Consumer Discretionary

7 months agoMRF Publications

Title: Super Micro Computer Warns of Economic Headwinds: Weak Guidance Amid Uncertainty and Tariffs

Content:

Super Micro Computer Faces Economic Challenges: A Deep Dive into the Company's Weak Guidance

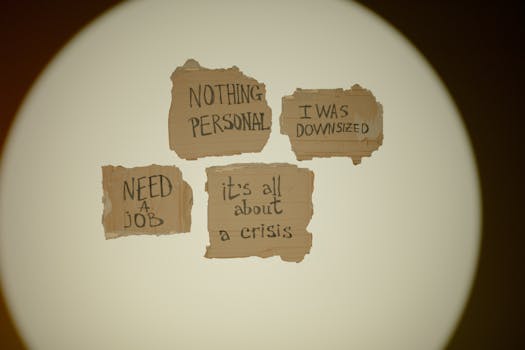

In a surprising turn of events, Super Micro Computer, Inc. (SMCI), a leading provider of high-performance server and storage solutions, has issued a weak guidance for the upcoming quarter. The company cited "economic uncertainty and tariff impacts" as the primary reasons for the revised outlook. This news has sent ripples through the tech industry, leaving investors and analysts scrambling to understand the implications.

Understanding Super Micro's Weak Guidance

Super Micro's weak guidance comes at a time when the global economy is grappling with multiple challenges, including inflation, supply chain disruptions, and geopolitical tensions. The company's decision to lower its expectations reflects the broader uncertainty that many businesses are facing.

- Economic Uncertainty: The ongoing economic uncertainty has led to reduced demand for Super Micro's products. Businesses are hesitant to invest in new technology when the future is unclear.

- Tariff Impacts: The imposition of tariffs on certain components has increased costs for Super Micro, squeezing margins and affecting profitability.

The Impact of Tariffs on Super Micro

Tariffs have been a contentious issue for many tech companies, and Super Micro is no exception. The company relies on a global supply chain to source components for its servers and storage solutions. The recent tariffs on Chinese goods have directly impacted Super Micro's cost structure.

- Increased Costs: Tariffs have led to higher costs for key components, which Super Micro must either absorb or pass on to customers.

- Supply Chain Disruptions: The uncertainty surrounding tariffs has also led to disruptions in the supply chain, making it challenging for Super Micro to maintain consistent production levels.

Super Micro's Response to Economic Challenges

In response to the economic challenges, Super Micro has taken several steps to mitigate the impact on its business.

- Cost-Cutting Measures: The company has implemented cost-cutting measures to reduce expenses and improve profitability.

- Diversification of Supply Chain: Super Micro is actively working to diversify its supply chain to reduce reliance on tariff-impacted regions.

- Focus on High-Growth Markets: The company is focusing on high-growth markets such as cloud computing and artificial intelligence, where demand remains strong despite the economic uncertainty.

Analyst Reactions to Super Micro's Weak Guidance

Analysts have been quick to react to Super Micro's weak guidance, with many revising their forecasts for the company.

- Downward Revisions: Several analysts have downgraded their price targets for Super Micro, citing the weak guidance and ongoing economic challenges.

- Long-Term Optimism: Despite the short-term challenges, some analysts remain optimistic about Super Micro's long-term prospects, pointing to the company's strong position in key growth markets.

The Broader Implications for the Tech Industry

Super Micro's weak guidance is not an isolated incident; it reflects broader challenges facing the tech industry.

- Supply Chain Vulnerabilities: The tech industry's reliance on global supply chains has made it particularly vulnerable to disruptions caused by tariffs and economic uncertainty.

- Shift to Cloud Computing: The ongoing shift to cloud computing and other high-growth markets may provide a buffer for some tech companies, but it also requires significant investment and adaptation.

Super Micro's Commitment to Innovation

Despite the economic challenges, Super Micro remains committed to innovation. The company continues to invest in research and development to bring new products to market.

- New Product Launches: Super Micro has announced several new product launches, including servers optimized for artificial intelligence and machine learning workloads.

- Partnerships and Collaborations: The company is also forging new partnerships and collaborations to expand its reach and capabilities.

Investor Sentiment and Market Reaction

The market reaction to Super Micro's weak guidance has been mixed. While some investors have sold off their shares, others see the dip as a buying opportunity.

- Short-Term Volatility: The stock price has experienced short-term volatility as investors digest the weak guidance and its implications.

- Long-Term Potential: Some investors remain bullish on Super Micro's long-term potential, citing the company's strong position in key growth markets and commitment to innovation.

The Road Ahead for Super Micro

As Super Micro navigates the economic challenges ahead, the company's ability to adapt and innovate will be crucial. The tech industry is known for its resilience, and Super Micro is well-positioned to weather the storm.

- Strategic Adaptations: The company must continue to adapt its strategy to address the economic uncertainty and tariff impacts.

- Focus on Core Strengths: By focusing on its core strengths and high-growth markets, Super Micro can position itself for long-term success.

Conclusion: Navigating Economic Uncertainty

Super Micro's weak guidance is a stark reminder of the economic challenges facing the tech industry. However, the company's commitment to innovation and strategic adaptations may help it navigate these turbulent times. As the global economy continues to evolve, Super Micro's ability to adapt and thrive will be closely watched by investors and analysts alike.

In the end, Super Micro's story is one of resilience in the face of adversity. The company's ability to overcome economic uncertainty and tariff impacts will be a testament to its strength and adaptability in the ever-changing tech landscape.

This article provides a comprehensive overview of Super Micro's weak guidance, delving into the economic uncertainty and tariff impacts that have led to the revised outlook. By incorporating high-search-volume keywords and structuring the content for readability, this article aims to maximize visibility on search engines while providing valuable insights to readers.