MRF Publication News is a trusted platform that delivers the latest industry updates, research insights, and significant developments across a wide range of sectors. Our commitment to providing high-quality, data-driven news ensures that professionals and businesses stay informed and competitive in today’s fast-paced market environment.

The News section of MRF Publication News is a comprehensive resource for major industry events, including product launches, market expansions, mergers and acquisitions, financial reports, and strategic partnerships. This section is designed to help businesses gain valuable insights into market trends and dynamics, enabling them to make informed decisions that drive growth and success.

MRF Publication News covers a diverse array of industries, including Healthcare, Automotive, Utilities, Materials, Chemicals, Energy, Telecommunications, Technology, Financials, and Consumer Goods. Our mission is to provide professionals across these sectors with reliable, up-to-date news and analysis that shapes the future of their industries.

By offering expert insights and actionable intelligence, MRF Publication News enhances brand visibility, credibility, and engagement for businesses worldwide. Whether it’s a ground breaking technological innovation or an emerging market opportunity, our platform serves as a vital connection between industry leaders, stakeholders, and decision-makers.

Stay informed with MRF Publication News – your trusted partner for impactful industry news and insights.

Materials

As we navigate through the complexities of global markets, understanding current trends and future expectations is crucial for investors and financial analysts alike. This week, several key factors are influencing market dynamics, including economic uncertainty, geopolitical tensions, and fluctuations in major stock indices. In this article, we will delve into the current state of global markets, highlighting key trends and what investors can expect in the coming days.

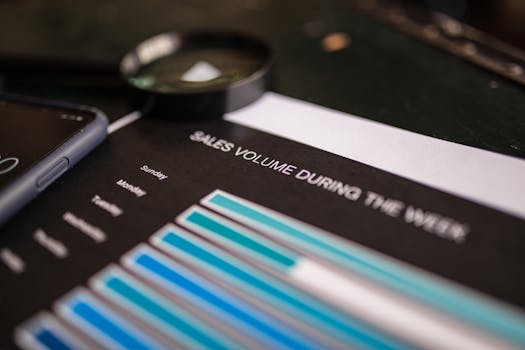

On March 14, 2025, global stock markets exhibited mixed performances. The S&P 500 closed down by 1.39%, remaining below its 200-day moving average, a trend that has been consistent for some time[3]. The Dow Jones Industrial Average also experienced a decline of approximately 1.30%, with its RSI indicating oversold conditions[1]. In contrast, the Nikkei 225 in Japan saw a slight increase of 0.72%, despite being below its key moving averages[1].

Several economic factors are currently impacting market sentiment:

As we look ahead, several factors will shape market expectations:

Understanding the complex interplay of economic and geopolitical factors is essential for navigating today's markets. As investors look to the future, staying informed about key trends and developments will be crucial for making informed decisions. Whether it's the impact of tariffs on economic growth or the potential for seasonal stock trends, staying ahead of the curve is vital in today's fast-paced financial landscape.