Materials

4 months agoMRF Publications

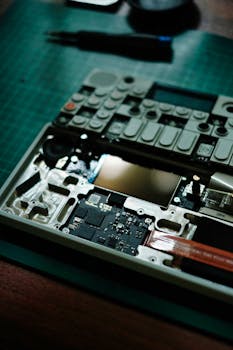

India's Electronics Push: PLI Scheme for Electronic Components to Launch in August-September

India is gearing up for a significant boost to its domestic electronics manufacturing sector. The government is reportedly eyeing an August-September timeframe to finalize and begin disbursement under the much-anticipated Production-Linked Incentive (PLI) scheme for electronic components. This move is expected to inject billions of rupees into the industry, attracting both domestic and international investment and accelerating India's journey towards becoming a global electronics manufacturing hub. This strategic initiative aims to reduce reliance on imports, create employment opportunities, and foster technological advancements within the country. Keywords like Electronics Manufacturing in India, PLI Scheme Electronics, India Electronics Policy, and Make in India Electronics are expected to see a surge in search volume following this announcement.

A Much-Needed Injection for the Electronics Sector

The Indian electronics sector has been clamoring for supportive policies to enhance its competitiveness on the global stage. Currently, a large portion of electronic components used in India are imported, leading to significant outflow of foreign exchange. The PLI scheme for electronic components is designed to address this challenge directly by providing financial incentives to manufacturers who set up or expand their production facilities in India. This incentive aims to make domestic manufacturing more attractive compared to importing finished products or components. This initiative directly addresses the challenges faced by the Indian electronics industry.

Key Features of the Electronic Components PLI Scheme

While the specifics are still being finalized, the PLI scheme for electronic components is expected to encompass several key features:

- Financial Incentives: Manufacturers will receive incentives based on incremental sales of domestically produced electronic components. The quantum of incentives and eligibility criteria are still under consideration and are expected to be revealed shortly.

- Focus on High-Value Components: The scheme is likely to prioritize the manufacturing of high-value and technologically advanced components, which are currently heavily reliant on imports. This includes key components used in mobile phones, consumer electronics, and other electronic devices.

- Target Sectors: The scheme will likely cover a wide range of electronic components crucial for various sectors, including semiconductors, integrated circuits, passive components, and others.

- Domestic Value Addition: The scheme will likely emphasize increasing domestic value addition in the electronics manufacturing process. This will involve promoting the growth of supporting industries and developing the necessary ecosystem.

- Job Creation: The projected scale of the scheme suggests the potential for substantial job creation, particularly in skilled manufacturing roles. This aligns directly with the government's employment generation goals.

Expected Impact and Economic Implications

The implementation of the PLI scheme is expected to have a profound impact on the Indian economy. Analysts predict:

- Reduced Imports: A significant reduction in reliance on imported electronic components, leading to savings in foreign exchange. This will directly strengthen the Indian Rupee and contribute to macroeconomic stability.

- Increased Domestic Production: A substantial increase in the domestic production of electronic components, boosting the overall manufacturing sector.

- Foreign Direct Investment (FDI) Inflow: Attraction of significant FDI into the Indian electronics sector, creating new investment opportunities. This is anticipated to drive economic growth and development.

- Technological Advancement: The scheme will incentivize technology adoption and innovation, furthering India's capabilities in the electronics domain. This will be crucial for developing a competitive electronics industry.

- Skill Development: A boost to the development of a skilled workforce in the electronics sector, creating high-quality employment opportunities.

Addressing Concerns and Challenges

While the PLI scheme is anticipated to be a game-changer, there are certain challenges that need to be addressed:

- Infrastructure Development: Adequate infrastructure, including power, logistics, and skilled labor, needs to be ensured to support the expanding manufacturing base. Improving infrastructure is crucial for the success of this initiative.

- Ease of Doing Business: Streamlining regulatory processes and ensuring a conducive business environment are essential for attracting investments. Simplifying business regulations will greatly impact investor confidence.

- Competition: India needs to strategically position itself to compete effectively with established global electronics manufacturing hubs. This requires a focused approach on efficiency, quality, and timely delivery.

- Supply Chain Resiliency: The scheme needs to consider building a resilient and diversified supply chain to mitigate future disruptions. Supply chain management will be critical for the long-term success of this policy.

Conclusion: A Pivotal Moment for India's Electronics Future

The imminent launch of the PLI scheme for electronic components marks a pivotal moment for India's electronics sector. The government's commitment to supporting domestic manufacturing through this initiative is a welcome development. While challenges remain, the potential benefits – from reduced imports and enhanced economic growth to job creation and technological advancement – are significant. The success of this initiative will depend on effective implementation, addressing potential challenges proactively, and fostering a collaborative environment between the government, industry, and academia. The coming months will be crucial in witnessing the unfolding of this ambitious plan and its impact on India's economic landscape. The future of electronics manufacturing in India appears bright, fueled by this ambitious and strategically important policy.