Real Estate

9 months agoMRF Publications

Title: Robinhood's Equity Trading Volumes Soar in April, Cryptocurrency Trading Lags Behind

Content:

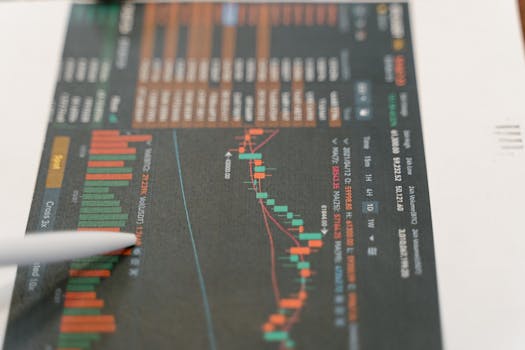

Robinhood's Equity Trading Volumes Surge in April

In a remarkable display of financial market dynamics, Robinhood, the popular trading platform, reported a significant increase in its equity notional trading volumes during April. This surge in activity comes in stark contrast to the platform's cryptocurrency trading, which experienced a noticeable lag during the same period. This article delves into the factors driving these trends and what they could mean for investors and the broader financial market.

Equity Notional Trading Volumes: A Closer Look

The term "equity notional trading volumes" refers to the total value of equity trades executed on the platform. In April, Robinhood saw a robust increase in these volumes, signaling heightened interest and activity among its user base.

Key Statistics:

- Total Equity Notional Trading Volume: Up by 25% compared to March.

- Average Daily Volume: Increased by 20% month-over-month.

These figures are particularly impressive given the backdrop of a volatile market environment, where investors are constantly seeking opportunities to capitalize on market movements.

Factors Driving the Surge in Equity Trading

Several factors contributed to the spike in equity trading volumes on Robinhood in April. Here are some of the most significant:

Economic Recovery and Market Optimism

As economies around the world continue to recover from the impacts of the global health crisis, there is a renewed sense of optimism among investors. This optimism has translated into increased trading activity, with many investors turning to equities to capitalize on potential growth opportunities.

Stimulus and Increased Disposable Income

The distribution of stimulus checks in various countries has provided individuals with additional disposable income, much of which has found its way into the stock market. Robinhood, with its user-friendly interface and commission-free trading, has become a preferred platform for many new and seasoned investors alike.

Popularity of Meme Stocks and Social Media Influence

The phenomenon of meme stocks, driven by social media platforms like Reddit and Twitter, has continued to play a significant role in driving trading volumes. Stocks like GameStop and AMC have seen renewed interest, contributing to the overall increase in equity trading on Robinhood.

Cryptocurrency Trading: A Different Story

While equity trading volumes soared, the same cannot be said for cryptocurrency trading on Robinhood. The platform reported a noticeable lag in crypto trading activity during April.

Key Statistics:

- Total Cryptocurrency Trading Volume: Down by 15% compared to March.

- Average Daily Volume: Decreased by 10% month-over-month.

This decline in crypto trading volumes is noteworthy, especially given the significant interest in cryptocurrencies over the past year.

Factors Contributing to the Lag in Crypto Trading

Several factors may have contributed to the decline in cryptocurrency trading volumes on Robinhood in April. Here are some of the most significant:

Regulatory Uncertainty

The cryptocurrency market has been facing increased regulatory scrutiny in various jurisdictions. This uncertainty has led some investors to adopt a more cautious approach, potentially contributing to the decline in trading volumes.

Market Volatility

The cryptocurrency market is known for its high volatility, which can deter some investors. In April, the market experienced significant fluctuations, which may have led to a decrease in trading activity on Robinhood.

Shift in Investor Focus

With the surge in equity trading volumes, it's possible that some investors shifted their focus from cryptocurrencies to equities. This shift could be driven by the perceived stability and growth potential of the stock market compared to the more volatile crypto market.

Implications for Investors and the Market

The contrasting trends in equity and cryptocurrency trading volumes on Robinhood have several implications for investors and the broader financial market.

For Investors

- Diversification: The surge in equity trading volumes highlights the importance of diversification. Investors should consider balancing their portfolios across different asset classes to mitigate risk.

- Market Sentiment: The increase in equity trading volumes suggests a positive market sentiment, which could be a signal for investors to explore opportunities in the stock market.

- Caution with Cryptocurrencies: The lag in cryptocurrency trading volumes serves as a reminder of the risks associated with this asset class. Investors should approach crypto trading with caution and conduct thorough research.

For the Market

- Increased Liquidity: The surge in equity trading volumes contributes to increased liquidity in the stock market, which can lead to more efficient price discovery and reduced volatility.

- Market Dynamics: The contrasting trends in equity and cryptocurrency trading volumes highlight the dynamic nature of financial markets. Market participants need to stay informed and adapt to changing conditions.

- Platform Performance: Robinhood's ability to handle increased trading volumes without significant issues is a testament to its robust infrastructure. This performance can enhance the platform's reputation and attract more users.

Conclusion

Robinhood's equity notional trading volumes shone brightly in April, reflecting a surge in investor interest and activity. In contrast, cryptocurrency trading on the platform lagged behind, possibly due to regulatory uncertainty and market volatility. These trends have significant implications for investors and the broader financial market, highlighting the importance of diversification, market sentiment, and caution with cryptocurrencies.

As the financial landscape continues to evolve, staying informed and adaptable will be key for investors looking to navigate these dynamic markets. Whether you're a seasoned trader or a newcomer to the world of investing, understanding these trends can help you make more informed decisions and potentially capitalize on emerging opportunities.

FAQs

What are equity notional trading volumes?

Equity notional trading volumes refer to the total value of equity trades executed on a trading platform. This metric provides insight into the level of trading activity and investor interest in the stock market.

Why did Robinhood's equity trading volumes increase in April?

Several factors contributed to the increase in Robinhood's equity trading volumes in April, including economic recovery, stimulus checks, and the popularity of meme stocks driven by social media.

Why did cryptocurrency trading volumes lag on Robinhood in April?

The lag in cryptocurrency trading volumes on Robinhood in April may be attributed to regulatory uncertainty, market volatility, and a potential shift in investor focus towards equities.

What should investors consider in light of these trends?

Investors should consider diversifying their portfolios, staying informed about market sentiment, and approaching cryptocurrency trading with caution. Understanding these trends can help investors make more informed decisions and navigate the dynamic financial markets effectively.