1. What is the projected Compound Annual Growth Rate (CAGR) of the 128 Beam Lidar?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

128 Beam Lidar

128 Beam Lidar128 Beam Lidar by Type (Mechanical Lidar, Solid State Lidar), by Application (Self-Driving Cars, Robot, Drone, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

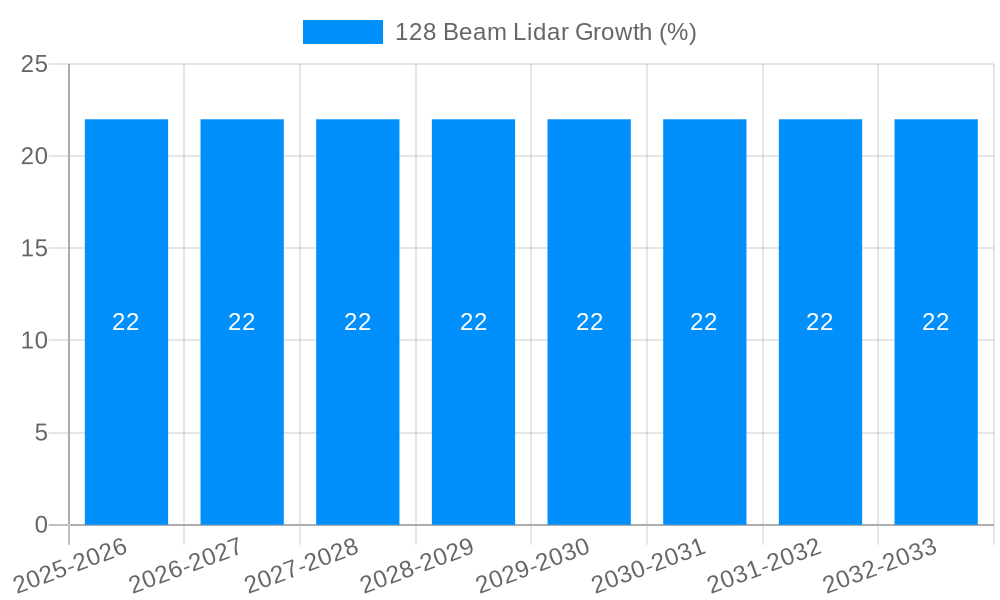

The 128-beam Lidar market is poised for substantial growth, driven by the accelerating adoption of advanced driver-assistance systems (ADAS) and the burgeoning autonomous vehicle (AV) sector. With a projected market size of approximately USD 1.2 billion in 2025, this segment is expected to expand at a Compound Annual Growth Rate (CAGR) of around 22% through 2033. The increasing demand for sophisticated perception systems in self-driving cars, robots, and drones, all requiring high-resolution object detection and precise spatial mapping, fuels this expansion. Key market players like Velodyne, Ouster, RoboSense, Hesai Technology, and VanJee Technology are actively innovating, focusing on reducing costs and improving the performance and reliability of 128-beam Lidar solutions to meet the stringent requirements of these applications. The market's value is estimated to reach over USD 5.5 billion by 2033, underscoring its significant potential.

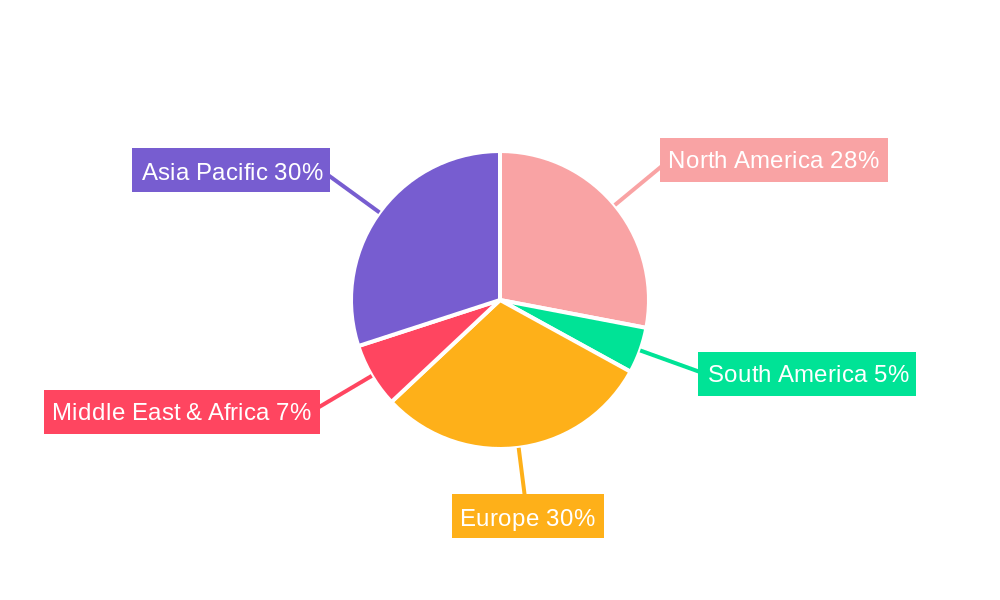

Geographically, the Asia Pacific region, particularly China, is emerging as a dominant force, driven by its robust automotive industry, significant government investment in smart city initiatives and autonomous technology, and a strong presence of leading Lidar manufacturers. North America and Europe also represent substantial markets, owing to early adoption of autonomous driving technologies and stringent safety regulations that necessitate advanced sensing capabilities. While Mechanical Lidar, with its established performance, currently holds a significant share, the market is witnessing a strong trend towards Solid-State Lidar solutions due to their advantages in terms of cost-effectiveness, durability, and smaller form factors. Overcoming the current restraints of high manufacturing costs and the need for further standardization will be crucial for unlocking the full potential of the 128-beam Lidar market in the coming years.

Here's a unique report description for a 128-Beam Lidar market analysis, incorporating your specific requirements:

The global 128-beam Lidar market is poised for substantial expansion, projected to surge from an estimated value of $750 million in the base year of 2025 to an impressive $3.5 billion by the end of the forecast period in 2033. This remarkable growth trajectory, spanning the historical period of 2019-2024 and the extensive study period of 2019-2033, is underpinned by a confluence of technological advancements and escalating demand across various sectors. During the historical period, early adoption in research and development for autonomous systems laid the groundwork for today's market, with initial deployments often costing upwards of $20,000 per unit, a figure that has significantly decreased with mass production. The estimated year of 2025 marks a critical inflection point, where affordability begins to intersect with performance, making 128-beam Lidar a more viable option for a wider array of applications. Key market insights reveal a discernible shift from purely high-end automotive prototypes to broader integration in commercial fleets, advanced robotics, and sophisticated drone systems. The increasing resolution and density offered by 128-beam configurations are crucial for enabling robust perception capabilities, particularly in complex and dynamic environments. Furthermore, the ongoing refinement of solid-state Lidar technologies, promising greater reliability and lower production costs, is set to revolutionize the market, potentially disrupting the dominance of traditional mechanical Lidar solutions. Industry developments are actively pushing the boundaries of range, field of view, and resistance to adverse weather conditions, directly addressing earlier limitations and paving the way for widespread adoption. The next few years are expected to witness a significant increase in the average selling price, which, while still substantial, will represent a marked improvement in value for money as manufacturing efficiencies scale. The market's dynamism is further highlighted by the ongoing R&D investments by major players, aiming to reduce unit costs to below $1,500 for mass-market applications by 2030.

The ascendance of the 128-beam Lidar market is primarily driven by the insatiable demand for enhanced safety and autonomy in the automotive sector. As the industry gears up for widespread deployment of Level 4 and Level 5 autonomous vehicles, the need for precise, real-time 3D environmental mapping becomes paramount. 128-beam Lidar systems, with their superior point cloud density and resolution, offer the critical perception capabilities required to accurately detect objects, identify their trajectories, and navigate complex urban landscapes. Beyond passenger vehicles, the burgeoning field of logistics and commercial transportation is also a significant propellant. Autonomous trucks and delivery robots rely heavily on advanced sensing technologies like 128-beam Lidar to ensure safe and efficient operation, minimizing human error and optimizing delivery routes. The rapid evolution of the robotics industry, encompassing warehouse automation, industrial robots, and service robots, further fuels this demand. These machines require sophisticated spatial awareness to perform tasks effectively and safely in dynamic, often unpredictable environments. The increasing sophistication of drones, from industrial inspection and surveying to last-mile delivery, also necessitates higher-fidelity sensing, making 128-beam Lidar a compelling upgrade. The foundational R&D from the historical period, with significant investments in sensor fusion and AI algorithms, is now translating into practical applications, creating a virtuous cycle of innovation and adoption.

Despite the promising growth, the 128-beam Lidar market is not without its hurdles. A primary challenge remains the cost of production. While prices have fallen dramatically from the tens of thousands of dollars per unit seen in the historical period, achieving an average selling price below the target of $1,500 for widespread consumer adoption in the forecast period requires significant manufacturing scale and technological breakthroughs, especially for solid-state variants. The sheer complexity of manufacturing high-density Lidar units with millions of components presents a substantial hurdle. Furthermore, performance limitations in adverse weather conditions, such as heavy rain, fog, and snow, continue to be a concern. While advancements are being made, Lidar’s reliance on light scattering can be compromised by atmospheric interference, necessitating sophisticated signal processing and sensor fusion with other perception modalities. Integration complexity within existing vehicle architectures and robotic systems also presents a challenge. Ensuring seamless data flow and processing from the Lidar sensor to the vehicle's central processing unit requires substantial engineering effort and standardization. The regulatory landscape for autonomous systems, while evolving, can also create uncertainties, potentially slowing down the pace of adoption and market penetration. Finally, consumer perception and trust in autonomous technologies, directly linked to the reliability of their sensing systems, remain an important factor that needs to be addressed through proven performance and safety.

The Self-Driving Cars segment is unequivocally set to dominate the 128-beam Lidar market, with its influence extending across all key geographical regions. This dominance is projected to propel the market from an estimated $750 million in 2025 to over $2.5 billion within the forecast period. The sheer scale of investment and the imperative for advanced safety features in the automotive industry make it the primary driver.

Within this overarching dominance of self-driving cars, Solid State Lidar is anticipated to experience the most significant growth within the Type segment. While mechanical Lidar has historically held sway, the inherent advantages of solid-state technology in terms of reliability, reduced moving parts, lower power consumption, and potential for mass production at a more affordable price point (targeting below $1,000 per unit by 2030) are compelling. This technological shift will be crucial in enabling the widespread adoption of 128-beam Lidar beyond niche automotive applications and into more cost-sensitive markets. The market for solid-state 128-beam Lidar is expected to grow from an estimated $400 million in 2025 to over $2 billion by 2033, outpacing the growth of mechanical Lidar.

The 128-beam Lidar industry is significantly propelled by the accelerating pace of autonomous vehicle development and adoption. Government initiatives and supportive regulations globally are creating a conducive environment for Lidar integration. Advancements in AI and machine learning are enhancing Lidar data processing capabilities, unlocking new use cases. Furthermore, the increasing demand for sophisticated robotics and drones across various industries is creating substantial market opportunities. The declining cost of manufacturing, driven by economies of scale and technological innovation in solid-state Lidar, is a key catalyst for broader market penetration.

This comprehensive report offers an in-depth analysis of the global 128-beam Lidar market, encompassing a detailed examination of trends, driving forces, challenges, and future prospects. Spanning the historical period of 2019-2024 through to the extensive forecast period of 2025-2033, the report provides critical insights into market dynamics. It delves into the technological evolution from mechanical to solid-state Lidar, its pivotal role in self-driving cars, robots, and drones, and the industry developments shaping its trajectory. With an estimated market value of $750 million in 2025, the report scrutinizes key regions, dominant segments, and the crucial growth catalysts that will propel the market to an estimated $3.5 billion by 2033, offering invaluable strategic intelligence for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Velodyne, Ouster, RoboSense, Hesai Technology, VanJee Technology.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "128 Beam Lidar," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the 128 Beam Lidar, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.