Industrials

6 months agoMRF Publications

Introduction to the US-China Trade Conflict

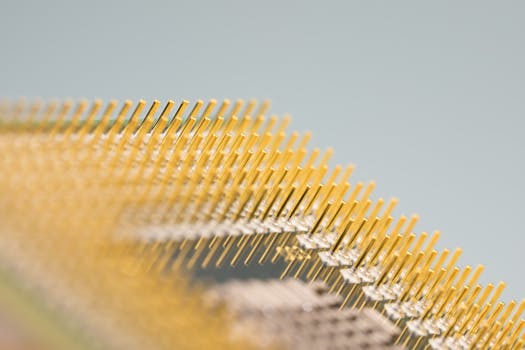

The ongoing trade war between the United States and China has taken a new turn as the Trump administration intensifies its restrictions on technology exports. In a significant move, the administration has ordered several key chip design software firms to halt their sales to China. This directive notably affects industry giants such as Synopsys and Cadence, sparking widespread concern over the future of semiconductor technology and global trade dynamics.

The Ban on Chip Design Software Exports

Key Players Impacted

- Synopsys: A leading provider of electronic design automation (EDA) software, crucial for the development of advanced semiconductor chips.

- Cadence: Another major player in the EDA market, whose software is essential for the design and verification of complex integrated circuits.

Details of the Ban

The U.S. Department of Commerce has issued a directive that prevents these companies from selling their sophisticated design tools to Chinese entities. This move is part of a broader strategy to curb China's technological advancement in critical areas such as artificial intelligence (AI), 5G technology, and advanced computing.

Rationale Behind the Decision

The Trump administration's decision is driven by national security concerns, aiming to prevent China from gaining a strategic advantage in cutting-edge technologies. The administration believes that by restricting access to these tools, it can slow down China's progress in developing advanced semiconductors, which are vital for military and commercial applications.

Implications for the Semiconductor Industry

Impact on Synopsys and Cadence

For Synopsys and Cadence, this ban represents a significant blow. Both companies have a substantial presence in the Chinese market, and the loss of this revenue stream could affect their financial performance and growth prospects. Moreover, the ban could lead to a shift in the global semiconductor supply chain, as Chinese companies seek alternative solutions or develop their own technologies.

Broader Industry Effects

- Supply Chain Disruptions: The ban could disrupt the global supply chain for semiconductors, as many companies rely on Chinese manufacturers for production.

- Innovation and Competition: The restriction on access to advanced design tools may slow down innovation in China, but it could also spur Chinese companies to accelerate their efforts to develop indigenous technologies.

- Global Trade Relations: This move is likely to further strain US-China trade relations, potentially leading to retaliatory measures from China.

Reactions from Stakeholders

Industry Leaders

Executives from Synopsys and Cadence have expressed their concerns over the ban, highlighting the potential negative impact on their businesses and the broader semiconductor industry. They argue that such restrictions could ultimately harm global technological progress and innovation.

Government Officials

U.S. government officials have defended the decision, emphasizing the need to protect national security interests. They argue that the ban is necessary to prevent China from using advanced technologies for military purposes.

Chinese Response

The Chinese government has strongly criticized the U.S. move, calling it an unfair trade practice that violates international trade norms. Chinese officials have hinted at possible retaliatory measures, which could further escalate tensions between the two economic superpowers.

The Future of US-China Trade Relations

Potential Outcomes

- Escalation of Trade War: The ban on chip design software could lead to further escalation of the US-China trade war, with both sides imposing additional tariffs and restrictions.

- Negotiation and De-escalation: There is also a possibility that this move could prompt renewed negotiations between the U.S. and China, potentially leading to a de-escalation of tensions and a new trade agreement.

- Long-term Impact on Global Trade: The ongoing trade conflict could have long-lasting effects on global trade patterns, reshaping the landscape of international commerce and technology development.

Strategies for Companies

Companies in the semiconductor industry, particularly those affected by the ban, will need to adapt to the changing trade environment. This may involve diversifying their supply chains, investing in alternative markets, and accelerating the development of new technologies to remain competitive.

Conclusion

The Trump administration's decision to ban the export of chip design software to China marks a significant escalation in the US-China trade war. This move not only impacts major players like Synopsys and Cadence but also has far-reaching implications for the global semiconductor industry and international trade relations. As the situation continues to evolve, stakeholders will need to navigate these challenges carefully to mitigate risks and capitalize on new opportunities.

Key Takeaways

- The Trump administration has ordered chip design software firms to stop selling to China, affecting companies like Synopsys and Cadence.

- The ban is driven by national security concerns and aims to slow down China's technological advancement.

- The move could disrupt global semiconductor supply chains and impact innovation in the industry.

- US-China trade relations are likely to be further strained, with potential for both escalation and negotiation.

- Companies in the semiconductor sector will need to adapt to the changing trade environment to remain competitive.

By staying informed and proactive, businesses and policymakers can better navigate the complexities of the US-China trade conflict and its impact on the global economy.