia-Pacific (APAC) region is poised to dominate the 4G security camera market, driven by a potent combination of rapid urbanization, burgeoning economies, a large and tech-savvy population, and significant investments in infrastructure development. Countries like China, India, and Southeast Asian nations are experiencing a surge in demand for enhanced security solutions across all application segments. In China, the strong presence of domestic technology giants such as Huawei and ZTE, alongside companies like Xiaomi and JOOAN, has fostered a competitive landscape with rapid product innovation and aggressive market penetration. The widespread availability of affordable 4G network coverage and the increasing disposable incomes of consumers further fuel this dominance.

Within the segment breakdown, Residential Security is expected to be a leading application, accounting for a significant market share. The rising concerns about personal safety and property protection in densely populated urban areas, coupled with the increasing adoption of smart home ecosystems, are propelling this growth. Consumers are actively seeking wireless, easy-to-install security solutions that offer remote monitoring capabilities via their smartphones. Companies like EZVIZ, Wyze, and SimpliSafe are particularly strong in this segment, offering a range of affordable and user-friendly 4G security cameras.

Furthermore, the 4K (8MP) and 5MP (1920p) resolution types are set to capture substantial market share. The demand for superior image clarity for both evidential purposes and detailed observation in residential and commercial settings is paramount. As the cost of higher resolution sensors and processing power decreases, these segments become more attractive to a wider audience. Brands like Dahua and Amazon (with its Ring brand) are investing heavily in these high-resolution offerings. The development of advanced AI-powered analytics, such as object recognition and facial detection, further enhances the value proposition of these high-resolution 4G security cameras, making them indispensable for comprehensive surveillance needs.

The 4G security camera industry is experiencing significant growth catalysts that are reshaping its landscape. A primary catalyst is the ongoing expansion and enhancement of 4G LTE and nascent 5G network infrastructure globally, providing faster and more reliable connectivity for untethered surveillance solutions. This improved network performance directly supports higher resolution video streaming and reduced latency. Another crucial growth driver is the increasing affordability of high-resolution camera sensors and advanced processing chips, making devices with superior image quality more accessible to a wider consumer base. Furthermore, the growing trend towards smart home integration and the broader IoT ecosystem is fueling demand as 4G security cameras become essential components of interconnected security and automation systems, offering enhanced convenience and functionality.

This comprehensive report delves deep into the multifaceted 4G security camera market, providing an in-depth analysis of its current state and future projections. The study encompasses a detailed examination of market segmentation by type, application, and region, with specific attention paid to the dominant players and emerging trends shaping the industry. It offers invaluable insights into the driving forces behind market growth, including technological advancements and evolving consumer security needs, while also critically evaluating the challenges and restraints that could impact future expansion. The report highlights key growth catalysts, such as network infrastructure development and smart home integration, and provides a comprehensive list of leading companies and their significant developments. The meticulously compiled data, spanning the historical period of 2019-2024 and extending through the forecast period of 2025-2033, with 2025 serving as the base and estimated year, offers a robust foundation for strategic decision-making. This report is designed to equip stakeholders with the necessary intelligence to navigate this dynamic and rapidly evolving market effectively.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include EZVIZ, Xiaomi, JOOAN, Huawei, TP-LINK, Lenovo, ZTE, Dahua, DIFANG, Amazon, Canary Connect, Hive, Logitech, Netatmo, Panasonic, SimpliSafe, Somfy One, Swann, Wyze.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "4G Security Camera," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the 4G Security Camera, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.