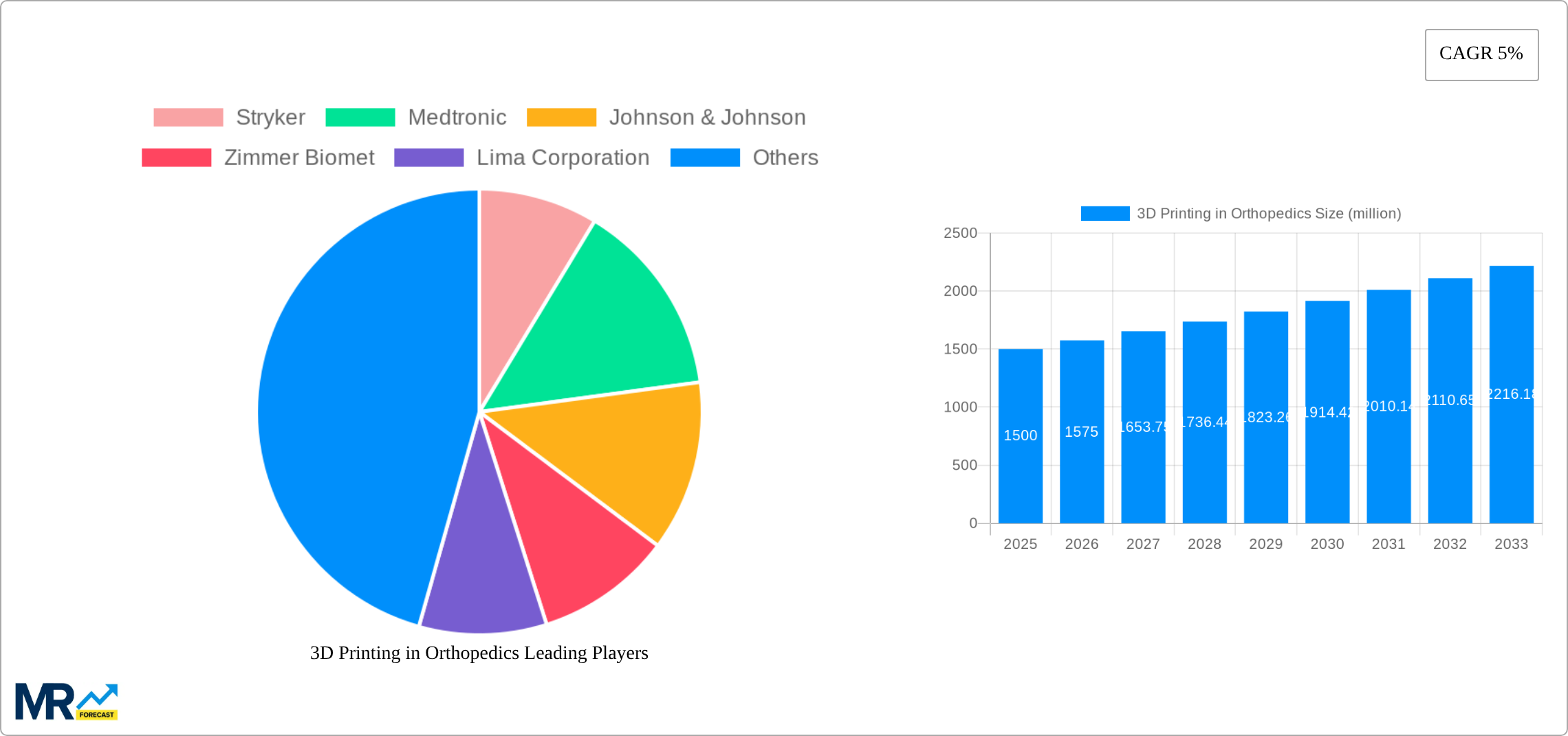

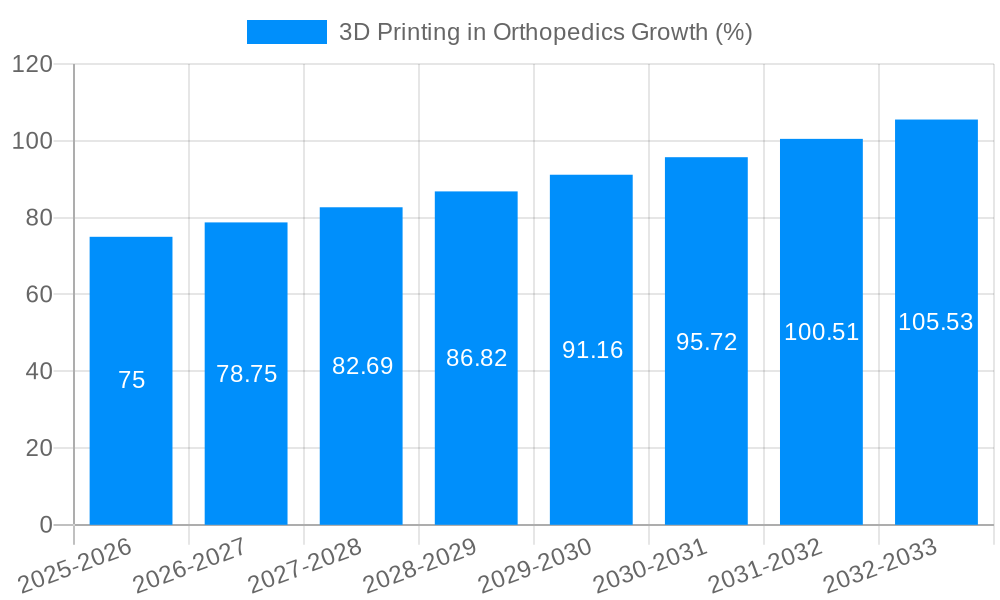

1. What is the projected Compound Annual Growth Rate (CAGR) of the 3D Printing in Orthopedics?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

3D Printing in Orthopedics

3D Printing in Orthopedics3D Printing in Orthopedics by Type (Metal Material, Polymer Material), by Application (Joint Implants, Spine Implants, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global 3D printing in orthopedics market is poised for significant expansion, projected to reach an estimated market size of approximately $1,500 million in 2025. Driven by an anticipated Compound Annual Growth Rate (CAGR) of around 5%, this burgeoning sector is fundamentally reshaping orthopedic implant manufacturing and patient care. Key growth catalysts include the increasing prevalence of orthopedic conditions such as osteoarthritis and osteoporosis, coupled with the growing demand for personalized medical devices. 3D printing's inherent ability to produce patient-specific implants, optimize complex geometries for enhanced performance, and enable rapid prototyping of innovative designs makes it an indispensable technology in modern orthopedics. Furthermore, advancements in biocompatible materials like titanium alloys and advanced polymers are fueling innovation and expanding the application scope of 3D-printed orthopedic solutions across various sub-segments.

The market is characterized by a dynamic competitive landscape with established medical device giants like Stryker, Medtronic, and Johnson & Johnson heavily investing in additive manufacturing capabilities. The application landscape is dominated by joint implants and spine implants, which benefit immensely from the precision and customization offered by 3D printing. However, emerging applications in other orthopedic areas, such as trauma and reconstructive surgery, are also showing promising growth potential. Despite the robust growth trajectory, certain restraints, including stringent regulatory approvals for novel implant designs and the initial high cost of advanced 3D printing equipment, may present challenges. Nevertheless, the long-term outlook remains exceptionally positive as technological advancements continue to lower costs, improve material properties, and enhance regulatory pathways, solidifying 3D printing's role as a transformative force in orthopedic care globally.

The global 3D Printing in Orthopedics market is poised for remarkable expansion, with a projected valuation set to reach an impressive \$5,800 million by 2025. This robust growth trajectory is underpinned by a confluence of factors, including an increasing demand for personalized implants, advancements in additive manufacturing technologies, and a growing elderly population susceptible to orthopedic conditions. The Study Period of 2019-2033 encapsulates a dynamic evolution, with the Base Year of 2025 serving as a pivotal point for future projections. During the Historical Period of 2019-2024, the market witnessed steady adoption, laying the groundwork for accelerated growth in the upcoming Forecast Period of 2025-2033. Key market insights reveal a significant shift towards patient-specific solutions, moving away from off-the-shelf implants. This customization allows for superior anatomical fit, leading to improved patient outcomes, reduced revision surgeries, and enhanced quality of life. The integration of advanced imaging techniques like CT scans and MRI with 3D modeling software has enabled orthopedic surgeons to design and print implants that precisely match a patient's unique bone structure. This precision is particularly crucial in complex reconstructive surgeries and in addressing congenital deformities. Furthermore, the development of biocompatible and durable materials, such as titanium alloys and various polymers, specifically engineered for orthopedic applications, is fueling innovation and expanding the scope of 3D printed implants. The economic viability of 3D printing, with its potential for reduced manufacturing lead times and waste, is also a significant trend, making it an increasingly attractive option for both large medical device manufacturers and specialized orthopedic centers. The market's trajectory indicates a continued surge in the application of additive manufacturing across a wide spectrum of orthopedic interventions, solidifying its position as a transformative technology in the field. The impact of this technology extends beyond implants, encompassing surgical guides, anatomical models for pre-operative planning, and even custom rehabilitation devices.

The burgeoning demand for personalized medical solutions stands as a paramount driver for the 3D printing in orthopedics market. Patients today are increasingly seeking treatments tailored to their specific anatomical needs, and 3D printing offers an unparalleled ability to create patient-specific implants that ensure optimal fit and function. This personalized approach significantly enhances surgical precision, reduces operative time, and ultimately leads to better patient outcomes and faster recovery periods. Coupled with this patient-centric trend is the relentless advancement in additive manufacturing technologies. Innovations in 3D printing hardware, materials science, and software are constantly pushing the boundaries of what is possible, enabling the creation of more complex geometries, intricate lattice structures for bone ingrowth, and implants with enhanced mechanical properties. The development of novel biocompatible materials, such as advanced titanium alloys and biocompatible polymers, is crucial for the widespread adoption of 3D printed orthopedic devices. These materials are engineered to mimic the properties of natural bone, promoting osseointegration and long-term implant stability. Furthermore, the growing global prevalence of orthopedic conditions, largely driven by an aging population and rising rates of obesity and sedentary lifestyles, is creating a substantial and sustained demand for orthopedic implants. As the number of individuals requiring joint replacements, spinal fusions, and other orthopedic procedures continues to rise, 3D printing offers a scalable and efficient solution for manufacturing these crucial medical devices. The inherent advantages of 3D printing, including reduced waste, on-demand production, and the potential for cost efficiencies in the long run, further contribute to its momentum.

Despite its immense potential, the 3D printing in orthopedics market faces several hurdles that could temper its rapid expansion. A primary concern revolves around regulatory approvals. The intricate nature of 3D printed implants and the use of novel materials necessitate rigorous testing and validation processes to ensure safety and efficacy, which can be time-consuming and costly. Establishing clear and consistent regulatory pathways across different geographies remains a challenge for widespread market penetration. Another significant restraint is the initial investment required for sophisticated 3D printing equipment, specialized software, and trained personnel. While the long-term cost-effectiveness of 3D printing is often cited as an advantage, the upfront capital expenditure can be a barrier, particularly for smaller healthcare institutions or developing regions. The availability of skilled labor is also a critical factor. Operating and maintaining 3D printing systems, as well as designing and post-processing complex orthopedic implants, requires specialized expertise that is not yet widely available. This skills gap can hinder the adoption and efficient utilization of 3D printing technology. Furthermore, while material science has advanced, concerns about the long-term biocompatibility and mechanical performance of certain 3D printed materials in the demanding orthopedic environment persist. Ensuring the consistent quality and performance of implants across different printing batches and facilities is paramount to building trust and widespread acceptance. Finally, reimbursement policies for 3D printed implants may not be fully established or as favorable as those for traditional implants in all healthcare systems, potentially impacting their accessibility and adoption by healthcare providers.

Segment Dominance: Joint Implants and Metal Material

The Joint Implants segment is anticipated to be a dominant force in the 3D printing in orthopedics market. This dominance stems from the sheer volume of joint replacement surgeries performed globally. Conditions like osteoarthritis and rheumatoid arthritis, which are increasingly prevalent due to an aging population and lifestyle factors, necessitate significant demand for hip, knee, and shoulder implants. 3D printing allows for the creation of highly customized joint implants that offer superior anatomical fit, improved osseointegration, and enhanced patient comfort and mobility. The ability to design porous structures that mimic natural bone architecture facilitates faster and stronger bone ingrowth, leading to more stable and longer-lasting implants. This translates to reduced revision rates and improved patient satisfaction.

Within the material type, Metal Material is expected to lead the charge. Titanium alloys, in particular, are the cornerstone of 3D printed orthopedic implants due to their excellent biocompatibility, high strength-to-weight ratio, and resistance to corrosion. The additive manufacturing of titanium allows for the creation of intricate lattice structures and patient-specific geometries that are impossible to achieve with traditional manufacturing methods. These complex designs enable better load distribution, reduced stress shielding, and improved bone ingrowth compared to solid metal implants. The market size for metal-based 3D printed orthopedic implants is substantial, driven by the long-standing preference for metal in load-bearing orthopedic applications.

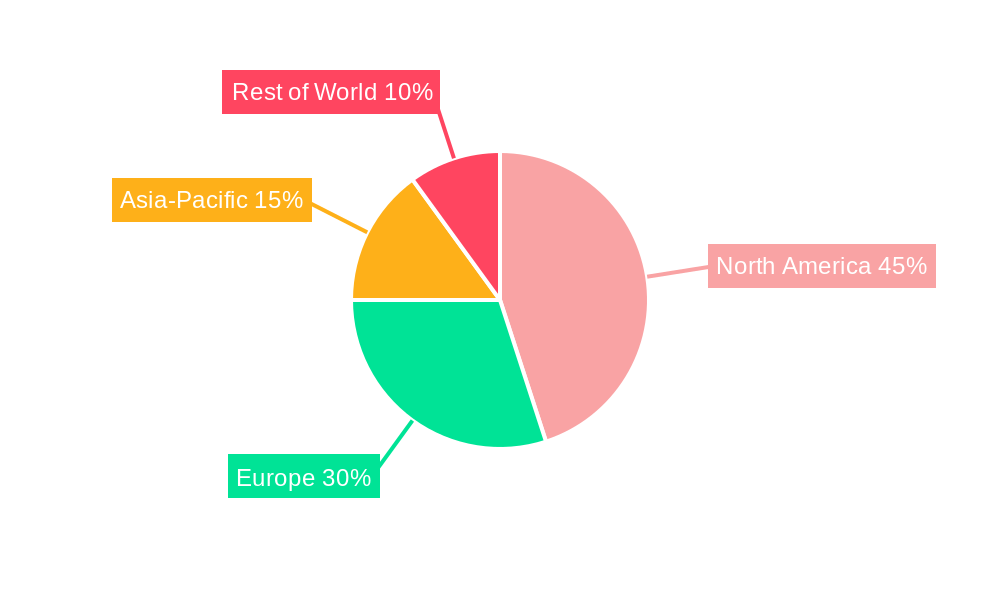

Regional Dominance: North America

North America is poised to maintain its position as a leading region in the 3D printing in orthopedics market. This dominance is attributed to a robust healthcare infrastructure, high adoption rates of advanced medical technologies, and significant investments in research and development. The region boasts a concentration of leading orthopedic device manufacturers, research institutions, and highly skilled medical professionals who are at the forefront of integrating 3D printing into clinical practice. The presence of well-established regulatory frameworks, although challenging, also provides a structured environment for the approval and commercialization of novel 3D printed orthopedic solutions. Furthermore, a higher prevalence of orthopedic conditions and a greater willingness among patients and healthcare providers to embrace innovative treatment modalities contribute to North America's market leadership. The substantial disposable income and favorable reimbursement policies in countries like the United States and Canada further bolster the adoption of high-value, technologically advanced orthopedic solutions, including 3D printed implants. The strong emphasis on personalized medicine and patient-centric care in this region aligns perfectly with the inherent advantages of 3D printing.

The orthopedic industry is experiencing a surge in growth catalyzed by rapid advancements in additive manufacturing. The increasing focus on personalized medicine, where implants are tailored to individual patient anatomy, is a significant driver. 3D printing enables the creation of patient-specific designs that enhance surgical precision and improve patient outcomes. Moreover, ongoing innovations in biocompatible materials and printing technologies are expanding the applications and improving the performance of 3D printed orthopedic devices. The development of novel alloys and polymers with superior mechanical and biological properties is crucial for their wider acceptance.

This report offers a comprehensive analysis of the 3D Printing in Orthopedics market, providing in-depth insights into its current landscape and future trajectory. The study covers the Study Period of 2019-2033, with a detailed examination of the Base Year of 2025 and projections for the Forecast Period of 2025-2033. It delves into historical trends from 2019-2024, highlighting key market dynamics. The report scrutinizes critical segments such as Metal Material and Polymer Material types, and applications including Joint Implants, Spine Implants, and Others. It identifies the dominant regions and countries contributing to market growth, alongside a thorough exploration of driving forces and prevailing challenges. The report also spotlights the leading companies actively shaping the industry and significant recent developments, offering a complete understanding of this transformative sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include Stryker, Medtronic, Johnson & Johnson, Zimmer Biomet, Lima Corporation, Conformis, Smith & Nephew, Adler Ortho, Exactech, AK Medical Holding, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "3D Printing in Orthopedics," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the 3D Printing in Orthopedics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.