Consumer Discretionary

6 months agoMRF Publications

**

Trump Era's Economic Gloom: How Negative Sentiment Stifled Investment & Hampered Growth

The Trump presidency, despite boasting significant tax cuts and deregulation, was met with a persistent undercurrent of negativity among investors. This pervasive pessimism, fueled by unpredictable policy shifts, trade wars, and escalating political rhetoric, arguably stifled investment and hindered robust economic growth, showcasing the powerful influence of sentiment on financial markets and challenging the narrative of unbridled economic prosperity. Understanding this dynamic is crucial for navigating future economic uncertainties and learning from past mistakes in economic policy and forecasting. This article explores how negativity shaped investment decisions during this period, examining the impact on various sectors and exploring the psychological factors at play.

The Reign of Uncertainty: Policy Volatility and Investor Sentiment

One of the primary drivers of negative investor sentiment during the Trump administration was the inherent unpredictability of its policies. Frequent shifts in trade policy, marked by the initiation of trade wars with major economies like China, created an environment of immense uncertainty. Keywords like "trade war impact on stock market," "tariff effects on investment," and "economic uncertainty index" reflect the intense focus on this volatile landscape. Investors, inherently risk-averse, reacted by delaying or reducing investment, opting for safer, albeit less lucrative, options. This is highlighted in studies examining the correlation between policy uncertainty and capital expenditures.

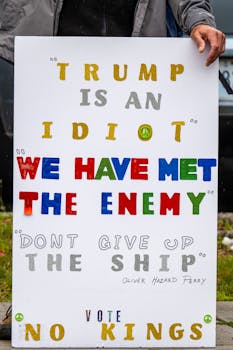

The frequent use of social media by President Trump, often characterized by inflammatory rhetoric and abrupt policy announcements, further exacerbated this sense of uncertainty. This created a "Trump risk premium," where investors demanded higher returns to compensate for the increased perceived risk. Searching for terms like "Trump tweets market impact" or "political risk premium" reveals a wealth of analysis on this specific phenomenon.

Beyond Tariffs: Sector-Specific Impacts of Negative Sentiment

The impact of negative sentiment wasn't uniformly distributed across sectors. While some industries benefited from specific policy changes (like deregulation in energy), others faced significant headwinds. The manufacturing sector, heavily impacted by trade wars, experienced significant challenges, with reduced investment in new equipment and expansion. Keywords such as "manufacturing investment decline," "supply chain disruption," and "global trade uncertainty" are directly relevant to the struggles faced in this sector.

Similarly, the agricultural sector was severely affected by retaliatory tariffs imposed by trading partners, leading to reduced exports and farm bankruptcies. This underscores the interconnectedness of global markets and the vulnerability of certain sectors to shifts in international relations, particularly under conditions of heightened uncertainty and negativity.

The Psychology of Investment: Fear, Doubt, and Uncertainty

The Trump era's impact on investor sentiment highlights the significant psychological factors influencing investment decisions. Fear, uncertainty, and doubt (FUD), frequently used terms in the financial world, played a dominant role. Investors, faced with unpredictable policy shifts and escalating geopolitical tensions, prioritized risk aversion over potential gains. This behavior aligns with well-established principles of behavioral economics, illustrating that rational economic models often fail to capture the complexities of human decision-making under pressure.

- Fear of the Unknown: The unpredictable nature of Trump’s policies fueled a constant sense of unease, discouraging long-term investments.

- Doubt in Policy Consistency: Frequent policy reversals eroded investor confidence in the long-term stability of the economic environment.

- Uncertainty about Future Regulations: The threat of new regulations or abrupt changes to existing ones stifled investment in certain sectors.

The Long-Term Consequences of Economic Gloom

The prevailing negativity during the Trump era had lasting consequences. Delayed investments meant slower economic growth, fewer job creations, and a potentially diminished capacity for future expansion. This reinforces the notion that a positive and stable policy environment is crucial for attracting investment and fostering sustainable economic development. Analyzing data on economic growth during this period and comparing it to historical trends reveals the significant impact of negative sentiment. Keywords like "GDP growth under Trump," "business investment trends," and "economic forecast accuracy" can offer valuable insights into this long-term impact.

Lessons Learned: Navigating Future Economic Uncertainty

The experience of the Trump era offers valuable lessons for both policymakers and investors. Clear, consistent, and transparent communication is crucial for fostering investor confidence. Predictable policy implementation, even if controversial, is generally preferable to unpredictable shifts. Moreover, investors must develop strategies for mitigating risk in volatile environments, acknowledging the significant role of sentiment in shaping market dynamics.

Understanding the interplay between political events, policy decisions, and investor psychology is key to making informed investment decisions and contributing to a more stable and sustainable economic future. Ignoring the influence of sentiment, as many economic forecasts seemed to do during the Trump era, can lead to inaccurate predictions and costly misjudgments. By recognizing and analyzing these interconnected factors, we can strive towards a future where economic policy and investment decisions are informed by a more complete and nuanced understanding of the complex forces at play.