1. What is the projected Compound Annual Growth Rate (CAGR) of the 1,4-Dichlorobutane?

The projected CAGR is approximately 9.9%.

1,4-Dichlorobutane

1,4-Dichlorobutane1, 4-Dichlorobutane by Type (97% Purity, 98% Purity, Others, World 1, 4-Dichlorobutane Production ), by Application (Industrial Application, Chemical Industry, Medicine, Others, World 1, 4-Dichlorobutane Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

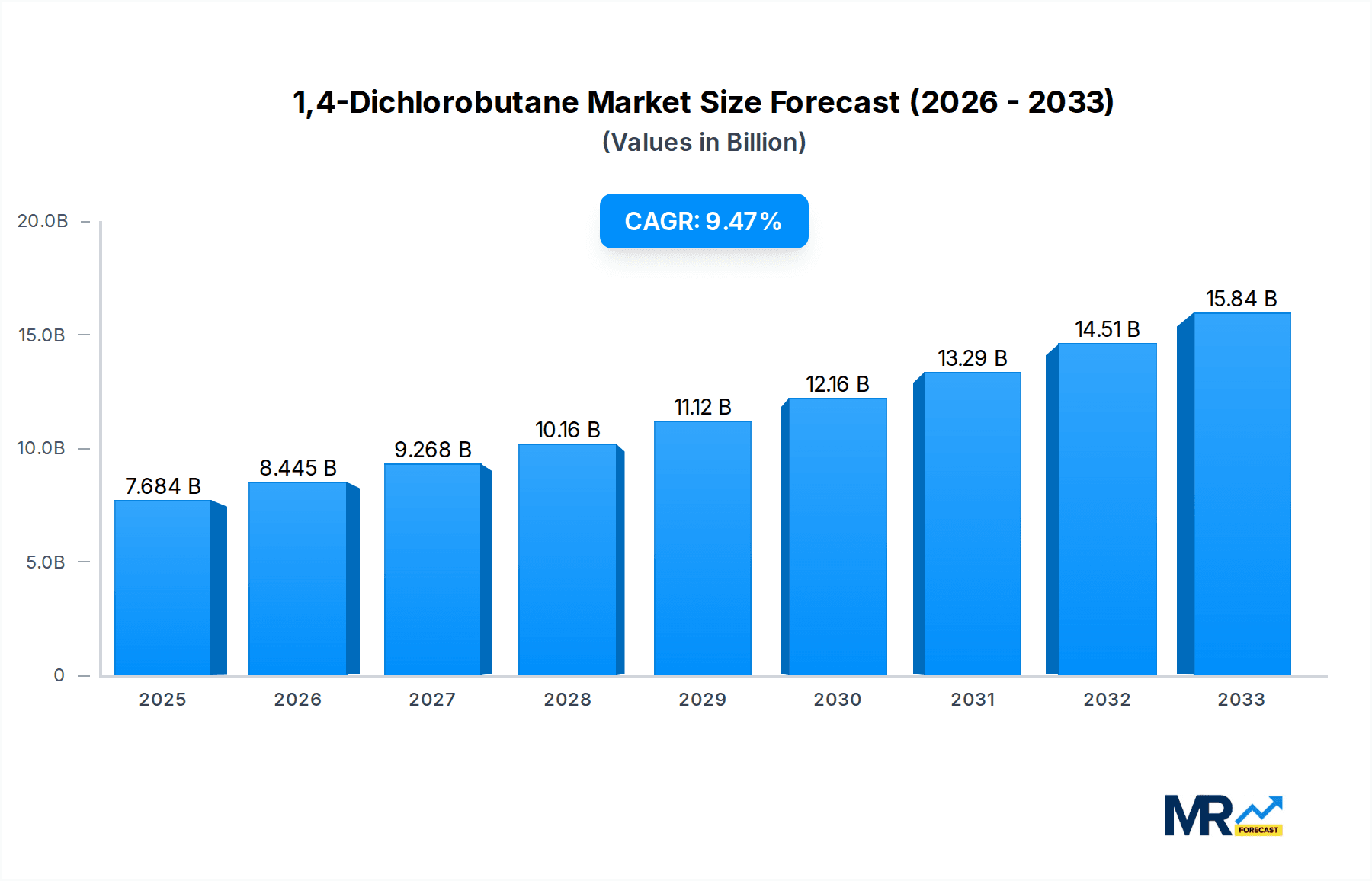

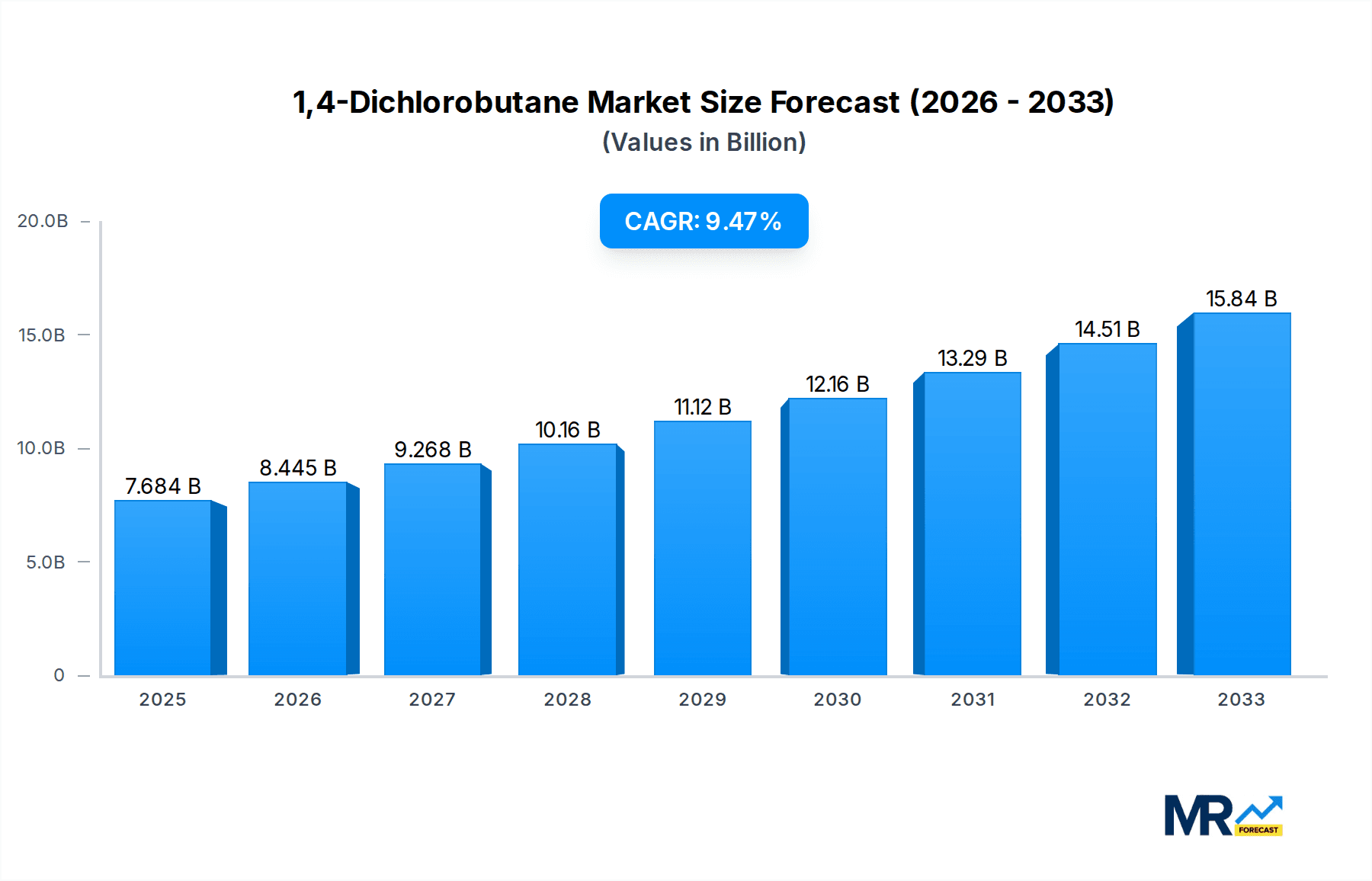

The global 1,4-Dichlorobutane market is projected for robust expansion, with a current estimated market size of approximately $7,684.4 million. This growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 9.9%, indicating a dynamic and expanding sector. The primary drivers for this upward trajectory are the burgeoning demands from the chemical industry and diverse industrial applications. 1,4-Dichlorobutane serves as a crucial intermediate in the synthesis of various fine chemicals, pharmaceuticals, and specialty polymers, making it indispensable for numerous manufacturing processes. The increasing focus on advanced materials and the continuous development of new chemical entities are further fueling its consumption. Furthermore, its utility in producing agrochemicals and its role in specific medical applications contribute significantly to market demand. The market is segmented by purity levels, with 97% and 98% purity grades holding the largest shares due to their widespread industrial adoption. The "Others" category, encompassing specialized applications, also shows promising growth potential.

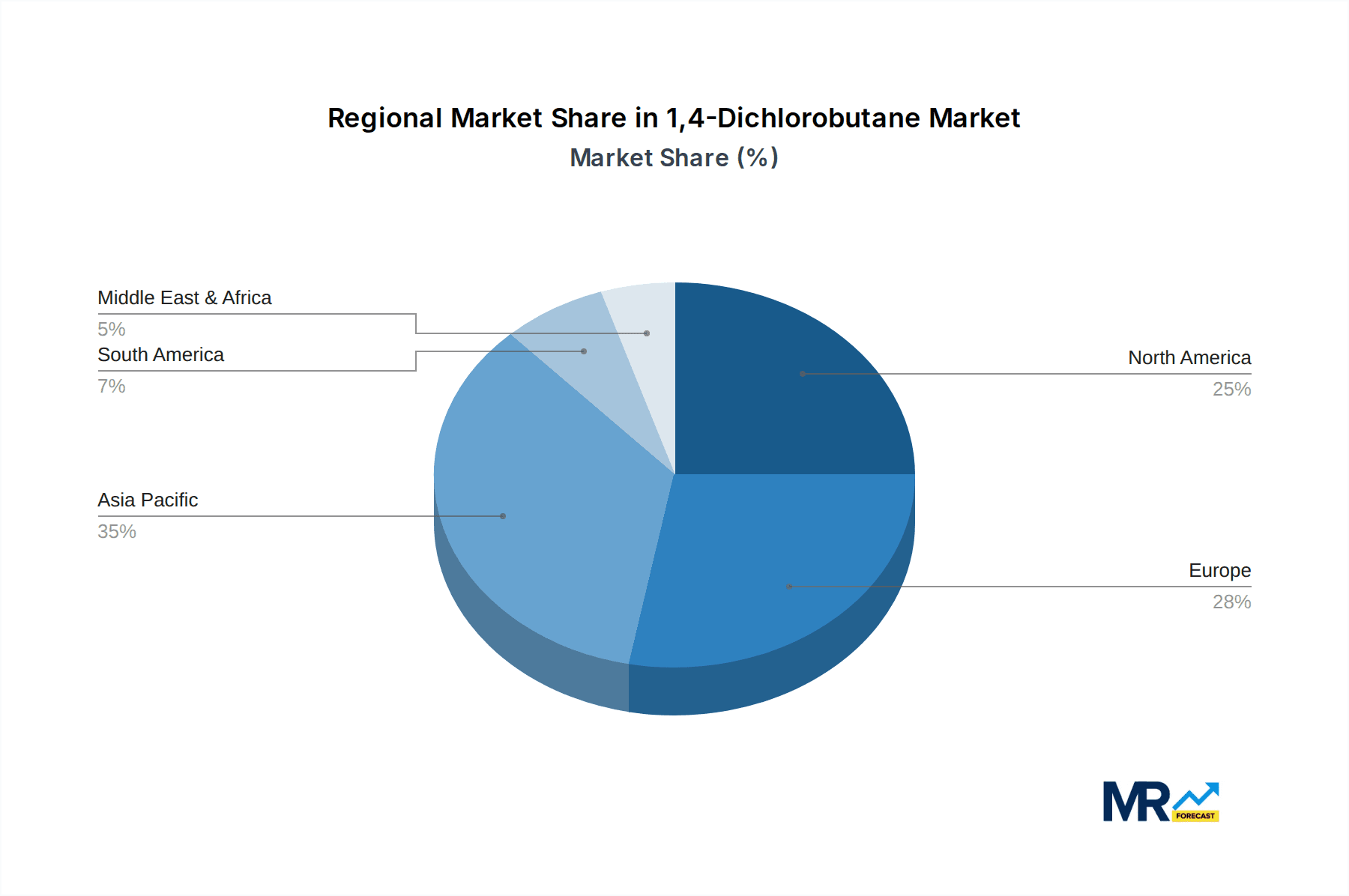

Looking ahead, the forecast period of 2025-2033 is expected to witness sustained growth, propelled by ongoing innovation and expanding end-use sectors. While the market is largely driven by industrial and chemical applications, emerging uses in niche medical segments could present new avenues for expansion. However, potential restraints such as stringent environmental regulations regarding chlorinated hydrocarbons and the fluctuating prices of raw materials could pose challenges to market players. Geographically, Asia Pacific, particularly China and India, is anticipated to emerge as a dominant region due to its large manufacturing base and increasing investments in the chemical sector. North America and Europe are also expected to maintain significant market shares, driven by established chemical industries and a strong emphasis on research and development. Key companies such as TCI, Alfa Aesar, and FUJIFILM Wako Pure Chemical Corporation are actively involved in the market, contributing to its competitive landscape and technological advancements.

This report provides a comprehensive analysis of the global 1,4-Dichlorobutane market, delving into its intricate dynamics from the historical period of 2019-2024, through the base year of 2025, and projecting future trends up to 2033. The study meticulously examines the production volumes, application trends, and industry developments that are shaping this crucial chemical intermediate. Our analysis indicates a steady growth trajectory for 1,4-Dichlorobutane, driven by its indispensable role in a variety of downstream industries.

XXX The global 1,4-Dichlorobutane market is poised for sustained growth, fueled by a confluence of factors encompassing industrial expansion, technological innovation, and evolving consumer demands. During the historical period of 2019-2024, the market witnessed a moderate but consistent increase in consumption, underpinned by its significant applications as a solvent, a precursor in the synthesis of pharmaceuticals and agrochemicals, and a building block for polymers and specialty chemicals. The base year of 2025 is anticipated to mark a pivotal point, with further acceleration expected throughout the forecast period of 2025-2033. Key insights from our study reveal that the demand for high-purity grades, particularly 98% purity, is on an upward trend, reflecting the stringent quality requirements in advanced manufacturing processes and the pharmaceutical sector. The increasing investment in research and development for novel applications, such as in the creation of advanced materials and more efficient chemical synthesis pathways, is also contributing to market buoyancy. Furthermore, the report highlights a discernible shift towards more environmentally conscious production methods, prompting manufacturers to explore greener synthesis routes and optimize resource utilization. This focus on sustainability, coupled with the expanding industrial base in emerging economies, is set to redefine the market landscape. The global production volume is projected to reach in the millions of metric tons, with a significant portion attributed to the Chemical Industry segment. Regional dynamics also play a crucial role, with Asia-Pacific expected to maintain its dominance due to robust manufacturing capabilities and a burgeoning domestic market. The market's resilience is further evidenced by its ability to adapt to fluctuating raw material prices and evolving regulatory frameworks. The projected compound annual growth rate (CAGR) underscores the long-term potential of this market, making it an attractive proposition for stakeholders seeking to capitalize on its expanding opportunities. The estimated market size in 2025 is expected to be in the millions of US dollars, indicating a substantial economic footprint. The interplay between supply chain efficiencies, technological advancements, and end-user industry expansion will be critical determinants of the market's future performance, painting a picture of a dynamic and evolving chemical landscape.

The growth of the 1,4-Dichlorobutane market is being significantly propelled by its intrinsic versatility and its indispensable role as a key intermediate in numerous chemical synthesis processes. The expanding Chemical Industry, across both developed and developing nations, forms a primary driver, with the compound finding extensive use in the production of pharmaceuticals, agrochemicals, and specialty polymers. The increasing global demand for advanced medicines and effective crop protection solutions directly translates into a higher requirement for 1,4-Dichlorobutane. Furthermore, its utility as a solvent in various industrial applications, ranging from coatings and adhesives to the manufacturing of electronic components, adds another layer of impetus. The continuous innovation within the chemical sector, leading to the development of new molecules and advanced materials, often relies on the unique properties of 1,4-Dichlorobutane as a building block. As industries strive for greater efficiency and novel product development, the demand for such versatile chemical intermediates is set to escalate, ensuring a steady upward trajectory for the market.

Despite its promising growth prospects, the 1,4-Dichlorobutane market faces several challenges and restraints that could potentially temper its expansion. Foremost among these are the environmental and health concerns associated with chlorinated hydrocarbons. Stringent environmental regulations regarding emissions and waste disposal of such compounds can lead to increased compliance costs for manufacturers, potentially impacting profit margins. The volatility of raw material prices, particularly those derived from petrochemical feedstocks, also poses a significant challenge, introducing uncertainty into production costs and market pricing. Furthermore, the availability of substitute chemicals with similar functionalities but potentially lower environmental impact could pose a threat to market share, especially in applications where performance parity can be achieved. The development and adoption of these alternatives, driven by both regulatory pressures and consumer preference for greener products, require continuous monitoring and strategic responses from market players. Additionally, logistical complexities and supply chain disruptions, exacerbated by geopolitical factors or natural disasters, can affect the timely and cost-effective delivery of 1,4-Dichlorobutane, thereby impacting its market accessibility.

The global 1,4-Dichlorobutane market is characterized by a dominant presence in the Asia-Pacific region, driven by its robust industrial infrastructure, burgeoning manufacturing sectors, and a rapidly expanding consumer base. Within this dynamic region, China stands out as a powerhouse, not only in terms of production but also in consumption, fueled by its extensive chemical industry and significant contributions to global supply chains. The sheer scale of manufacturing activities across various segments, from industrial applications to the pharmaceutical sector, necessitates a substantial and consistent demand for 1,4-Dichlorobutane.

When considering segments, World 1,4-Dichlorobutane Production itself, as a foundational element, underpins the market's structure. However, the Chemical Industry segment is a primary driver of consumption and thus market dominance. This segment encompasses a broad spectrum of applications, including its use as a precursor in the synthesis of various organic compounds, polymers, and specialty chemicals. The continuous innovation and expansion within the global chemical industry directly translate into increased demand for intermediates like 1,4-Dichlorobutane.

Furthermore, the Industrial Application segment is also a significant contributor to market dominance. This includes its utilization as a solvent in the production of adhesives, coatings, and as a cleaning agent in various manufacturing processes. The ongoing industrialization and manufacturing growth in emerging economies further bolster the demand in this segment.

Asia-Pacific Region:

Key Segments Driving Dominance:

The estimated production volume for 1,4-Dichlorobutane in the dominant regions and segments is projected to be in the millions of metric tons, underscoring its substantial market share. The interplay between the vast manufacturing capabilities in Asia-Pacific and the critical role of the chemical and industrial application segments in driving demand solidifies their position as the key drivers of the global 1,4-Dichlorobutane market. The forecast period of 2025-2033 is expected to witness continued consolidation of this dominance, albeit with potential shifts in specific sub-segments based on evolving technological advancements and regulatory landscapes. The market's growth will be further propelled by increasing investments in downstream industries within these dominant regions, ensuring a sustained demand for 1,4-Dichlorobutane.

The 1,4-Dichlorobutane industry is experiencing significant growth catalysts driven by the relentless pursuit of innovation in downstream sectors. The pharmaceutical industry's continuous quest for new drug development and the agrochemical sector's need for more effective crop protection solutions are primary stimulants. Furthermore, advancements in material science are uncovering novel applications for 1,4-Dichlorobutane in the synthesis of high-performance polymers and specialty chemicals, thus expanding its market reach. The increasing global industrial output, particularly in emerging economies, also fuels demand for its solvent and intermediate properties, creating a robust growth trajectory.

This report offers an exhaustive examination of the 1,4-Dichlorobutane market, delving into its historical performance, current landscape, and future projections from 2019 to 2033. It meticulously analyzes key market drivers, restraints, and emerging opportunities. The study provides in-depth insights into regional market dynamics, segment-wise performance, and the competitive strategies of leading manufacturers. With an estimated market size in the millions of US dollars in 2025 and projected production volumes in the millions of metric tons, this report offers a holistic view essential for strategic decision-making within the chemical industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 9.9%.

Key companies in the market include TCI, Alfa Aesar, Biosynth Carbosynth, Chem Service, FUJIFILM Wako Pure Chemical Corporation, HPC Standards GmbH, AccuStandard.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "1,4-Dichlorobutane," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the 1,4-Dichlorobutane, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.