1. What is the projected Compound Annual Growth Rate (CAGR) of the 2,2′-Bipyridine?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

2,2′-Bipyridine

2,2′-Bipyridine2, 2′-Bipyridine by Application (Industrial Reagent, Organic Synthesis, Pharmaceutical intermediates), by Type (98% Purity, 99% Purity), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

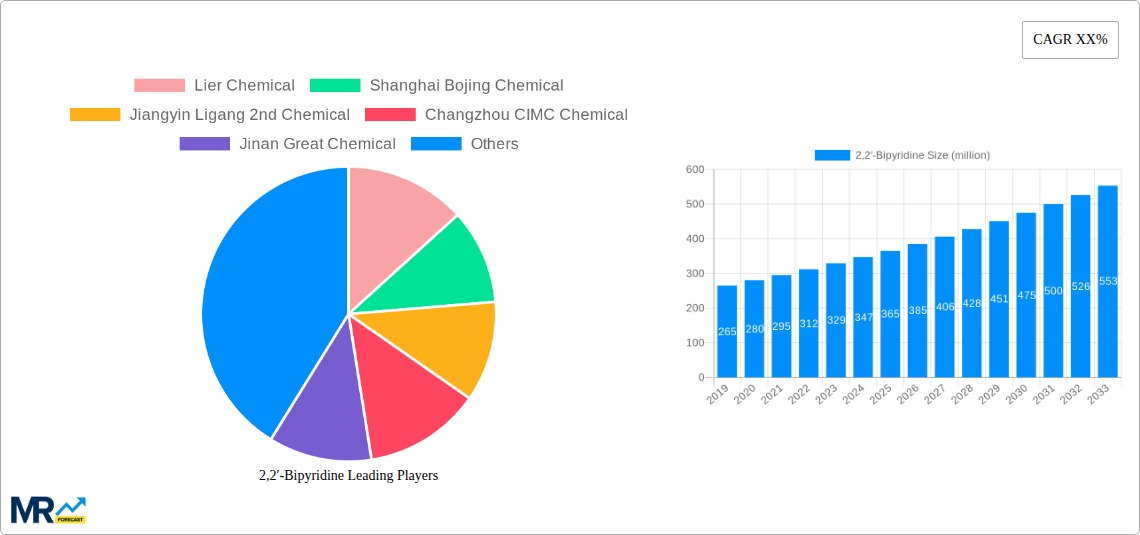

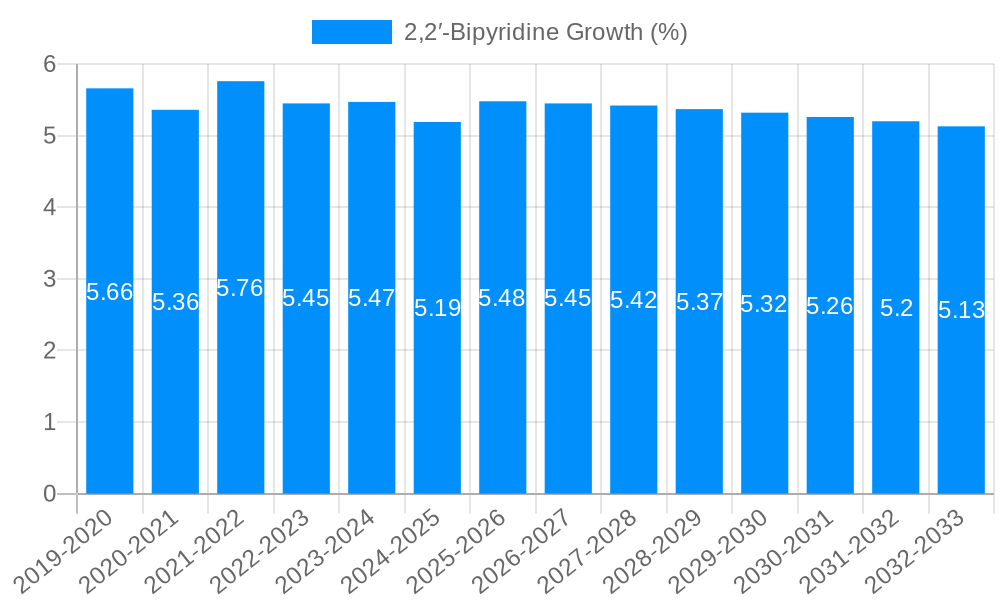

The global 2,2′-Bipyridine market is poised for significant expansion, projected to reach approximately USD 380 million by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of around 6.5% anticipated between 2019 and 2033. The value unit is in millions of US dollars, reflecting the substantial financial footprint of this chemical compound. Key drivers fueling this expansion include the escalating demand from the pharmaceutical industry, where 2,2′-Bipyridine serves as a crucial intermediate in the synthesis of various active pharmaceutical ingredients (APIs). Furthermore, its extensive use as an industrial reagent in diverse applications, ranging from catalysis in organic synthesis to its role in analytical chemistry, significantly contributes to market buoyancy. The increasing sophistication of chemical manufacturing processes and the continuous research and development efforts aimed at discovering novel applications are also propelling the market forward.

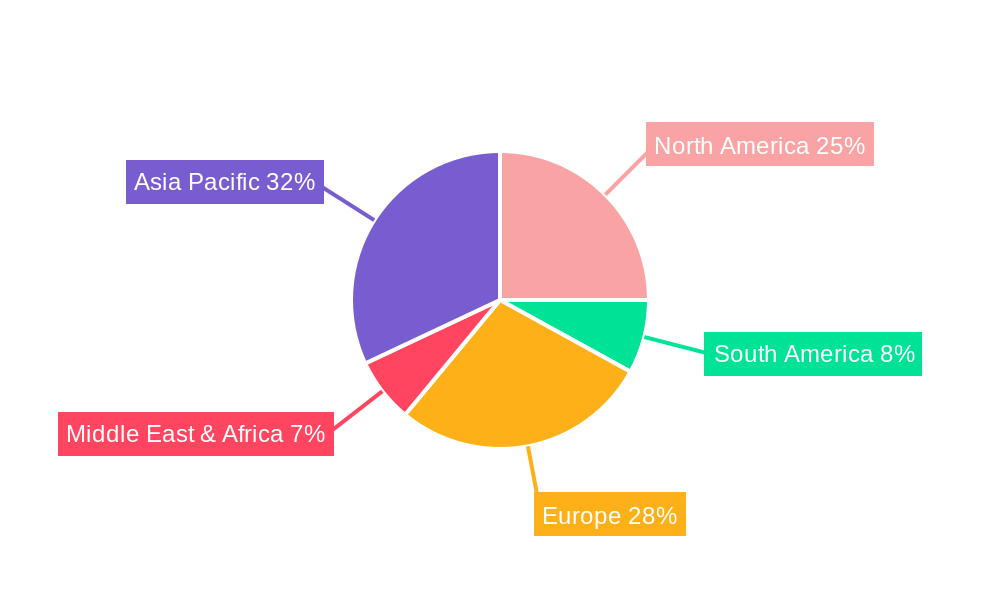

The market is segmented into different purity levels, with 98% and 99% purity grades dominating the landscape, catering to the stringent requirements of specialized industrial and pharmaceutical applications. Geographically, the Asia Pacific region, particularly China and India, is emerging as a powerhouse, driven by its burgeoning chemical manufacturing sector and increasing investments in research and development. North America and Europe also represent substantial markets, supported by established pharmaceutical and chemical industries. While the market exhibits strong growth potential, certain restraints, such as the volatile pricing of raw materials and stringent environmental regulations related to chemical production and disposal, could pose challenges. Nevertheless, ongoing technological advancements in synthesis and purification techniques, coupled with the discovery of new applications in emerging fields like materials science, are expected to mitigate these restraints and ensure sustained market growth. Leading companies like Lier Chemical and Shanghai Bojing Chemical are actively shaping the market through innovation and strategic expansions.

The global 2,2′-Bipyridine market is poised for significant expansion over the Study Period: 2019-2033, with a particular focus on the Base Year: 2025 and the Forecast Period: 2025-2033. During the Historical Period: 2019-2024, the market has witnessed steady growth, driven by an increasing demand for high-purity chemicals in critical industrial and research applications. As of Estimated Year: 2025, the market's valuation is projected to reach several million units, reflecting its burgeoning importance. A key trend observed is the escalating adoption of 2,2′-Bipyridine as a versatile ligand in catalysis, a fundamental aspect of modern organic synthesis. This has led to a demand for higher purity grades, such as 99% Purity, as stringent reaction conditions and sensitive catalytic processes necessitate minimal impurities to ensure optimal efficiency and product selectivity. The Industrial Reagent segment continues to be a strong contributor, with 2,2′-Bipyridine finding widespread use in laboratory settings for various analytical and synthetic procedures. Furthermore, its role as a crucial building block in the synthesis of complex organic molecules, including those with pharmaceutical applications, is gaining considerable traction. This has spurred innovation in manufacturing processes, aiming for enhanced yields and reduced production costs to meet the growing demand. The market is also experiencing a diversification in its application landscape, with emerging uses in material science and electrochemistry, hinting at future growth avenues beyond its traditional roles. The increasing emphasis on sustainable chemistry and green synthesis is also influencing the market, with researchers exploring more environmentally friendly production methods for 2,2′-Bipyridine and its derivatives. Regulatory landscapes, though not explicitly detailed here, are also implicitly shaping market dynamics, influencing production standards and the approval of new applications, particularly in the pharmaceutical sector where stringent quality control is paramount. The overall trend points towards a mature market characterized by increasing sophistication in its applications and a growing demand for specialized, high-purity products.

The growth of the 2,2′-Bipyridine market is predominantly propelled by its indispensable role in organic synthesis. Its exceptional chelating ability, forming stable complexes with a wide array of metal ions, makes it a cornerstone ligand in various catalytic systems. These catalytic processes are fundamental to the efficient and selective synthesis of complex organic molecules, which are in high demand across multiple industries. The pharmaceutical sector, in particular, is a significant driver, as 2,2′-Bipyridine serves as a key intermediate in the production of numerous active pharmaceutical ingredients (APIs). The increasing global demand for novel therapeutics and the expansion of the pharmaceutical industry worldwide directly translates into a higher requirement for high-quality 2,2′-Bipyridine. Beyond pharmaceuticals, its utility as an industrial reagent in analytical chemistry and as a component in the development of new materials, such as organic light-emitting diodes (OLEDs) and solar cells, further bolsters market growth. The continuous advancements in research and development, leading to the discovery of new catalytic applications and material science innovations, are consistently opening up new avenues for 2,2′-Bipyridine utilization. As industries strive for more efficient and sustainable chemical processes, the demand for effective ligands like 2,2′-Bipyridine is expected to surge, making it a critical chemical in the modern industrial landscape.

Despite its robust growth trajectory, the 2,2′-Bipyridine market faces certain challenges and restraints that could temper its expansion. One significant hurdle is the stringent quality control requirements, especially for applications in the pharmaceutical intermediates segment. The production of high-purity grades, such as 99% Purity, demands sophisticated manufacturing processes and rigorous purification techniques, which can be costly and resource-intensive. This can lead to higher production costs and consequently, higher product prices, potentially limiting its adoption in price-sensitive applications. Furthermore, the availability and cost of raw materials used in the synthesis of 2,2′-Bipyridine can fluctuate, impacting overall market stability. Environmental regulations surrounding chemical manufacturing, particularly concerning waste disposal and emissions, can also pose a challenge. Companies need to invest in sustainable production methods and comply with increasingly strict environmental standards, adding to operational expenses. The development of alternative ligands or catalytic systems that offer comparable or superior performance at a lower cost could also present a competitive threat. Moreover, the technical expertise required for the safe handling and effective utilization of 2,2′-Bipyridine in complex synthetic procedures may limit its widespread adoption in smaller or less technologically advanced organizations. Supply chain disruptions, influenced by geopolitical factors or unforeseen events, can also lead to price volatility and affect the consistent availability of the product.

The Organic Synthesis segment, driven by its extensive applications in producing complex chemicals, pharmaceuticals, and advanced materials, is anticipated to be a dominant force in the 2,2′-Bipyridine market. The demand for high-purity grades, particularly 99% Purity, within this segment is expected to soar as researchers and industrial chemists push the boundaries of molecular design and catalytic efficiency. This segment's dominance is closely intertwined with advancements in methodologies like cross-coupling reactions, asymmetric catalysis, and C-H functionalization, all of which heavily rely on sophisticated ligands like 2,2′-Bipyridine for achieving selectivity and high yields.

Key Segments Dominating the Market:

Organic Synthesis: This segment is the bedrock of 2,2′-Bipyridine demand. Its role as a versatile chelating agent in homogeneous catalysis is crucial for synthesizing a vast array of organic compounds. From academic research to industrial-scale production of specialty chemicals, its application in catalysis, particularly in transition metal-catalyzed reactions, is unparalleled. The development of new catalytic systems for novel bond formations and transformations continuously fuels the demand for high-purity 2,2′-Bipyridine. Furthermore, its use as a precursor in the synthesis of more complex ligands and organometallic complexes further solidifies its importance. The drive towards greener and more efficient synthetic routes in the chemical industry inherently favors molecules like 2,2′-Bipyridine that enable precise control over reaction pathways.

Pharmaceutical Intermediates: The pharmaceutical industry represents another significant pillar of the 2,2′-Bipyridine market. It is a vital building block in the synthesis of numerous active pharmaceutical ingredients (APIs). The growing global healthcare needs, coupled with continuous drug discovery and development, ensure a steady and increasing demand. The stringent regulatory requirements in the pharmaceutical sector necessitate the use of extremely high-purity intermediates, thereby driving the demand for 99% Purity grades. The ability of 2,2′-Bipyridine to facilitate the formation of chiral centers and complex molecular structures essential for drug efficacy makes it an indispensable component in pharmaceutical manufacturing.

Key Regions/Countries Influencing Market Dominance:

Asia Pacific: This region, particularly China, is expected to lead the market in terms of both production and consumption. The presence of a robust chemical manufacturing infrastructure, coupled with a rapidly growing pharmaceutical and fine chemical industry, makes it a powerhouse. Countries like China are not only major producers but also significant consumers due to their extensive research and development activities and manufacturing capabilities. The increasing investment in advanced chemical synthesis and the rise of contract manufacturing organizations (CMOs) in this region further contribute to its dominance. The cost-effectiveness of production in Asia Pacific also makes it a competitive supplier to global markets.

North America: With a strong emphasis on pharmaceutical innovation, advanced materials research, and a well-established chemical industry, North America plays a crucial role. The region hosts numerous leading pharmaceutical companies and research institutions that drive demand for high-purity 2,2′-Bipyridine for drug discovery and development, as well as for cutting-edge material science applications. The focus on sustainable chemistry and the development of novel catalytic processes further fuels the market in this region. The presence of stringent quality standards also ensures a consistent demand for premium grades.

Europe: Europe, with its long-standing tradition in chemical research and manufacturing, remains a key player. Countries like Germany, the UK, and Switzerland are home to major chemical and pharmaceutical companies and leading academic institutions. The region's commitment to innovation in catalysis, organic synthesis, and material science, along with a strong regulatory framework, ensures a consistent demand for high-quality 2,2′-Bipyridine. The focus on sustainability and green chemistry also drives the adoption of efficient synthetic methodologies that utilize such versatile ligands.

The 2,2′-Bipyridine industry's growth is significantly catalyzed by the relentless pursuit of novel drug discovery and development, where it serves as a crucial intermediate. Furthermore, advancements in catalysis, particularly in sustainable and efficient organic synthesis, unlock new applications. The expanding use of 2,2′-Bipyridine in the development of next-generation materials, such as in optoelectronics and battery technology, provides a strong growth impetus. Increasing investments in research and development by both academic institutions and industrial players are continuously uncovering novel uses and improving production efficiencies, thereby fostering market expansion.

A comprehensive report on 2,2′-Bipyridine would delve into the intricate market dynamics, providing in-depth analysis from the Historical Period: 2019-2024 through the Forecast Period: 2025-2033, with a sharp focus on the Base Year: 2025. It would dissect the market by Application, meticulously examining the growth within Industrial Reagent, Organic Synthesis, and Pharmaceutical Intermediates. Furthermore, it would analyze the demand for various purity grades, specifically 98% Purity and 99% Purity, highlighting their respective market shares and growth drivers. The report would also explore the geographical landscape, identifying key regions or countries poised for market dominance. Critical trends, driving forces, and the challenges confronting the market would be thoroughly investigated, offering a holistic understanding. Moreover, it would provide insights into significant industry developments, including technological advancements and evolving regulatory landscapes, and showcase the leading players contributing to the market's evolution.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Lier Chemical, Shanghai Bojing Chemical, Jiangyin Ligang 2nd Chemical, Changzhou CIMC Chemical, Jinan Great Chemical, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "2,2′-Bipyridine," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the 2,2′-Bipyridine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.