1. What is the projected Compound Annual Growth Rate (CAGR) of the 3D Printing for Defense?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

3D Printing for Defense

3D Printing for Defense3D Printing for Defense by Type (Plastics Material, Metals Material, Other Materials), by Application (Air Force, Army, Marine), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

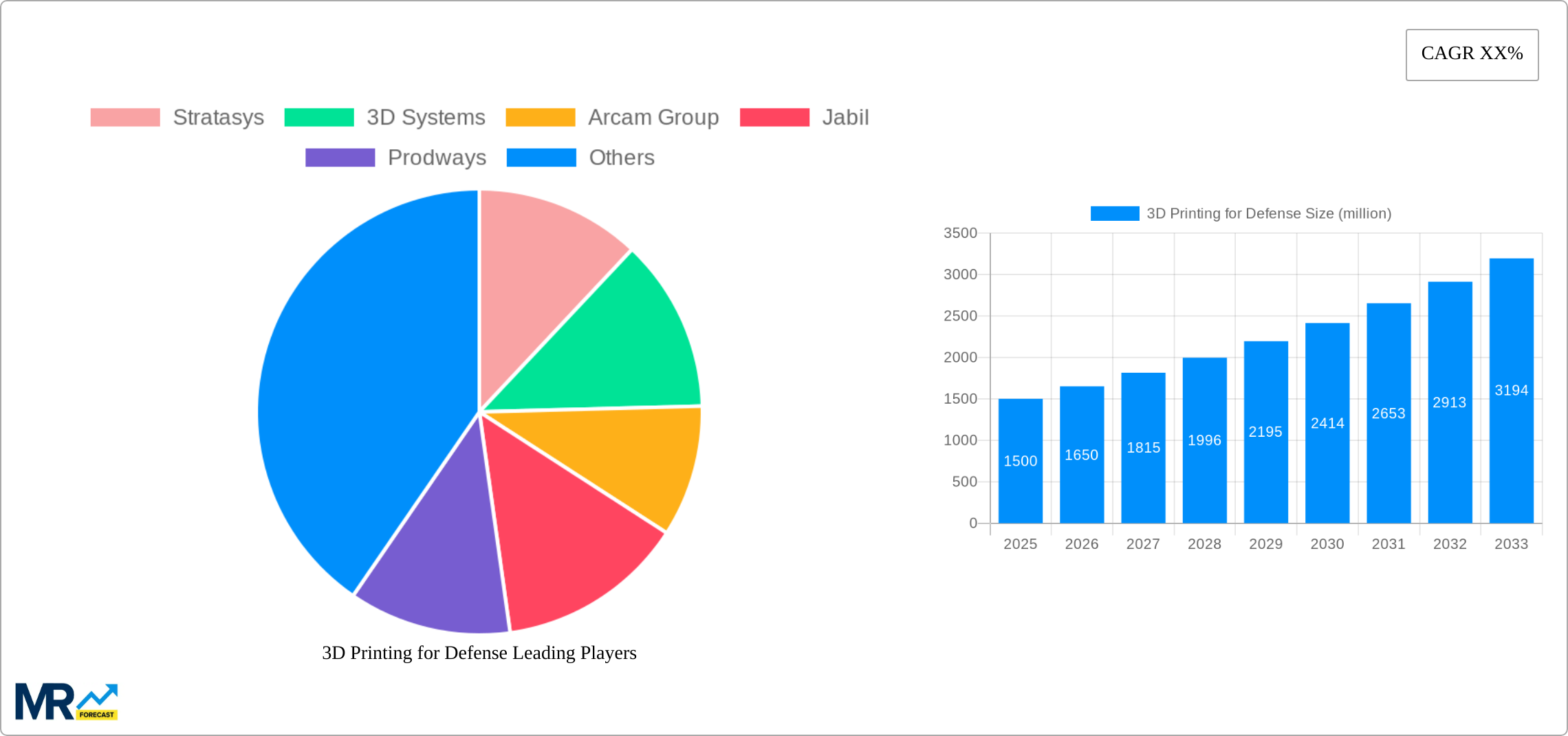

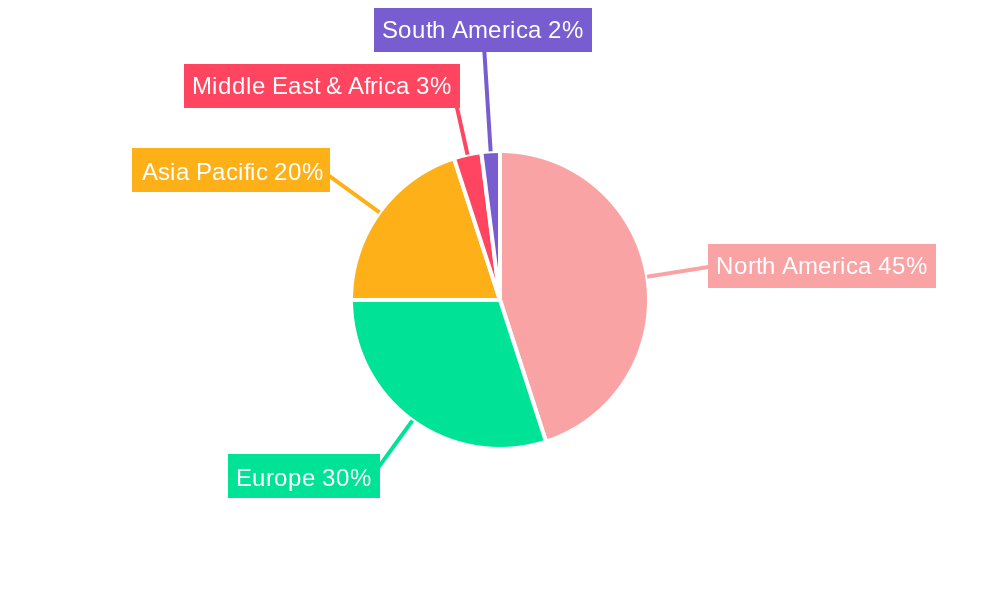

The global 3D printing market for defense applications is experiencing robust growth, driven by the increasing need for customized, lightweight, and high-performance military equipment. The market's expansion is fueled by several factors, including the rising adoption of additive manufacturing for prototyping, the production of complex geometries, and the development of advanced materials tailored for defense applications. The ability to rapidly produce customized parts on demand, reduce logistical challenges associated with traditional manufacturing, and enhance operational readiness contributes significantly to the sector's growth. Plastics and metals remain the dominant materials used, with a growing emphasis on specialized materials offering enhanced durability, heat resistance, and stealth capabilities. Key application areas include the production of components for aircraft, unmanned aerial vehicles (UAVs), ground vehicles, and naval vessels. The segmentation reveals a strong demand across all branches of the military – Air Force, Army, and Marine – reflecting the versatility and advantages of 3D printing technology in various military applications. North America currently holds a significant market share, owing to the robust defense budgets and advanced manufacturing infrastructure in the region, followed by Europe and Asia-Pacific.

However, market growth faces some challenges. High initial investment costs associated with 3D printing equipment and materials can be a barrier for smaller defense contractors. Furthermore, concerns regarding the qualification and certification of 3D-printed parts for critical defense applications require rigorous testing and validation processes. The evolving technological landscape necessitates continuous research and development efforts to overcome limitations in material properties, printing speed, and scalability. Nevertheless, ongoing innovations in 3D printing technologies, coupled with increasing governmental investments in defense modernization, suggest the market will continue its upward trajectory. The focus is shifting towards exploring advanced materials, such as high-strength alloys, composites, and ceramics, to further enhance the performance and capabilities of 3D-printed defense components. Companies specializing in high-precision 3D printing systems and materials are well-positioned to capitalize on this expanding market. The increasing emphasis on rapid prototyping and on-demand manufacturing will drive further market expansion in the years to come.

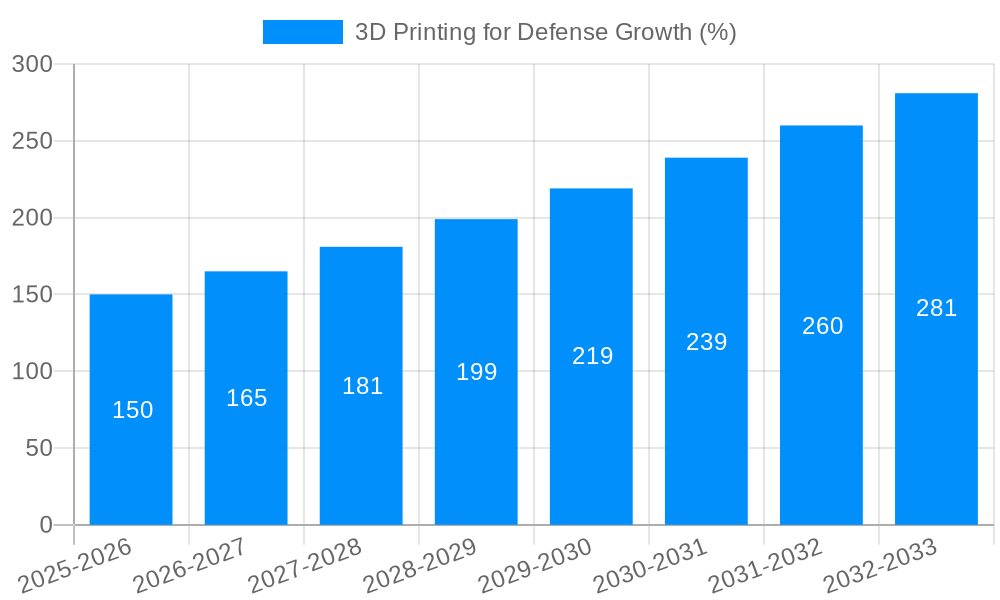

The global 3D printing for defense market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. Driven by advancements in additive manufacturing technologies and a growing need for customized, lightweight, and high-performance military equipment, the sector shows immense potential. The market's expansion is particularly noticeable in the adoption of metal-based 3D printing for producing durable components like aircraft parts, weaponry, and armored vehicles. This shift from traditional manufacturing methods allows for faster prototyping, on-demand production, and reduced reliance on complex supply chains – crucial advantages in the defense industry. Furthermore, the increasing interest in utilizing plastics for creating customized training aids, drones, and less critical components contributes significantly to the market's overall growth. The use of other materials, though currently a smaller segment, presents opportunities for future innovation, particularly in the development of advanced materials with enhanced properties like improved heat resistance or electromagnetic shielding. The consumption value of 3D printed defense components is expected to surge significantly over the forecast period (2025-2033), with metals consistently dominating the materials segment due to their inherent strength and durability requirements in defense applications. The historical period (2019-2024) already indicated a strong upward trend, setting the stage for this continued expansion. Specific applications within the Air Force, Army, and Marine Corps are experiencing parallel increases as each branch seeks to leverage the benefits of 3D printing for logistical advantages and enhanced operational capabilities. This trend will likely lead to increasing government investment and further private sector participation, driving innovation and accelerating market growth.

Several key factors propel the growth of the 3D printing for defense market. The demand for lightweight and high-strength components is paramount in military applications, and 3D printing excels at producing such parts with intricate designs not achievable through traditional methods. This allows for optimized weight distribution, improved performance, and reduced fuel consumption in aircraft and ground vehicles. Furthermore, the ability to rapidly prototype and produce customized components on-demand provides substantial logistical advantages. This is especially crucial in conflict zones where supply chains can be easily disrupted. The reduced lead times and minimized material waste associated with 3D printing translate to significant cost savings in the long run. The increasing adoption of digital design and manufacturing techniques within the defense industry is also a key driver. These techniques seamlessly integrate with 3D printing workflows, streamlining the entire production process from design to final product. The geopolitical landscape also plays a significant role. The need for rapid response and adaptation in military operations necessitates agile manufacturing solutions, and 3D printing provides exactly that. As defense budgets continue to expand globally, a greater proportion is being allocated towards research, development, and adoption of advanced technologies like 3D printing, thereby accelerating market growth. Finally, continuous technological improvements in 3D printing techniques, materials, and software are steadily expanding its capabilities and making it more attractive to defense organizations.

Despite the significant potential, the 3D printing for defense market faces several challenges. The high initial investment cost of 3D printing equipment can be a barrier to entry, particularly for smaller defense contractors. Ensuring the consistent quality and reliability of 3D printed parts is also critical in defense applications where failures can have serious consequences. Rigorous quality control measures and stringent testing protocols are essential to address this. Moreover, the relatively slow printing speeds of some 3D printing techniques, especially for large-scale components, can hinder production timelines. This is particularly relevant in situations requiring rapid deployment of equipment. The development of suitable materials with the required mechanical properties and certifications for defense applications remains an ongoing challenge. The lack of standardized design and manufacturing processes for 3D printed defense components also presents an obstacle. Establishing industry standards and best practices would promote interoperability and efficiency. Finally, concerns regarding intellectual property protection and the potential for unauthorized replication of designs are legitimate issues requiring careful consideration. Addressing these challenges through research, development, and collaboration across the industry will unlock the full potential of 3D printing in the defense sector.

The North American region, particularly the United States, is expected to dominate the 3D printing for defense market due to its substantial defense budget, robust technological infrastructure, and presence of major 3D printing companies. The high concentration of defense research and development initiatives in the US further contributes to this dominance. Within the application segment, the Air Force is likely to be a key driver of growth, given the importance of lightweight and high-performance components in aerospace applications. The demand for customized parts for aircraft maintenance, repair, and overhaul (MRO) operations significantly fuels the market. The Army, too, is increasingly adopting 3D printing for producing various components for ground vehicles and weaponry, contributing significantly to the segment's expansion. The Marine Corps' adoption of 3D printing for logistical support and field maintenance is also expected to increase market demand.

The metals materials segment is expected to hold a significant share of the market due to its strength, durability, and suitability for high-stress applications within the defense industry. Metals offer crucial properties absent in plastics or other materials when it comes to military hardware. This makes them essential for critical components in various military vehicles and weaponry.

The growth of the 3D printing for defense industry is fueled by several factors including the increasing demand for lightweight yet high-strength components, the need for rapid prototyping and customization, and the potential for significant cost savings. Government investment in research and development for additive manufacturing technologies is further accelerating the growth. The ability of 3D printing to produce complex geometries and internal structures previously impossible with traditional manufacturing methods further enhances its attractiveness within the defense sector. Finally, the ongoing development of new materials and processes specifically designed for additive manufacturing continually pushes the boundaries of what's possible in defense applications.

This report provides a comprehensive analysis of the 3D printing for defense market, encompassing historical data, current market trends, and future projections. It delves into the key driving forces, challenges, and growth catalysts shaping the market, providing valuable insights into the competitive landscape and major players. Detailed segmentation by type, application, and region allows for a thorough understanding of the market's dynamics. The report concludes with a forecast of market growth and potential future developments, providing valuable information for businesses, investors, and policymakers alike. The study period from 2019 to 2033, with a base year of 2025 and forecast period of 2025-2033, ensures a comprehensive perspective on this rapidly evolving sector. The historical data from 2019-2024 gives context to the current market conditions and future projections. The report leverages market intelligence and projected consumption values in the millions to offer a detailed view of the potential and future of 3D printing within the defense sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Stratasys, 3D Systems, Arcam Group, Jabil, Prodways, The ExOne Company, Fracktal Works, Markforged, Optomec, EnvisionTEC, Sciaky, SLM Solutions Group, EOS.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "3D Printing for Defense," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the 3D Printing for Defense, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.